The convergence of fixed and mobile services (FMC) enables telecom operators to provide services from two traditionally separate sectors with a single bill to end users. FMC can act as an acquisition tool; operators can also lower churn due to the inconvenience of disconnecting several services. There are also potentially significant network and cost synergies between fixed and mobile businesses that convergence can bring for operators who already have both.

The market generally develops in five phases, starting from simple cross-selling, followed by mobile cross-selling into families, cross-selling intensification before transitioning to converged customer acquisition and convergence leadership through innovation. Major North American operator offerings are at a more advanced phase of evolution, while operators in Latin America have developed bundles that are usually based on the simple cross-selling approach.

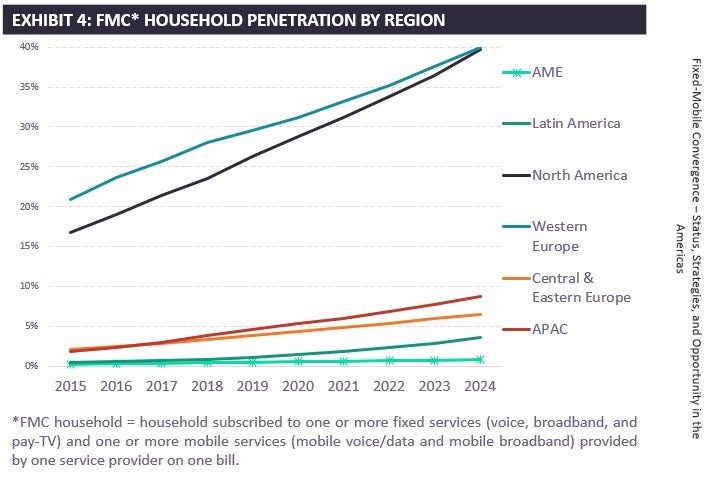

FMC household penetration in North America reached 26.3% by year-end 2019, making it the second most developed market only after Western Europe. GlobalData expects North America’s penetration to reach 39.8% by year-end 2024.

Meanwhile, FMC household penetration in Latin America is very low compared to North America. FMC penetration in Latin America reached 1.1% at year-end 2019, making it the second least developed FMC market. GlobalData expects Latin American penetration to reach 3.6% by year-end 2024. Brazil and Colombia are the more converged markets in Latin America.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Related Company Profiles

FMC Corp