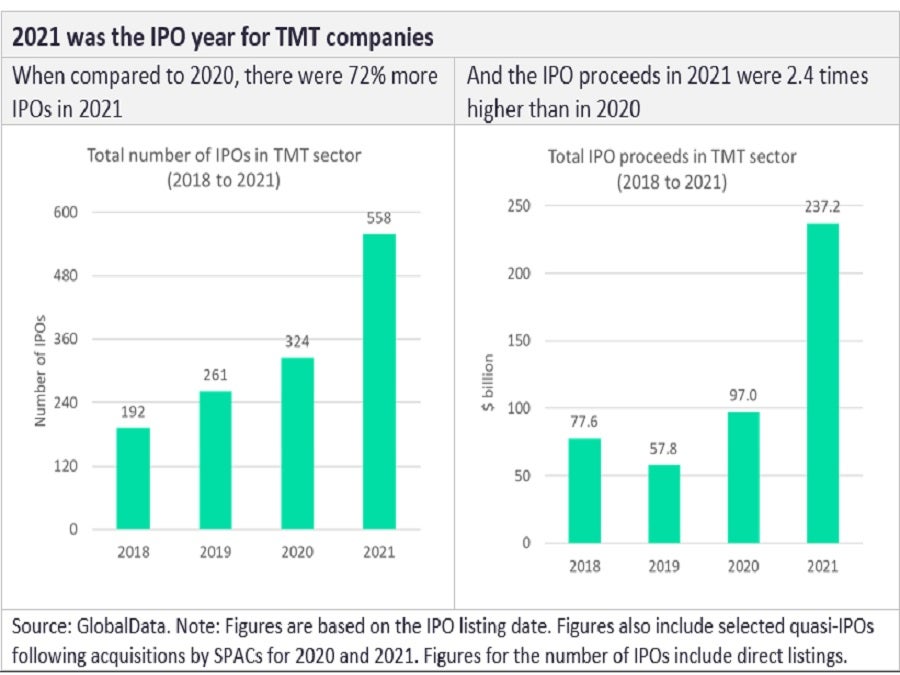

2021 was a record year for tech, media, and telecom (TMT) IPOs, with a total of 558 listings producing $237 billion in capital raised. Since 2018, there have been 1,335 TMT IPOs globally, with TMT companies raising total proceeds of $470 billion.

According to GlobalData, there were 72% more TMT IPOs in 2021 than in 2020, and the total proceeds of TMT IPOs were 2.4 times higher. It was also a record year for billion-dollar TMT IPOs, with 53 in total compared to 45 from 2018 to 2020. This indicates that not only has TMT IPO activity increased in 2021, but TMT companies are raising larger amounts in their listings. Also, established themes like ecommerce, fintech, and cloud have seen the most successful IPOs over the last four years.

In 2021, many notable companies went public with huge IPO proceeds—Rivian, China Telecom, Kuaishou Technology, Lucid Motors, and Coupang.

Rivian

The electric vehicle company—which is backed by Amazon—was listed on Nasdaq US on November 13, 2021, raising $11.9 billion. The IPO valued the company at $66.5 billion and the proceeds will be used to boost the production of its trucks, vans, and SUVs.

China Telecom

The Chinese telecom giant was listed in Shanghai after being delisted from the US in 2021. The company raised proceeds of $8.4 billion at an offer price of $0.7 per share. This valued the company at $59.7 billion at the time of the listing.

Kuaishou Technology

The online video platform made its debut on the Hong Kong exchange (HK) on February 5, 2021. The stock started trading at a premium of over 194%, compared to its IPO issue price of $14.8 apiece. It raised $5.3 billion in proceeds and soared to a valuation of nearly $150 billion, making it a very successful IPO.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataLucid Motors

Another electric vehicle company, Lucid went public through a special purpose acquisition company (SPAC) merger and was listed on the Nasdaq on July 26, 2021. The IPO raised proceeds of $4.6 billion and achieved a valuation of $24 billion. All proceeds will be used as growth capital for the company to execute its strategic and operational initiatives.

Coupang

The South Korean ecommerce company made its debut in New York on March 11, 2021. The IPO proceeds were $4.6 billion, with an IPO issue price of $35. This valued the company at $60 billion at the time of the IPO. The proceeds will be used for general corporate purposes, including working capital, operating expenses, and capital expenditures.

Established themes have seen the most successful TMT IPOs in 2021

In 2021, ecommerce and fintech were associated with the most successful IPOs. There were 70 ecommerce IPOs and together they raised $53.6 billion in proceeds. Ecommerce companies such as Coupang, Grab, and Didi Chuxing were listed in 2021 with higher TMT IPO proceeds. 40 of them were from fintech IPOs with total proceeds of $29.2 billion; Nubank, One97 Communications, and SoFi were the biggest fintech IPOs in 2021.

The TMT IPO pipeline for 2022 already looks crowded; ecommerce and fintech will remain the biggest themes driving TMT IPOs in 2022. Notable ecommerce companies that are gearing up for a 2022 IPO include Instacart, Flipkart, Lalamove, Oyo Rooms, and Ola Cabs. We will also see big fintech companies Klarna and Chime go public in Sweden and the US in 2022.

Related Company Profiles

China Telecom Corp Ltd

Coupang Inc

Grab Holdings Ltd

One97 Communications Ltd.