Bitcoin can process up to seven transactions per second.

At that rate, it would take about 35 years for everyone on Earth to complete just one transaction. But transactions are not finalized on a first come first served basis—those willing to pay a greater fee can skip the queue. As a result, Bitcoin will become a form of peer-to-peer electronic cash exclusively for the very wealthy.

A transaction fee of just $5 prices out those looking to buy a coffee with their bitcoin, and Bitcoin fees reached a peak of $40 in 2023, but hope is not lost for the cypherpunk’s dream of digital cash. This article will delve into three prominent solutions for scaling Bitcoin to the masses.

Lightning’s faster than lightning payments

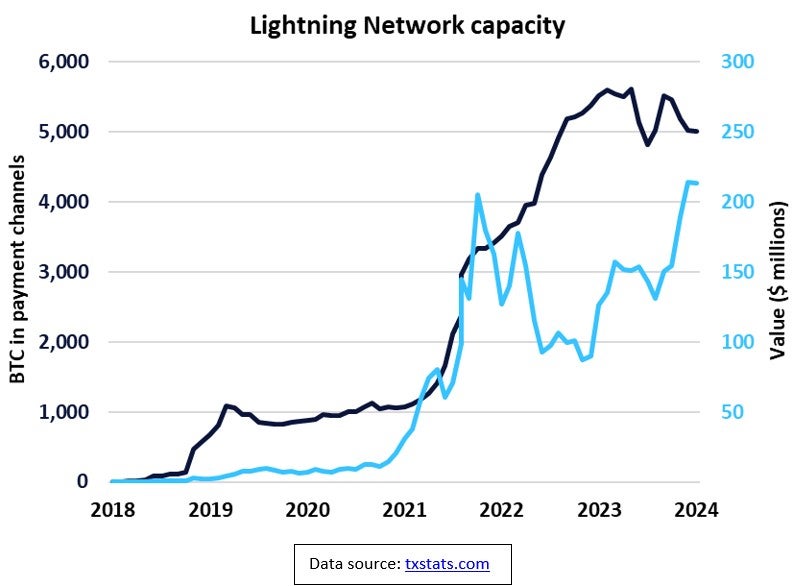

The Lightning Network is a protocol built on top of Bitcoin that enables instant payments with minimal fees. It relies upon the use of payment channels. Once a payment channel is established between two users, bitcoins can be sent back and forth free of charge. Users who do not share a payment channel can still transact with each other by sending payments across the network of payment channels.

The Lightning Network played a significant role in El Salvador’s adoption of Bitcoin in 2021, powering Chivo Wallet—the official Bitcoin and dollar wallet of the Government of El Salvador. At the time of writing, the Lightning Network consists of 58 thousand payment channels containing a combined $210m worth of BTC according to mempool.space. An estimated $1b was transacted over the Lightning Network in 2023 according to a recent report from Bitcoin technology and financial services company River.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataYou can think of bitcoin in a payment channel like beads on an abacus. The beads move freely back and forth on the wire, but it is difficult to add or remove beads from the wire. Behind the scenes, bitcoin in a payment channel is held in a 2-of-2 multi-signature address, with both parties holding one of two keys required to spend the bitcoin. To make payments, the two parties exchange partially signed transactions–redistributing the shared ownership of the bitcoins held in the multi-signature address.

Unfortunately, this solution is not without its drawbacks. Private keys must be online to update the state of a payment channel which is bad for security and useability as a recipient must be online to receive payments. Users must manage channel liquidity—if there are no bitcoins on your counterpart’s side of your payment channel, then you cannot receive bitcoins. The final nail in the coffin is that an on-chain transaction is still required to establish a payment channel.

