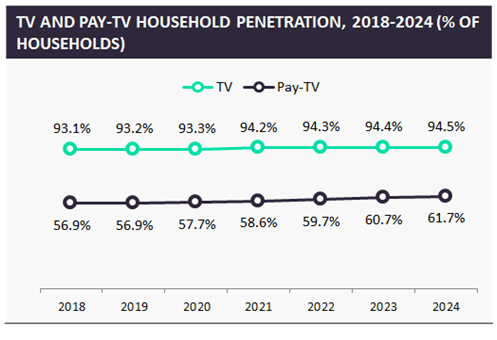

Pay-TV household penetration in Mexico will reach 56.9% by year-end 2019, the second-highest in Latin America with 17.7 percentage points above the Latin America average.

By year-end 2019, the country will showcase higher pay-TV household penetration than countries such as Brazil, Chile, Colombia, and Uruguay.

Moreover, the market will continue to grow and reach 61.7% in 2024, led by subscription growth in cable and IPTV segments. The increasing adoption of multi-play bundles with integrated pay-TV access will be one of the main adoption drivers during the period.

Direct-to-home (DTH) will account for 49.6% of total pay-TV subscriptions estimated for 2019, followed by cable (43.2%) and Internet Protocol TV (7.2%). Although still a niche segment, IPTV subscriptions will increase rapidly at a combined annual growth rate of 13.8% over 2019-2024, to account for 17.7% of total pay-TV subscriptions by 2024, supported by steadily growing fixed broadband penetration in the country.

DTH provider, Sky, leads in the Mexican pay-TV market, Izzi Telecom from Grupo Televisa, is the second-largest pay-TV operator and the largest cable operator within the country. Meanwhile, Totalplay from Grupo Salinas is the leading IPTV service provider.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Related Company Profiles

Sky Ltd