In January 2026, the US wireless market saw 674 new smartphone deals across major carriers—AT&T, T-Mobile, Verizon, Spectrum Mobile, and Xfinity Mobile.

Carrier strategy reviews and performance

Verizon

In January 2026, Verizon adjusted its promotional economics. It flattened its bring-your-own-device (BYOD) discounts across unlimited tiers, aligning them all at $10/month over 36 months, and lowered its switch-in e-gift card from $300 to $200. These changes reflect a shift toward retention and lower acquisition costs.

In Q4 2025, Verizon reported its strongest postpaid net additions since 2019 (551,000 lines), modest 1.1% growth in mobility service revenue ($17.37bn), and strong equipment sales (+9.1% YoY to $8.2bn). Verizon is pivoting toward a more disciplined promotion strategy—trading off headline value for sustainable volume and margin preservation.

AT&T

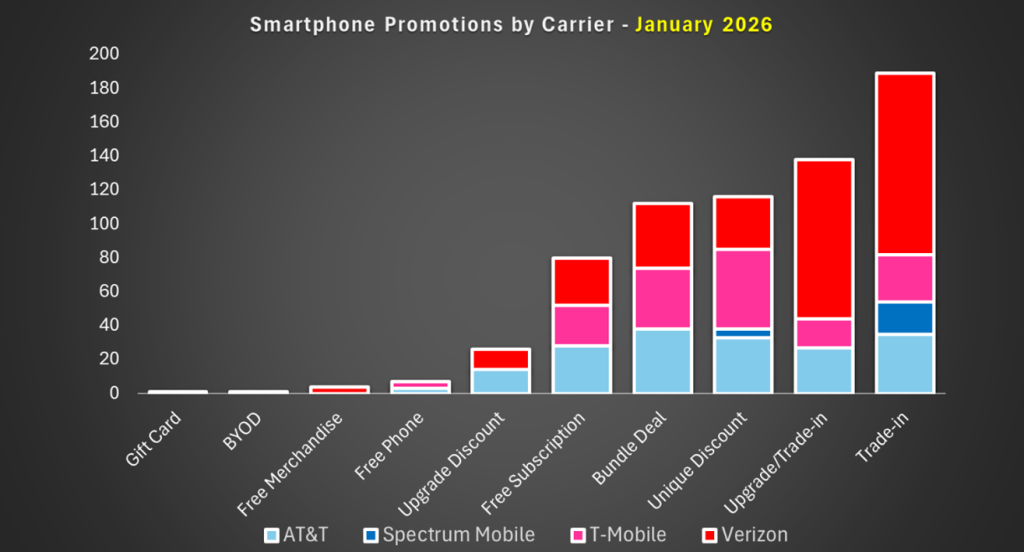

AT&T focused on scale, consistency, and accessibility. With 178 offers in January, including 38 bundle deals, 35 trade-in, and 33 trade-in-upgrade incentives. Its Q4 showed 421,000 postpaid phone net additions and $17bn in mobility service revenue.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataNotably, convergence with AT&T Fiber appears strong: over 40% of fibre households also subscribe to wireless. AT&T’s “value-based” promotions are aimed at strengthening loyalty, simplifying buying decisions, and leveraging multi-product relationships.

T-Mobile

In January, T-Mobile introduced its Better Value plan: priced at $155/month for three lines, gated by eligibility (e.g., adding or porting lines, long tenure). Benefits include unlimited premium data, large hotspot allotments, international perks, streaming bundles, and a price guarantee. T-Mobile is targeting both switchers and high-value existing customers through differentiated product bundles and price guarantees.

T-Mobile delivered industry-leading customer growth in Q4 and full-year 2025, adding 7.8 million postpaid customers and two million broadband customers, driving strong service revenue growth of 8% for the year. Strengthened by major network quality awards and continued 5G broadband expansion, T-Mobile enters 2026 positioned for sustained profitable growth and margin expansion.

Spectrum Mobile

Spectrum leaned heavily on trade-in requirements: About 80% of its 24 January promotions required one. As an MVNO tethered to Spectrum Internet, every mobile line adds value through convergence. Q4 2025 saw 428,000 net additions and a 19% YoY growth in lines, ending 2025 with 11.8 million mobile lines.

Xfinity Mobile

In January, Xfinity revamped its rewards programme—Xfinity Membership—to reward multiservice (e.g., internet, mobile, video) usage and accelerated tier ascension.

New Platinum benefits include accessory discounts, Peacock Premium, and better convergence benefits. Comcast added 323,000 mobile lines in Q4 2025. Without aggressive handset deals, Xfinity is compensating via loyalty and bundling.

Final verdict

Carriers are moving past deep discounts toward more sustainable promotional frameworks. Promotions are tools not just to win new lines but to reinforce long-term customer value—through churn reduction, service tier migration, and convergence. Disciplined offers that balance acquisition cost with lifecycle economics will define leaders in 2026.