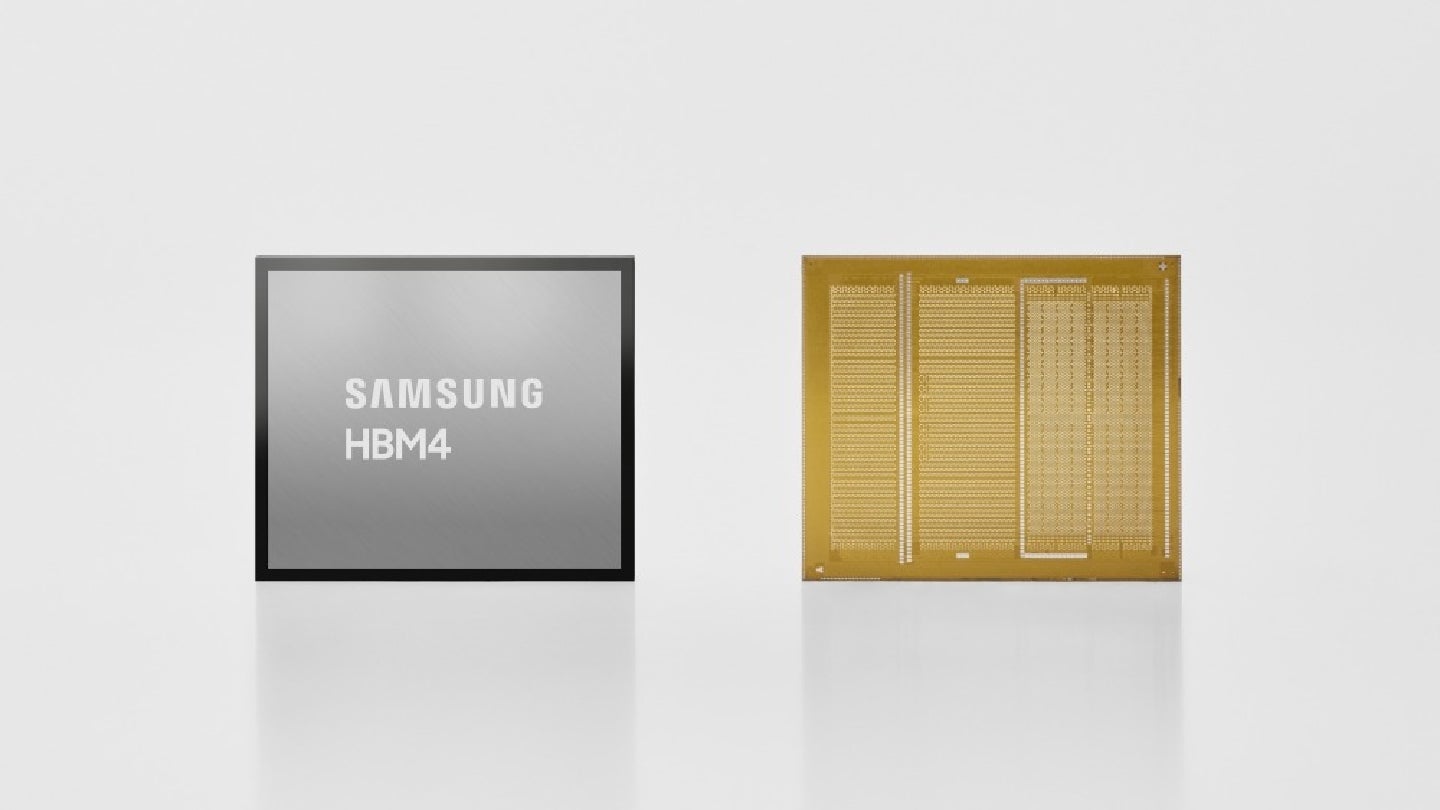

Samsung Electronics has begun mass production of HBM4 high-bandwidth memory and has shipped commercial products to customers, moving early into the HBM4 market.

