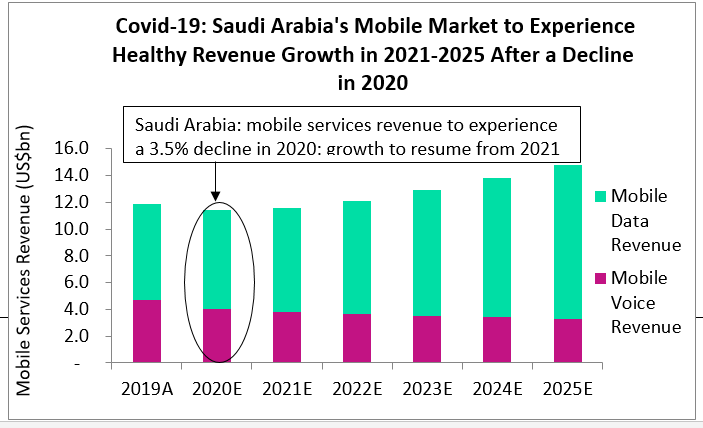

Saudi Arabia’s mobile services market will experience a 3.5% decline in revenue for 2020 in comparison to 2019, according to research and data analytics firm GlobalData’s telecom country forecasts.

Growth will, however, resume in 2021 and remain healthy during the 2021-2025 forecast period, supported by higher mobile data consumption, 5G adoption, telcos’ focus on prepaid to postpaid migration, and growth in cellular M2M/IoT.

Roaming and visitor mobile revenues have sharply fallen amid global movement restrictions. The Covid-19 crisis has resulted in a number of telco store closures which is expected to slow-down new subscriber acquisition and up to some level, prepaid top-ups. This will impact ARPUs and subscriber growth for the year.

As a counter-measure, telcos have stepped up their digital channels, promoting eShops, social network channels, and client account management apps – e.g. MySTC, Mobily app, and Zain app – for sales transactions and customer care. Furthermore, mobile wallets have also been part of the solution equation with STC Pay, for instance, offering El Eidya service for monetary gift exchanges during el Eid celebration.

VAT increase will slow consumer spending

The forecast has accounted for the combined economic fallout from the oil price crash and the Covid-19 crisis, where GlobalData’s current economic scenario (updated on a weekly basis) expects a negative real GDP growth of -4.4% for the Kingdom in 2020, with a rebound in 2021. This will impact consumer spending and consequently mobile ARPUs, while creating more pressure on the job market that could result in job losses and, as such, blue and white collar foreign workers leaving the country.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataMoreover, the VAT increase from 5% to 15% to bridge the expected fiscal gap, will be effective on July, 1st. This is also likely to burden consumer spending and result in a more price-competitive market.

That said, we expect the mobile services market to remain resilient and post growth over 2021-2025, supported by several opportunities that the crisis has further strengthened.

Mobile data consumption can drive recovery

Mobile data consumption, for instance, will continue to surge, opening the opportunity for telcos to up-sell customers with larger data plans in order to meet their needs for entertainment, streaming, eLearning, telework, eHealth and social networks usage. GlobalData expects the average data usage per smartphone customer to reach 16GB by 2025, up from an estimated 5GB in 2019.

5G is another growth pillar that telcos are committed to further expanding. All three market players have launched commercially the service in 2019 and with the experienced traffic surges during the stay-at-home period, 5G will help offer the needed capacity and speeds that will support telcos in better catering for consumer demands, especially for home router customers not covered by FTTH. Despite revising its mobile 5G subscriber forecasts downwards for 2020 to account for the Covid-19 impact, GlobalData still expects 5G to develop relatively quickly in the market, accounting for 40% of total mobile subscribers by 2025.

Cellular M2M/IoT subscriptions will also continue to experience strong growth, underpinning a number of smart city projects in the country (e.g. the new city NEOM) and driving efficiencies and automation for a number of sectors (e.g. powering predictive maintenance for the oil & gas sector).

In line with the Kingdom’s Vision 2030, Telecoms and ICT will be the backbone of the future economy and help the country diversify the economy and reduce its reliance on oil.