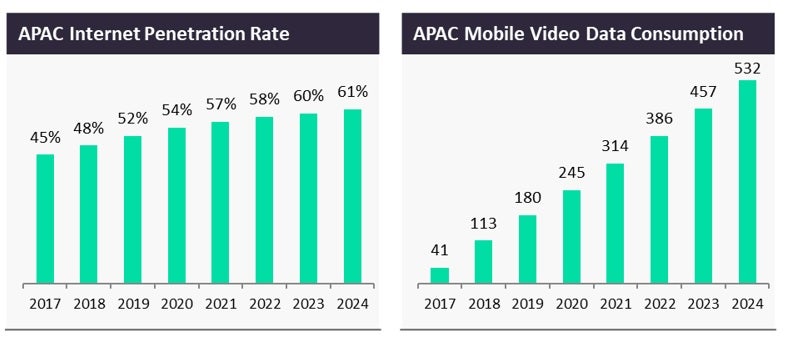

At 4.1 billion people, Asia comprises the majority of the global population. GlobalData estimates that subscription video on demand (SVOD) subscription will reach 392 million by year-end 2019 and to continue over the forecast with SVOD subscriptions reaching 550 million and 44% household penetration by year-end 2023. This is driven by increasing internet penetration and data consumption.

Firstly, increasing fixed internet penetration, which GlobalData expects to increase from 48.2% of the population in 2018 to 60.9% in 2024, has been aided by great investments by telecom companies and the government into both fixed and wireless infrastructure, enabling accessibility to digital media across multiple devices. While high levels of internet access would be expected from developed countries such as Japan, South Korea and Australia, what is striking is that the developing world is also quickly catching up in terms of telecom infrastructure initiatives, in particular with fibre to leverage on the advantages of network convergence.

Firstly, increasing fixed internet penetration, which GlobalData expects to increase from 48.2% of the population in 2018 to 60.9% in 2024, has been aided by great investments by telecom companies and the government into both fixed and wireless infrastructure, enabling accessibility to digital media across multiple devices. While high levels of internet access would be expected from developed countries such as Japan, South Korea and Australia, what is striking is that the developing world is also quickly catching up in terms of telecom infrastructure initiatives, in particular with fibre to leverage on the advantages of network convergence.

For instance, Thailand has launched the Universal Service Obligation (USO) initiative under which the regulator, NBTC, aims to deploy a fibre network across the country, in particular to rural areas. As more Asia-Pacific countries begin to see the benefit of having their own National Broadband Networks (NBN), more people than ever before, especially in the traditionally underserved rural areas, will be connected to the internet at ultra-high speeds. These new networks will supersede and outperform the legacy cable pay-TV infrastructure that serves as conduits to incumbent cable TV services to the advantage of OTT players.

Secondly, data has shown that when internet access is provided, it comes with a corresponding exponential increase in video data consumption. Across the Asia Pacific, video data consumption on mobile has been estimated to have tripled from 41 exabytes per year to 112 exabytes a year from 2017 to 2018 alone. People are spending more time on their devices viewing various forms of digital media, be it on social media or on video streaming sites such as YouTube or the Chinese equivalent Tudou.

The five types of OTT video providers must find different ways to become a market winner

In GlobalData’s definition, there are generally five types of OTT video providers:

- Internet aggregators – Aggregators are internet distributors. e.g. Netflix, Stan, Tencent Video, iFlix, Hotstar, Youtube Red, Amazon Prime.

- Pay-TV operators – Pay-TV operators, usually incumbent cable companies. e.g. Foxtel Now, Watcho (Dish TV India), Astro Go.

- Broadcasters – Includes both commercial and public service broadcasters. e.g. ESPN Play, HBO GO, POOQ, TVer, myTV Super.

- Telecom network operators – Fixed and mobile service providers. e.g. Oksusu, Viu, AIS Play, HyppTV.

- IT vendors – The main players in this segment are the platforms operated by Apple on iOS devices (iTunes) and by Google on Android devices (Google Play). Game console manufacturers are also in this category. e.g. Apple iTunes, Google Play, PlayStation Video, Microsoft Xbox Video.