The Liquid Network: Bitcoin’s underutilized sidechain

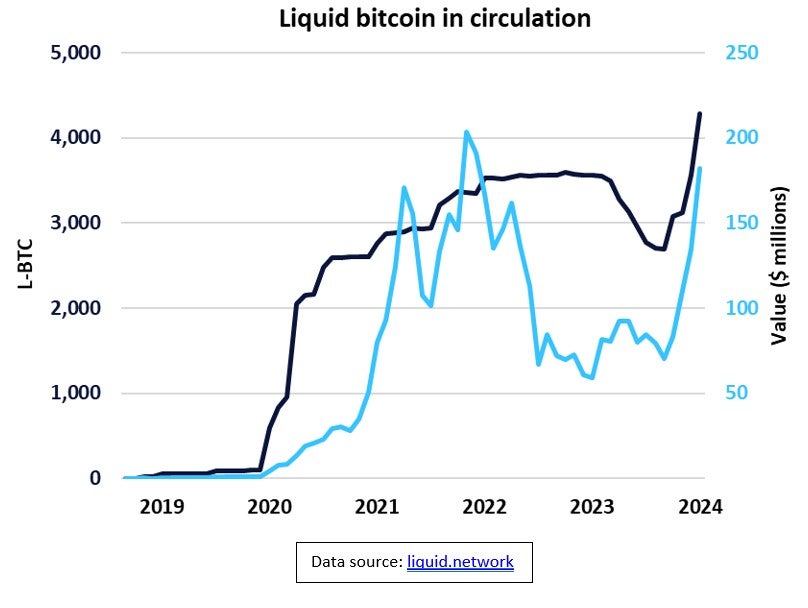

The Liquid Network is a second blockchain that runs parallel to Bitcoin’s mainchain known as a sidechain. Users of the Liquid Network transact with L-BTC (liquid bitcoin), a token on Liquid’s blockchain backed 1-to-1 by bitcoins held in a multi-signature wallet controlled by a federation.

The benefits of transacting on Liquid’s blockchain over Bitcoin’s include faster final settlement, confidential transactions, and (for now at least) lower fees. However, this comes at the cost of trusting a federation to operate the sidechain fairly and secure the BTC held by the network. The multinational federation consists of companies, such as cryptocurrency exchanges and wallet developers.

Liquid functions similarly to Bitcoin, with the major difference being in their consensus mechanism. Bitcoin uses the decentralized, yet energy-intensive, proof-of-work, whereas Liquid uses an approach called Strong Federations. Federation members take turns in proposing the next block which the other members validate and sign. Blocks also occur more frequently on Liquid with a fixed one-minute interval compared to Bitcoin’s average block time of ten minutes.

Liquid is still a blockchain and blockchains cannot scale to billions of users. Despite its shorter block time, Liquid’s transaction capacity is only a marginal improvement over Bitcoin’s at seven to ten per second, owing to confidential transactions taking up more block space. For now, however, blocks remain mostly empty and transaction fees are below $0.10.

The return of Chaumian Ecash

Chaumian Ecash lies in the same grey area between custodial and self-sovereignty as the Liquid Network. Like L-BTC, Ecash notes are backed 1-to-1 by bitcoins. These bitcoins are held by the issuing mint, which could be operated by a trusted federation. Unlike L-BTC, Ecash notes do not exist on a blockchain and are just stored on the user’s device. Because of this, Ecash can achieve greater scale and can even be sent without an internet connection.

Designed by David Chaum in 1982, Ecash was the technology behind DigiCash, a company that marketed Ecash to banks as an online payments solution before online card payments became mainstream. The adoption of Chaumian Ecash in Bitcoin is still in its early days, with projects like Fedimint and Cashu showing promise.

Final thoughts

While none is a silver bullet, the three solutions complement each other to form a comprehensive solution. For example, Lightning payment channels between Ecash mints enable interoperability and L-BTC can be used to top up balances on the Lightning Network via Boltz. However, this layered approach to scaling bitcoin payments and ownership leads to a complex user experience that will not appeal to consumers accustomed to frictionless payments provided by the likes of PayPal and Apple Pay.

Related Company Profiles

Riverbed Technology Inc

PayPal Holdings Inc