Chip manufacturing major Intel has agreed to sell around 20% stake in IMS Nanofabrication to Bain Capital Special Situations (Bain Capital).

The transaction values the Vienna, Austria-based IMS at approximately $4.3bn.

According to Reuters, Intel’s 20% stake in IMS was worth around $860m.

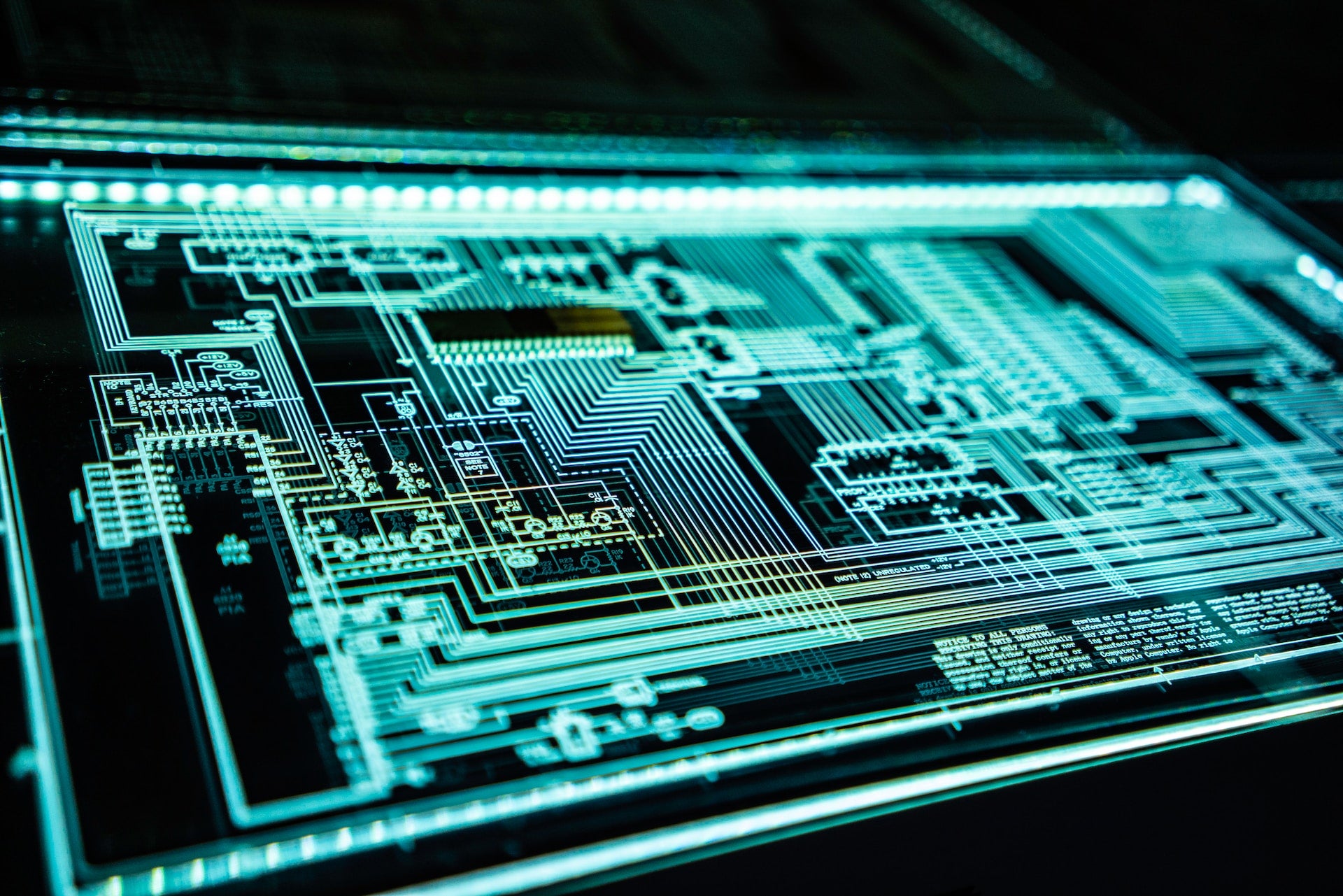

Intel first invested in IMS in 2009 and acquired the company, which makes equipment that is used by semiconductor manufacturers, in 2015.

Specifically, IMS develops multi-beam mask writing tools, which are crucial to creating advanced EUV (extreme ultraviolet lithography) masks used during chip manufacturing.

Intel stated that the investment will support IMS to further innovate and build partnerships to cash on the market opportunity for its offerings.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataIntel senior vice president of corporate development Matt Poirier said: “The advancement of lithography is critical to driving continued progress in the semiconductor industry, and mask writing plays a central role in the industry’s transition to new patterning technologies, such as high-NA EUV.

“Bain Capital’s investment and partnership will provide IMS with increased independence and bring strategic perspective to help accelerate the next phase of lithography technology innovation, ultimately benefitting the ecosystem as a whole.”

Bain Capital partner Marvin Larbi-Yeboa said: “As the global leader and innovator of emerging technologies in the semiconductor fabrication and nanotech industries, we believe IMS is well-positioned to capitalise on attractive secular tailwinds as additional chip production capacity comes online and build on its leading competitive position, tech differentiation and cutting-edge product capabilities.”

The deal is anticipated to complete in the third quarter of 2023.

Last week, Intel announced plans to invest more than €33bn ($36.29bn) in Europe for chip manufacturing and research and development.