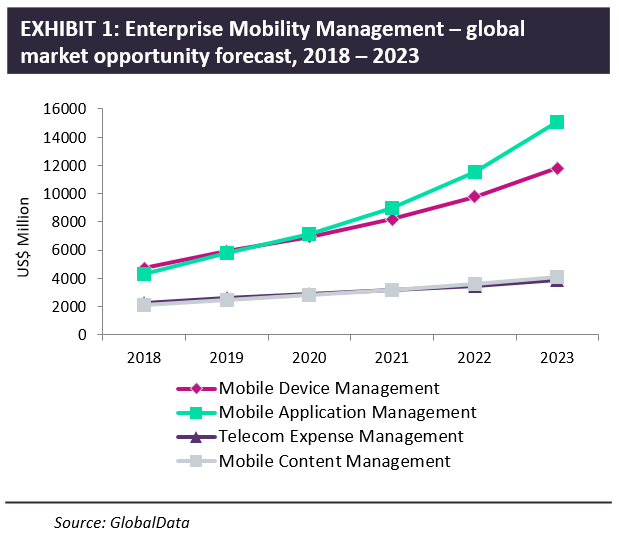

According to a new forecast from GlobalData, the market for Enterprise Mobility Management reached $13.3bn in 2019, a year in which mobile application management caught up to mobile device management in terms of revenues.

The compound annual growth rate (CAGR) for mobile application management, at 27% over five years, is significantly higher than for the other three software capabilities in the forecast (mobile device management, telecom expense management and mobile content management).

These forecasts pertain specifically to revenues for software platforms from vendors such as VMware, AirWatch, BlackBerry, Microsoft and IBM and also includes TEM vendors. But while the forecasts focus on software, there is a strong relationship between these numbers and revenues for services from operators and SIs that may resell the software along with additional professional services, managed services, or support options. For example, many operators offer device lifecycle management services that deal with device procurement, provisioning, kitting, staging, repair and end-of-life management.

GlobalData’s 2019 GlobalData Customer Insight survey, based on 3300 respondents, noted that 58% of companies are already using EMM solutions and 54% are using TEM software. This suggests that there remains considerable upsell opportunity both for software vendors and operators in helping customers manage their mobile devices, especially as mobility is used for so many different functions within an organisation and is increasingly mission-critical.

What does this mean for mobile operators?

Operators are not necessarily involved in building a lot of custom mobile applications; while they may do so for large customers, they often resell third-party software products in areas such as workforce management and may offer mobile UC, Push-to-Talk, prioritisation and pre-emption for public safety and other mission-critical communications, and in-building WiFi or private cellular networks. They do help customers with mobile security, however, going beyond MDM/UEM to end-point security, and threat management services. The rise of mobile application management as a commonly used and rapidly growing part of EMM software platforms indicates that even if they do not develop them, operators can help manage and secure applications, as well as help companies customise software that is more horizontal in nature to meet the needs of a particular vertical industry.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataWhere does IoT fit in?

GlobalData has predicted for several years that there will be some convergence of software and security solutions used for management of traditional mobile devices and those offered for management of IoT devices. This has been slow to occur as the different ecosystems involved in each segment remain separate.

For example, connectivity and device management vendors for IoT are not generally the same vendors as those for MDM/UEM, although the latter set has been talking about adding IoT device management for a long time. We do see evidence that this kind of convergence is slowly happening, as it would be more cost-effective for enterprises to manage both kinds of mobile devices from the same platform. Admittedly IoT devices are more diverse and many still lack operating systems or other ways to instruct and manage them.

Related Report:

5G Commercial Use Cases Update & Telco Go-To-Market Strategies

Related Company Profiles

Microsoft Corp

BlackBerry Ltd

VMware Inc