Chinese chip foundry Hua Hong Semiconductor has received approval for a 18bn yuan ($2.6bn) second listing on Shanghai Stock Exchange.

In an announcement, Hua Hong said the listing committee of the Shanghai Stock Exchange has approved the share sale.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The listing, which could be the biggest in China so far this year, is yet to receive approval from the China Securities Regulatory Commission.

Hua Hong’s announcement comes as Beijing tries to achieve self-sufficiency due to escalating tensions with Washington over technology.

The US has imposed sweeping sanctions to restrict Chinese companies’ access to technologies crucial for developing semiconductors.

According to Reuters, Hua Hong plans to use the proceeds to upgrade and expand production.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThis year, over a dozen Chinese chipmakers, including Lontium Semiconductor and Skyverse Technology, have sold shares in the open market on the mainland, the news agency added.

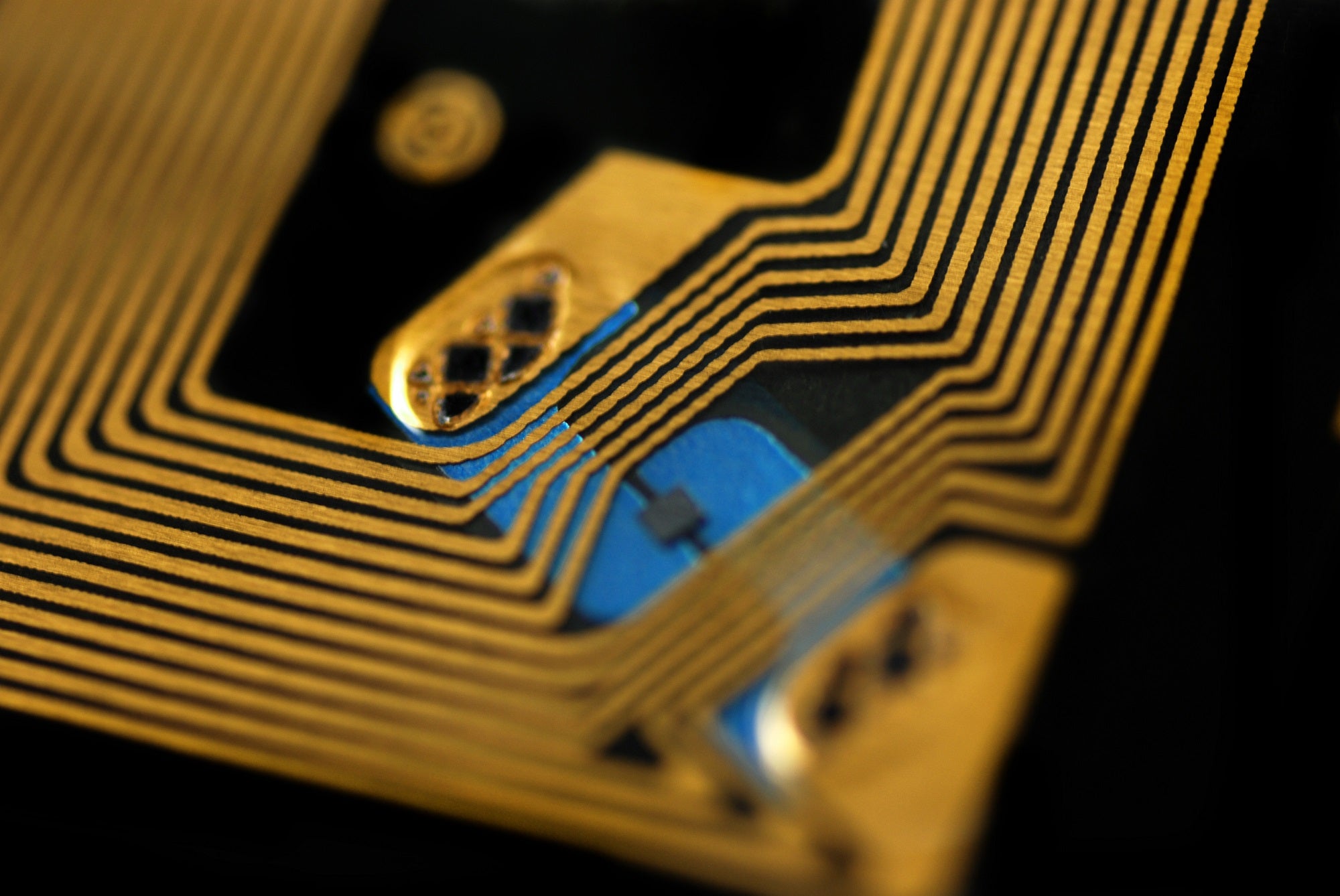

Based in Shanghai, Hua Hong specialises in producing semiconductors on 200mm wafers for various industries such as consumer electronics, communications, and computing.

In its Hong Kong initial public offering, the company raised approximately HK$2.6bn ($332m), according to Bloomberg.

Earlier this year, Hua Hong secured state support to set up a $6.7bn wafer fabrication plant in eastern Wuxi.

The new plant which will be Hua Hong’s second 12-inch manufacturing facility in the city, will manufacture chips using mature tech nodes such as 65nm, 55nm, and 40nm.