5G rollout is reliant on a range of factors in terms of both supportive regulations and investments.

In a regulatory sense, the communications law changed in July 2020 in the UK to speed up 5G rollout by reducing the technical limitations on mast building and size. These changes allow operators to emplace their existing telecoms masts with more equipment to drive coverage and introduce a greater amount of mast sharing between telcos where possible.

Existing masts can also be strengthened to support 5G equipment to be installed on them, without requiring an approval from the relevant authority. In terms of new masts, these can be built taller to support more equipment and mast sharing between telcos.

Telcos can also put building-based masts closer to highways (to maximize coverage on the major road routes) and deploy supporting radio equipment in cabinets near the masts with no anterior approval.

Investment wise, both government grants and wider telco investments will be needed to truly deliver a nationwide 5G coverage.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe UK’s £1 billion Shared Rural Network project (subsidized by the government and telcos) is set to drive significant improvement into maximizing mobile coverage with a target of 95% 4G coverage of the UK landmass by 2025. This will potentially have a knock-on effect on the relative 5G coverage, with telcos able to leverage 4G mobile assets and masts to add 5G equipment.

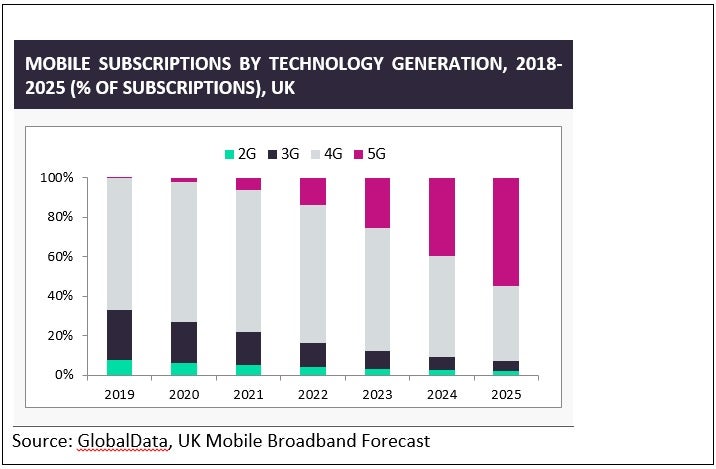

Whilst 4G may have accounted for 66.6% of total mobile subscriptions in 2019; its share will decline over the forecast period to reach 50.9% by 2024 due to customer migration to 5G. GlobalData expects 5G subscriptions to account for 39.9% of all mobile subscriptions by 2024.