The company used its sixth-generation 10 nanometre-class DRAM process, known as 1c, to reach stable yields from the start of mass production without additional redesigns.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Samsung reports its HBM4 delivers a processing speed of 11.7 gigabits per second (Gbps), above an industry standard of 8Gbps. It also reports a 1.22 times increase over the maximum pin speed of 9.6Gbps for HBM3E, and states the design can reach up to 13Gbps to reduce data bottlenecks as AI models scale.

The company claimed that HBM4 increases total memory bandwidth per stack by 2.7 times compared with HBM3E, reaching up to 3.3 terabytes per second.

Using 12-layer stacking, Samsung will supply HBM4 in capacities from 24GB to 36GB. The company plans to align capacity options with customer schedules by using 16-layer stacking to offer up to 48GB.

To address power consumption and thermal constraints linked to a doubling of data I/Os from 1,024 to 2,048 pins, Samsung has integrated low-power design measures into the core die.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIt reports a 40% improvement in power efficiency through low-voltage through-silicon via technology and power distribution network optimisation. Compared with HBM3E, Samsung also highlighted a 10% improvement in thermal resistance and a 30% increase in heat dissipation.

Samsung links the performance, energy efficiency and reliability of HBM4 to higher GPU throughput in data centres and improved management of total cost of ownership.

On production, Samsung points to manufacturing resources, including DRAM capacity and dedicated infrastructure, as a basis for supply chain resilience amid rising demand for HBM4. It also highlights design technology co-optimisation between its foundry and memory businesses as a factor supporting quality and yields, and cites in-house advanced packaging capabilities as a means to shorten production cycles and reduce lead times.

Samsung executive vice president and memory development head Sang Joon Hwang said: “Instead of taking the conventional path of utilising existing proven designs, Samsung took the leap and adopted the most advanced nodes like the 1c DRAM and 4nm logic process for HBM4.

“By leveraging our process competitiveness and design optimisation, we are able to secure substantial performance headroom, enabling us to satisfy our customers’ escalating demands for higher performance, when they need them.”

Samsung plans to broaden technical partnerships with key partners following discussions with global graphic processing unit (GPU) manufacturers and hyperscalers working on next-generation application-specific integrated circuit (ASIC) development.

Looking ahead, Samsung expects its HBM sales to more than triple in 2026 compared with 2025 and is expanding HBM4 production capacity. Following the market introduction of HBM4, the company expects sampling for HBM4E to begin in the second half of 2026, and custom HBM samples to reach customers in 2027 based on individual specifications.

The HBM4 update comes after Samsung reported financial results for the fourth quarter and fiscal year 2025. For the quarter ended 31 December 2025, the company posted quarterly consolidated revenue of Won93.8tn ($64.9bn), a 9% increase quarter on quarter, and operating profit of Won20.1tn.

Samsung’s revenue for the full year was Won333.6tn, while operating profit was WON43.6tn.

The company’s Device Solutions division recorded a 33% quarter-on-quarter sales increase, with the memory business setting record quarterly revenue and operating profit. This was driven by expanded sales of HBM and other products, as well as higher market prices.

The Device Solutions division recorded quarterly consolidated revenue of Won44tn and operating profit of Won16.4tn for the fourth quarter of 2025.

In the fourth quarter of 2025, despite limited supply availability, Samsung reported the memory business met strong conventional DRAM demand while expanding HBM sales amid higher prices. The business focused on profitability through higher sales of products including HBM, server DDR5 and enterprise solid state drives (SSDs).

In 2026, Samsung indicates the memory business will maintain close customer partnerships and aims to meet demand through shipments of HBM4 and expanded sales of AI-related products including DDR5, SOCAMM2 and GDDR7. It also plans to target AI-related NAND demand by scaling sales of high-performance TLC products for inference-focused SSD demand.