A large portfolio of both local and foreign content, as well as producing original content is a key competitive advantage for OTT video service providers to differentiate themselves and attract more subscribers. However, how a platform should gain a strategic advantage also depends on the incumbent position of the OTT player.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataIncumbent pay-TV operators and broadcasters offer an OTT platform as a defensive strategy to hedge their bets in an increasingly digital environment that has been spurring cord-cutting. Very often, their OTT platforms serve as catch-up TV for programmes that were aired via broadcast or linear/live streaming of content. The ‘TV Everywhere’ (TV) business model, has become the de facto premier incumbent play, whereby access to OTT content is contingent on participation in the pay-TV service. A good example of this is BBC iPlayer, which was launched in 2005.

Internet aggregators, after years of growth in a blue ocean, are increasingly swimming in red amid new entrants from traditional telecom companies, cable companies and broadcasters. As pure-play OTT content providers, they should seek out partnerships with telcos that want to augment their bundles into triple or quad-play, potentially integrating with set-top boxes. Doing so allows the internet aggregator to leverage the incumbent telco’s subscription base to drive customer acquisition. For instance, PLDT is iflix’s shareholder and exclusive distribution partner in the Philippines. Similarly, Globe, PLDT’s rival in the Philippines, has the exclusive distributorship rights for HOOQ’s platform in the country. Both telcos bundle their respective OTT partner’s service with their plans to make their offerings more competitive. Internet aggregators can also partner to have their services natively integrated on customer set-top boxes. For example, Netflix in South Korea is integrated into LG U+’s U+tv IPTV set-top boxes.

Telecom operators that decide to establish their own OTT service instead of partnering an internet aggregator have to subscribe to a different approach. If they have a pre-existing pay-TV service, an OTT platform can serve as catch-up TV for programmes that have been aired. Otherwise, a nascent OTT service should try to focus on niche areas, such as local content or sports at initial launch. Having a video offering in bundles can contribute to increasing customer retention and winning new subscribers.

Content strategy is often a decision about localisation vis-à-vis internalisation

Asia is an extremely culturally and politically diverse place. Hence, the larger concern for content makers is the balance between localisation and internationalisation. There are four content trends that GlobalData has identified.

Local language: There is great linguistic diversity between, and sometimes even within, countries in the Asia Pacific. In each market, there are people who might not even be able to speak any foreign language. OTT players must focus on market-specific language content to win subscribers. International content, such as Hollywood movies, can have broad market appeal, but needs to be translated, be it by dubbing over or subtitling. For example, Hong Kong’s Viu offers content in over 10 languages to cater to the markets it has ventured into. Content that originates in English tends to perform well in the few Asian markets where English is widely spoken such as Philippines, India, Malaysia and Singapore.

Cultural exports: Cultural content is a form of soft power and a unique cultural export from a certain country. In Asia, Chinese, Japanese, Thai and Korean dramas are popular. Recent successes include the k-drama Descendants of the Sun and Chinese period drama Story of Yanxi Palace. Obtaining the licenses to distribute these popular series can be a big driver of subscriptions even outside of Asia.

Production of original content: Original content is a key differentiator, as the runaway success of HBO Go’s Game of Thrones has demonstrated. Overall spend on content production is up across Asia-Pacific, with OTT players heavily contributing. For example, iQyi in China spent $794 million on content production and licensing in Q1 2019 alone.

Live sports: Live sports are a big draw regardless of distribution platform, and OTTs in the region spend heavily for rights to stream these events. This includes Hotstar streaming the 2019 Cricket World Cup, Tencent Video streaming NBA and Spark Sport streaming the All Blacks. Certain countries have an affiliation to a certain sport, for example, basketball is popular in China while cricket is popular in India.

It is also important to avoid the potential geopolitical minefields that may result in censorship. China, for example, is known to be particularly sensitive to various political issues such as the Hong Kong protests and Tibetan independence movement. Another case in point was the depiction of the “Nine-Dashed Line” in the Chinese-produced Abominable animation that resulted in the film being banned in Vietnam and Malaysia, who were parties to the territorial dispute over the islands in the South China Sea.

OTT players looking to succeed in Asian markets will be considering these factors as they compete for viewer mindshare. Regardless of whether they offer an SVOD, TVOD or AVOD business models, it is expected that VOD viewership will only increase as data caps are increased or eliminated and 5G adoption runs its course, allowing consumers to view media seamlessly and on-the-go over multiple devices, with it a massive revenue potential to be tapped.

Related Company Profiles

Google LLC

Netflix Inc

Apple Inc

Amazon.com Inc

PLDT Inc