Amazon‘s $1.7bn deal to acquire iRobot, maker of the robotic vacuum cleaner Roomba, is on the brink of collapse as European Union (EU) antitrust regulators are poised to veto the transaction, according to reports.

Despite a warning from the European Commission regarding potential anticompetitive practices in the robot vacuum cleaner market, Amazon chose not to provide solutions to address these concerns.

The European Commission, acting as the EU’s competition watchdog, initiated an investigation into the acquisition in July and is expected to make a decisive ruling by 14 February.

This setback comes after the UK government’s competition watchdog, the Competition and Markets Authority, approved Amazon’s purchase in June 2023, asserting that the company’s market presence in the UK was moderate with existing significant rivals.

The concerns raised by the European Commission primarily revolve around fears that Amazon could impede iRobot’s competitors on its online platform, particularly in France, Germany, Italy, and Spain.

Although potential remedies could be implemented under the recently enacted EU rules, known as the Digital Markets Act, the European Commission appears hesitant, citing the lengthy enforcement process and the absence of legal challenges to the new legislation.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataIf EU antitrust regulators proceed with a veto, it would not only thwart Amazon’s iRobot acquisition but also establish a higher threshold for future deals involving online rivals.

Such a move is likely to prompt stringent demands for significant remedies in exchange for regulatory approval. The impact of this potential veto is already reflected in iRobot’s shares, which plummeted by 30% after the news.

As the fate of the deal hangs in the balance, the vacuum cleaner market, particularly Roomba models, with prices reaching approximately £1,648 in the UK, awaits the resolution of this high-stakes regulatory battle.

According to GlobalData’s Thematic Intelligence: Tech Regulation report, existing competition laws were not made with the digital era in mind, particularly when defining significant market power and anticompetitive practices, and have struggled to adapt to the challenges of the digital economy.

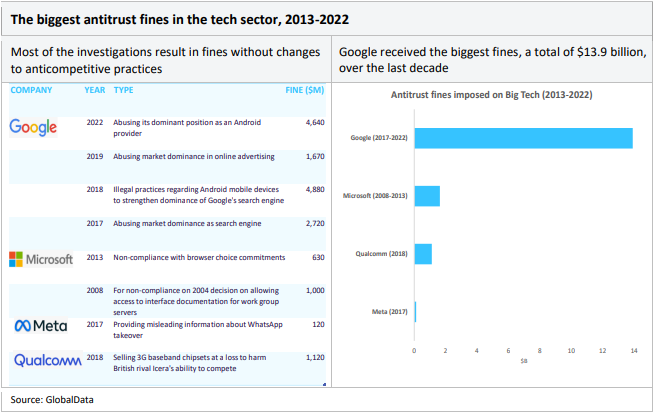

In 2022, an EU court upheld a record fine of EUR4.1bn ($4.6bn) against Google for using the Android platform to cement its search engine’s dominance.

Between 2017 and 2022, the EU fined Google a total of EUR12.4bn ($13.9bn) for violating competition around search, the Android operating system, and advertising.

The fines totalled about 5% of Google’s total revenue in 2022 ($282.8bn).

There remains little incentive for Big Tech companies to change their behaviour, and even after lengthy investigations resulting in hefty fines, their anticompetitive practices remain in the spotlight.

GlobalData principal analyst Laura Petrone said, “Considering the increased scrutiny large tech M&A deals are subject to, the news doesn’t come as a surprise.

“Regulators across different jurisdictions are adopting a tougher stance on merger enforcement, especially when it comes to large digital platforms that are dominant in a given market buying competitors in adjacent markets, such as consumer robotics.

“The EC is expected to give its final decision by the middle of February but as it stands the deal is very unlikely to receive the green light from the EU regulator. It doesn’t help the fact that Amazon isn’t offering any concessions at the moment to appease regulators’ concerns.”