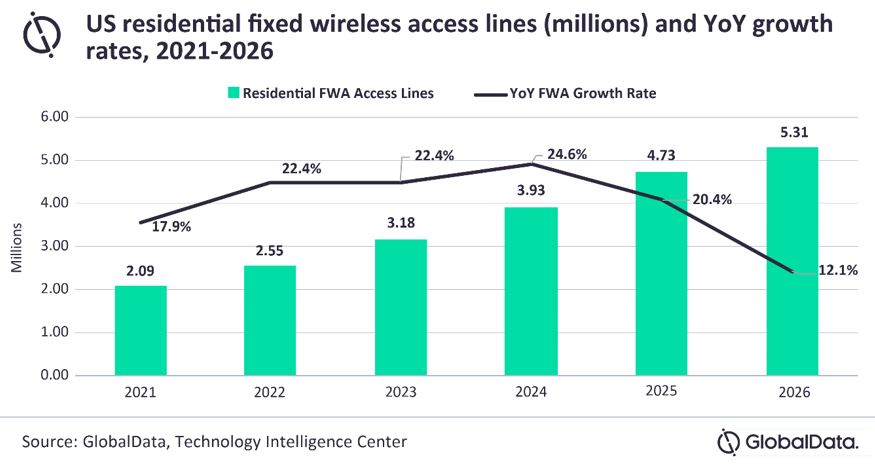

US fixed wireless access (FWA) residential subscribership is expected to grow at a compound annual growth rate (CAGR) of 16.1%, with the market expanding to 5.31 million subscribers in 2026 from 2.09 million in 2021. This growth will be driven by the expansion of 5G networks coupled with increasing demand for broadband internet in the post-Covid-19 era.

GlobalData’s recently published North America Fixed Communications Forecast Pack reveals that consumer adoption of the FWA service, which is a wireless alternative to traditional cable, fiber and satellite-based internet service, is on an upward trajectory with residential FWA subscriber growth peaking in 2024 before stabilizing.

5G and Covid-19 underlie FWA growth trend

This is due to a multiplicity of factors, including the expanding deployment of 5G technology as well as lifestyle changes wrought by Covid-19 and related lockdowns, which drove work, schooling and entertainment into the home and created multiple competing needs for residential broadband access. Even before these developments, FWA was gaining traction thanks to demands for faster broadband with lower latency in unserved and underserved areas, the push for digital inclusion, and the growing adoption of digital voice assistants such as Alexa and Google Assistant, as well as related smart home devices.

There is a case for FWA in underserved areas, whether delivered via 5G or 4G LTE, including rural markets and certain urban areas that do not have ample broadband options. Fixed wire is also attractive to households where a remote worker needs a second broadband service that is not shared with the rest of the family. To sweeten the deal, some carriers are bundling fixed wire with value-added services such as streaming video or offering discounts for packages that include mobile service.

FWA can help service providers derive new revenue streams while leveraging excess capacity on their mobile networks.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataCable and fiber still rule

The US FWA sector generated an estimated $446 million in service revenues during 2020, and GlobalData predicts FWA revenues will reach $1.26 billion in 2026. However, FWA will capture only a small portion of the overall US fixed broadband market, which will remain dominated by cable and fiber. GlobalData forecasts US service revenues from all fixed broadband communications technologies will be just under $71.50 billion in 2026.

Covid-19 has accelerated digital adoption by consumers, leading to an upsurge in demand for broadband access that will continue to grow. This is encouraging for adoption of FWA services, though they will not become the dominant form of broadband delivery.