On October 8, 2025, Verizon announced its pending acquisition of Starry, a fixed wireless access (FWA) provider that specialises in leveraging mmWave spectrum to serve multi-dwelling units (MDUs) in urban markets.

The deal could prove a savvy bit of business, buttressing Verizon’s FWA push with its efforts in the MDU space while also allowing the operator to see some return on its hefty investment in mmWave spectrum.

The problem is that the announcement’s timing – coming just two days after Verizon surprised the market with a sudden CEO change – means most of the deal’s positives could be lost in the wash.

The end of Starry’s decade-long rollercoaster ride

Some will recognise Starry from its brief turn as an industry darling near the start of the current decade. Founded in 2014 and launched publicly in 2016, Starry did pioneering work in utilising licensed high-band spectrum (specifically, in the 24 GHz and 37 GHz ranges) to provide FWA service, including an on-demand upload speed boost feature introduced in August 2022.

After debuting on the New York Stock Exchange in March 2022 and receiving $269m in Rural Digital Opportunity Fund (RDOF) awards from the federal government five months later (August 2022), Starry’s trajectory took an abrupt turn. Its scale ambitions ran against broader macroeconomic headwinds. Launching an ambitious expansion just as inflation skyrocketed in the US, and investment dollars became scarce for niche telecom bets, resulted in Starry failing to outrun its creditors. Within a few months, Starry would be hoist by its own petard.

By October 2022, Starry was defaulting on its RDOF awards. The company entered bankruptcy just four months later (February 2023), only to emerge in August 2023 as a smaller, streamlined outfit focused on serving its five core markets: Boston (MA), New York (NY), Los Angeles (CA), Denver (CO), and Washington, DC. Disabused of its previous notions of achieving scale, Starry spent the intervening two years maturing its mmWave FWA architecture.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataVerizon’s pending Starry acquisition lacks the considerable footprint and subscriber gains of the other M&A actions that have been announced by the major US operators in 2024 and 2025. While the financial terms of the deal remain undisclosed, Starry’s 100,000 subscribers are a veritable drop in the ocean compared to the US’s larger broadband providers.

That said, it’s important to note that what Verizon is really acquiring is Starry’s technical and operational acumen in delivering FWA via mmWave – not only a spectrum range with unique deployment considerations, but also a resource Verizon just so happens to have in abundance.

Verizon shores up MDU play amid C-suite shakeup

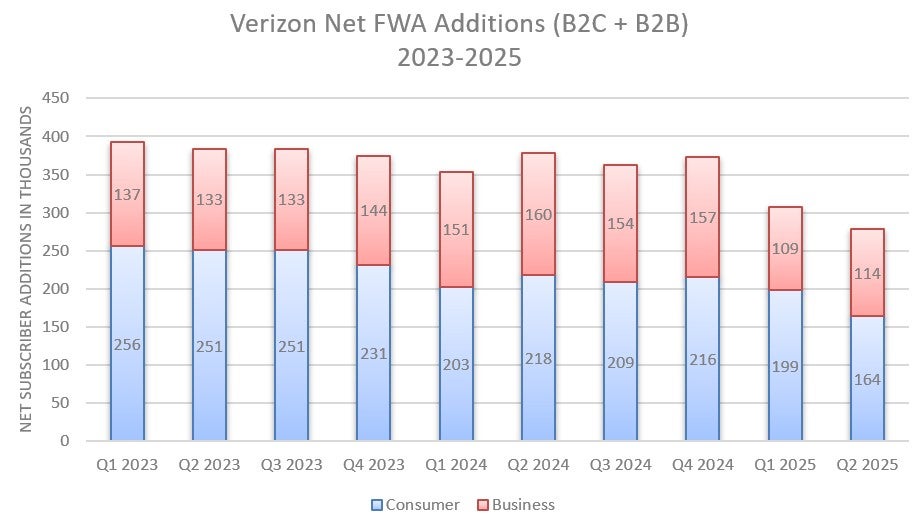

The deal occurs after Verizon’s FWA subscriber acquisition cadence has slacked off over the last few quarters and as business subscribers make up an increasingly heavy portion of its FWA subscriber mix. Any traction Verizon can gain in the MDU space with its mmWave offering will keep the faucet open on the residential opportunity without adding traffic burden to its mid-band network.

Source: GlobalData, company earnings reports

Verizon execs have been teasing a new MDU FWA solution since October 2024. By April 2025, the company was claiming that the long-teased solution had been launched in 15 markets. Then-CEO Hans Vestberg noted during Verizon’s Q1 2025 earnings call that the offering would “ramp up” over the course of the year, offering multiple services ranging from typical FWA performance to “fiber-like” speeds.

Of course, news of the Starry deal also hit the wires just two days after Verizon announced that its board of directors had appointed former PayPal CEO Dan Schulman to take over for Vestberg “effective immediately.”

This timing doesn’t just threaten to wash the announcement from the news cycle; the sequence paints the picture of a company throwing irons in the fire just as some internal chaos sets in, raising questions about its near-term capacity and long-term willingness for follow-through.

While this purchase should certainly add gasoline to Verizon’s MDU efforts, the question now will be whether the result allows Verizon to net substantial return out of its mmWave holdings.

The propagation characteristics for mmWave are rather different than for low- or mid-band ranges, offering higher speeds but far less range and penetration, and Verizon was the biggest spender in the Federal Communications Commission’s largest mmWave auction. The new C-suite regime will be putting a premium on efficient returns.