The Q2 2020 results for social media giant Snap have seen Covid again take its toll, as while it beat expectations on revenue, it fell short on user numbers.

In the early stages of lockdown there had been a surge in user numbers on the company’s Snapchat platform, but this has failed to sustain momentum, leading to 238 million daily active users; a 17% rise year-on-year but 1 million below average analyst estimates.

Revenue, meanwhile, also climbed 17% to $454.2m, beating average estimates of $441.6m. Adjusted earnings-per-share was a loss of 9 cents, an improvement on the estimate of a 10 cent loss.

While the Snap stock price had climbed 55% in 2020, it dropped 6% in after-hours trading following the Q2 results announcement.

Covid mars Snap Q2 results, but positivity remains

Speaking during an earnings call to announce the Q2 results, Snap CEO Evan Spiegel was frank about the challenges of operating in the current environment but maintained an air of positivity.

“We continued to grow our community and business in a challenging and uncertain environment,” said Spiegel.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“I am proud of our team for innovating on new experiences for our community and driving value for our partners, demonstrating the importance of our service in people’s lives. We are grateful that the resilience of our business has allowed us to remain focused on our future growth and opportunity.”

The company also declined provide projections for Q3, citing “the uncertainties related to the ongoing Covid-19 pandemic and the rapidly shifting macro conditions”.

However, while the Snap Q2 results were not earth-shattering, they also weren’t devastating for investors, and some believe that the company is showing strong performance against competitors in the social media space.

“Unlike its rivals Facebook, Instagram and TikTok, Snap has sailed through the first half of the year. Strong Q1 earnings and a solid Q2 cemented the platform’s position as a social media platform to be reckoned with,” said Yuval Ben-Itzhak, CEO of Socialbakers.

“The platform has not only been able to capitalise on the lockdown to grow user traffic and engagement, but it also recently announced updates such as augmented reality, Local Lenses and Bitmoji for games which will likely attract both users and advertisers to the platform.”

Snap places focus on augmented reality

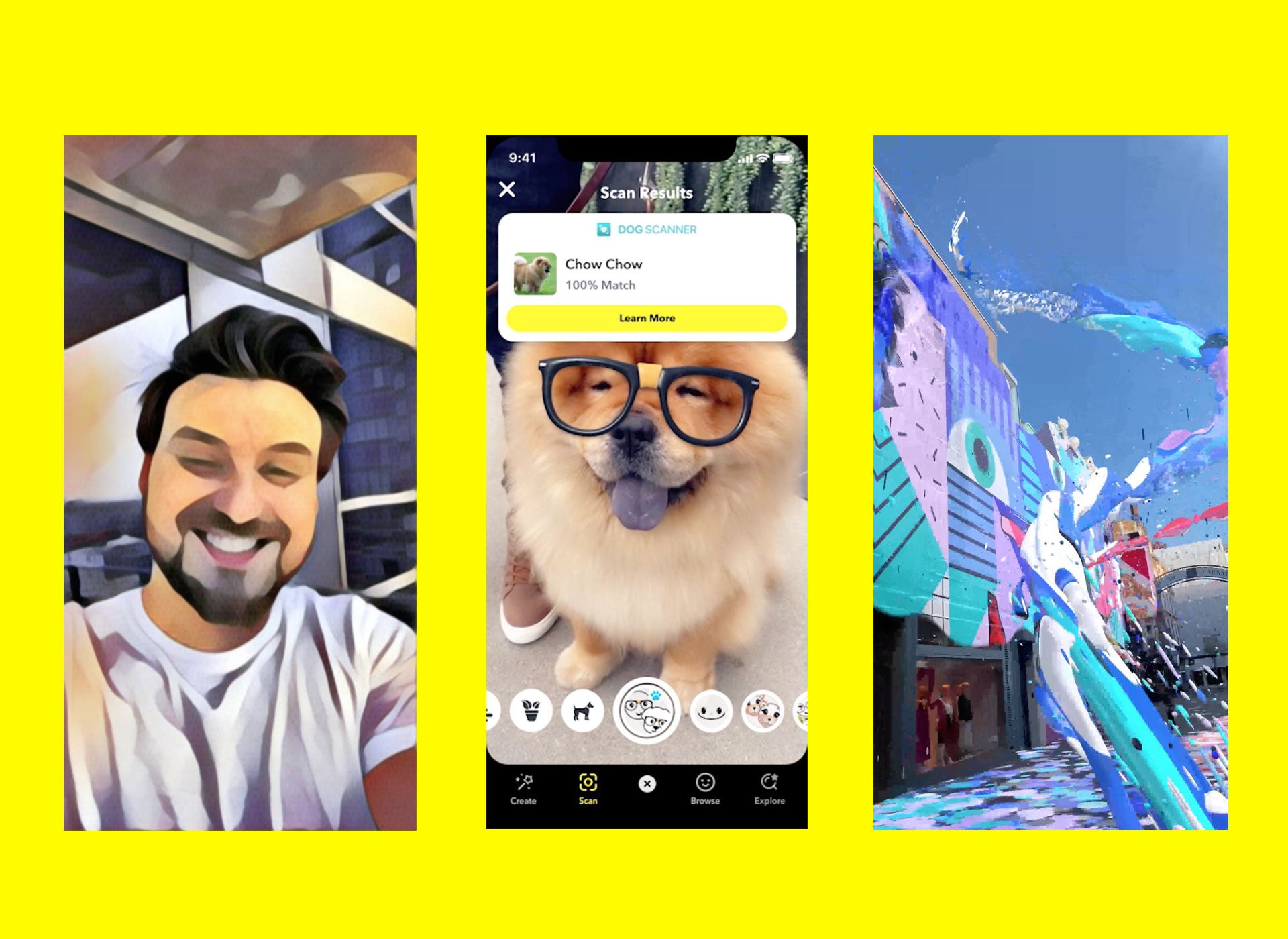

Augmented reality (AR) has been an increasing priority for Snap, with the company proudly announcing that 180 million users engaged in AR on a daily basis on Snapchat during Q2.

It also has rolled out an array of AR features, including Voice Scan, which enables users to start AR filters using their voice, Local Lenses, which provide localised AR experiences, and has introduced a new category of its AR Lenses that allow users to add music.

The company has also added support for developers to introduce real-time information into the AR content they create for Snapchat through a feature dubbed Dynamic Lenses.

While it is not the only company in the space to make use of AR – Instagram is also a key player in this area – Snapchat arguably remains the leader in AR-enhanced social media within western markets. It is thought that this will be key to maintaining attraction for younger users, who are increasingly being lured to Chinese video-focused rival TikTok.

“Snap’s competitors are facing immense challenges: its biggest rival for younger audiences, TikTok, is facing tough headwinds in the US, with talks about the platform being banned due to espionage concerns. Meanwhile, Facebook and its family of apps are still weathering the storm of an advertising boycott. This could be a chance for the platform to capitalise on its recent innovations and grow its audience size and its appeal to advertisers,” said Ben-Itzhak.

“However, Instagram’s imminent launch of Reels in the US market, a rival to TikTok capitalising on the content format of the moment, is likely to pose a threat to Snap’s ambitions. With more than 1 billion monthly active users on Instagram, Snap can’t come close to offering the scale of Facebook’s family of apps. It’s differentiation and innovation that will keep Snap thriving in Q3 and beyond.”

Read more: Snap VP backs social planning startup Zyng in £197,000 pre-seed round