British lender Lloyds Banking Group is the latest bank to put a bitcoin ban in place, following in the footsteps of US banking giants JP Morgan Chase, Bank of America, and Citigroup last week.

Lloyds Banking Group — which runs the brands Lloyds Bank, Bank of Scotland, Halifax and MBNA — is thought to be the first bank in the UK to ban credit card customers from borrowing to buy the digital currency.

The bitcoin buying ban applies only to credit card customers, those using debit cards will still be able to buy the cryptocurrency.

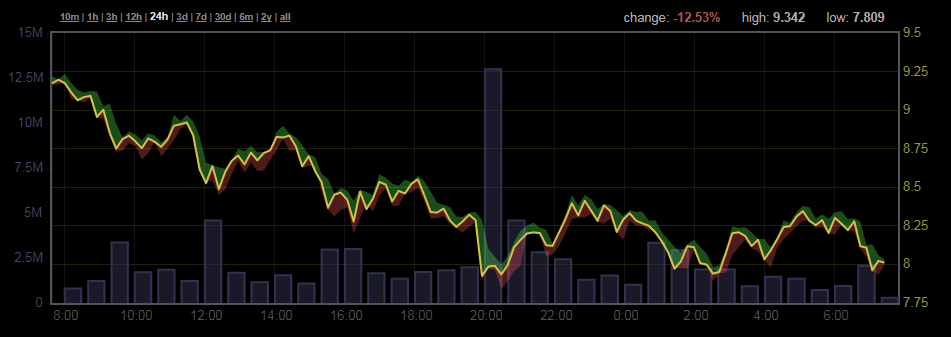

The bank is concerned that people could run up huge losses borrowing to buy bitcoin which last year surged to a price of almost $20,000 per bitcoin before falling back to under $10,000. Bitcoin is trading at around $8,000 per coin this morning.

Other cryptocurrencies have also fallen in the last few weeks after increasing many times in price last year, some far more than bitcoin.

What the bank said:

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataA Lloyds spokesperson said:

Across Lloyds Bank, Bank of Scotland, Halifax and MBNA, we do not accept credit card transactions involving the purchase of cryptocurrencies. We continually review our products and procedures and this is part of that.

Why it matters:

It’s expected that Lloyds is the first of many banks to move to ban bitcoin buying, with the Telegraph newspaper quoting banking experts who have predicted other financial institutions will quickly follow suit.

Governments and regulators are under increasing pressure to rein in bitcoin, both due to its soaring value and its attraction to criminals who use it to buy illegal goods online. Bitcoin’s relative anonymity has led to it becoming a common way for people to buy things on the so-called dark web.

British prime minister Theresa May recently said that action against digital currencies may be required “precisely because of the way they are used, particularly by criminals”.

She told Bloomberg:

In areas like cryptocurrencies, like Bitcoin, we should be looking at these very seriously.

While most cyptocurrencies already abide by so-called Know Your Customer financial responsibility regulations the UK’s Treasury said late last year it wanted update regulation to bring virtual currency platforms into anti-money laundering and counter-terrorist financing regulation.

Background:

Other financial services companies and tech giants have cracked down on bitcoin and cryptocurrencies in recent weeks.

On Friday last week JP Morgan Chase, Bank of America, and Citigroup said they are no longer allowing customers to buy cryptocurrencies using credit cards.

A JP Morgan Chase spokesperson said in a statement:

At this time, we are not processing cryptocurrency purchases using credit cards, due to the volatility and risk involved,” “We will review the issue as the market evolves.

The banks join credit companies Capital One Financial and Discover Financial Services in banning bitcoin purchases, with Discover first enacting the ban in 2015.

Earlier this month, US billionaire Warren Buffett said he wasn’t interested in cryptocurrencies, warning that the bitcoin boom will “come to a bad ending”.

Meanwhile, social media titan Facebook recently announced it would block any advertising that promotes cryptocurrency products and services.