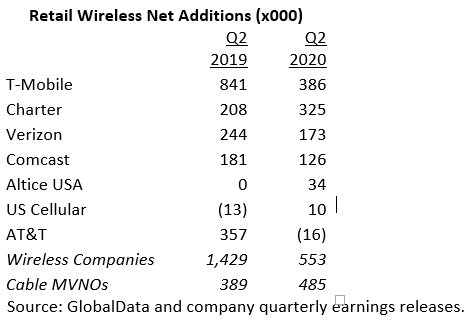

Results from Q2 2020 show that cable operators in the US took nearly half of wireless retail customer net additions. That was due in part to a Covid-19-related slowdown in overall growth, but it also reflects increasing interest in moving away from traditional mobile operators if the value proposition is right.

In the past three years, thee of the four largest US cable operators – Comcast, Charter, and Altice USA — have added the option for customers to take mobile wireless service. Those services, branded under the cable operator’s label (Xfinity Mobile for Comcast, Spectrum Mobile for Charter) are supplied by the traditional mobile operators. A fourth significant operator, Cox, is said to be considering offering similar service.

For mobile operators like Verizon, T-Mobile, and AT&T, so-called mobile virtual network operators (MVNOs) can be a source of very high-margin revenue since the MVNO (in this case the cable operator) pays for voice minutes and data megabytes without the host operator incurring any traditional marketing costs such as advertising or handset subsidies.

However, results from Q2 2020 may have mobile operators questioning whether these MVNO relationships are doing more harm than good. A survey of the largest mobile and cable operators shows that cable MVNOs accounted for nearly as many net new mobile subscribers as the traditional mobile brands.

These results suggest that the mobile operators may be gaining MVNO revenues but are losing out on the opportunity to win these retail customers with their own brands.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataCable operators may be perfect MVNO customers

For years, cable operators have built their businesses around a common theme: sign customers to as many services as possible to increase ‘stickiness’ and make it complicated to switch to another provider. Over the past ten-plus years, these operators have enjoyed tremendous success offering a ‘triple play’ bundle consisting of Internet, video, and home phone service. However, with a growing number of customers ‘pulling the plug’ on both traditional home phone and video services in favor of cellular and over-the-top video services like Netflix and Hulu, cable operators are eager to embrace mobile wireless into their service bundles.

In fact, cable operators may just be the perfect MVNO customers. That’s because the bulk of their customers’ phone usage comes when they are utilizing their cable-enabled WiFi service, usually at home and occasionally as part of these operators’ massive WiFi hotspot networks. For example, Comcast’s Xfinity WiFi includes millions of hotspots, including cafes, retail outlets, and – unbeknownst to many home customers – often their home WiFi router. As a result, cable operators are able to offer very price-attractive mobile deals to customers, knowing that most of that usage will not actually require cellular mobile service.

As more customers begin to look at their cable operators as mobile operators, traditional mobile operators – nearly all with enormous installed bases to protect – may find themselves increasingly at risk of customers jumping ship for more favorable terms offered by their cable operator competitors.

Related Company Profiles

Netflix Inc

Comcast Corp

Altice USA Inc