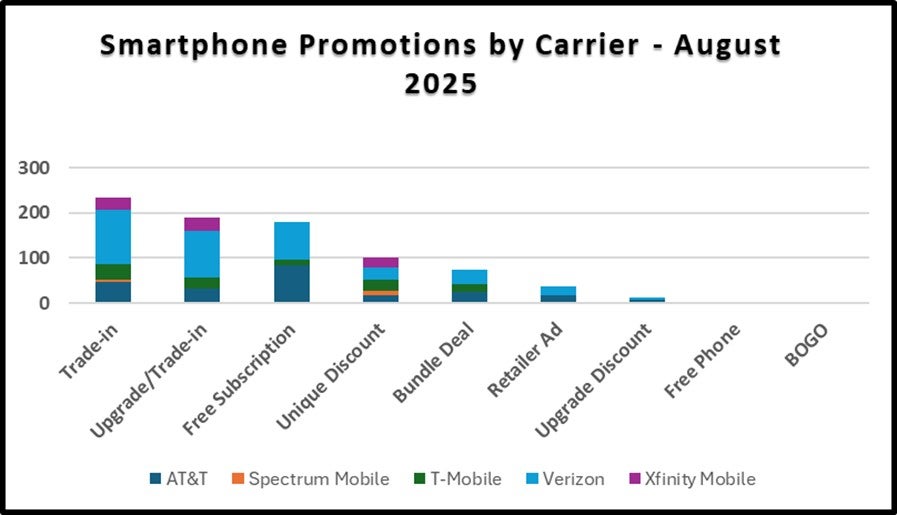

In August 2025, the US smartphone market saw a surge of promotions – 831 offers across major carriers (Verizon ran 393, AT&T 229, and T-Mobile 112).

These deals spanned nine categories (trade-in credits, upgrade bonuses, free phones, subscription bundles) but shared one goal: slash device prices upfront and bind customers to longer, higher-value plans.

Carriers have upped the ante

Carriers have clearly upped the ante to lure new subscribers and keep current ones from defecting in an increasingly saturated market. Trade-in credits were the cornerstone of August’s offers, making new phones free or very cheap in exchange for an old device.

Those credits (often up to $1,000) were applied via bill discounts over 24–36 months, meaning customers had to stay on the network to receive the full benefit. This way, shoppers enjoyed ultra-low-cost upgrades while carriers locked in multi-year loyalty. AT&T even extended 36-month device financing (“Level Up”) to all prepaid users (after six months of service) to coax budget-conscious customers into upgrading now and eventually moving up to postpaid plans. In short, carriers lowered the cost barrier to upgrade but lengthened the required commitment.

Source: GlobalData Pricing and Promotions, Handset Promotions US, August 2025

New device launches trigger carriers promotion blitz

New device launches also spurred short-term promotion frenzies. The Google Pixel 10 debut triggered hefty incentives – trade-in plus new-line credits worth up to $1,250 – aimed at driving sign-ups.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThese deals came with strings attached (requiring unlimited plans and high-value trade-ins), ensuring carriers still gained high-value customers. Still, Apple iPhone and Samsung Galaxy models dominated the overall promotions, underscoring that carriers depend on those perennial favorites for steady demand. Carriers may hype new launches like the Pixel, but iPhones and Galaxies remain the core draws that keep customers upgrading.

Notably, each carrier tackled the promotion blitz with a slightly different twist. Verizon offered the most deals and even bundled a free Google AI service trial with certain phone purchases to entice users onto its priciest plans. AT&T kept things simple and fair – giving existing customers the same big trade-in deals as new ones and even extending financing to prepaid – which likely helped it sustain industry-low churn. T-Mobile reserved its largest phone rebates (around $1,000) for subscribers on its top-tier plans, effectively trading device discounts for higher monthly spend. Even cable MVNOs such as Spectrum and Xfinity echoed these tactics with hefty trade-in offers to pull new subscribers onto their unlimited plans.

Outlook

Ultimately, carriers are now locked in a permanent promotion war to secure subscriber loyalty. For consumers, flagship phones have never been cheaper – often even bundled with free services – as long as they commit to a premium plan.

Promotions have shifted from occasional specials to a standard strategy: major device subsidies and perks are now routine tools to tie users into a carrier’s ecosystem. With competition still fierce and new flagship releases on the horizon, carriers must ensure these aggressive offers yield real loyalty and profits – or risk a race to the bottom where only the customer wins.