Efforts to allocate broadband spectrum in the US have hit a snag due to recent bureaucratic obstacles and missteps.

Specifically, the Senate’s failure to extend spectrum auction authority at the Federal Communication Commission (FCC) has pitched the US’s broadband spectrum allocation process into turmoil, casting serious doubt on when a cogent, long-term roadmap for the country’s spectrum future can be expected to take shape.

The legislature dropping the ball on renewing the FCC’s spectrum auction authority is jamming up all manner of government spectrum business, including long-term agenda items like identifying and repurposing relevant spectrum bands and short-term requirements like handing over licenses for assets purchased in 2022.

Lack of planning is an issue

The glaring absence of a US roadmap for broadband spectrum allocation was already a source of consternation for bandwidth-hungry companies in the telecom space. Mobile data usage is a runaway train, with video, social media, gaming, and communications applications only getting more data-intensive.

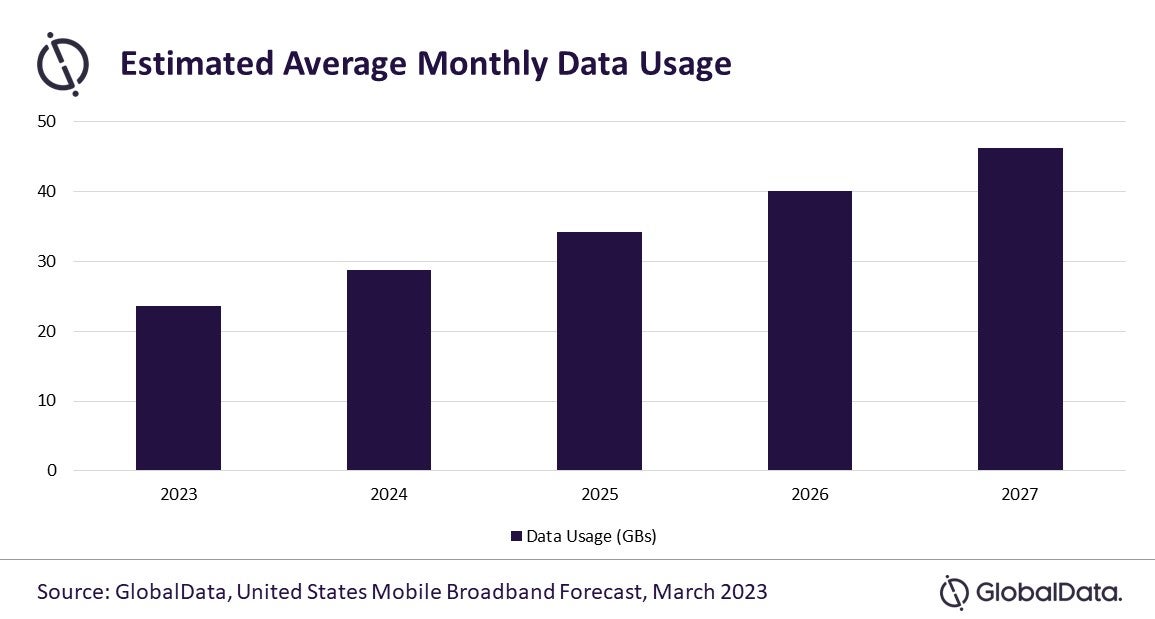

As shown in the diagram above: GlobalData research estimates that the average monthly mobile data usage for a subscription in the US will increase from 23.6 gigabytes (GBs) in 2023 to 46.3 GBs in 2027.

The ongoing trends in streaming and short-form video as well as the more nascent cloud gaming space will see that usage spike continue. Consequently, carriers will need to be able to lash together multiple spectrum ranges if they hope to beat usage to the spot.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataIndustry is still hustling to light up spectrum assets

Some factors would conspire to make the timing of this latest setback seem fortuitous: The US telecom industry at large is still hustling to light up spectrum assets acquired in the last few rounds of auction activity, and dire macroeconomic winds would likely mute operator appetite for near-term spending. Yet, that fails to take into consideration not only immediate issues such as fulfilling license obligations for auctions wrapped up in 2022, but also just how long-sighted a process spectrum allocation is.

Successfully repurposing is a years-long ordeal that requires coordination and earnest cooperation across a variety of organizations and industries, many of which too often work at cross-purposes. The US wireless operators, which are only just starting to see some of the advantages touted (too) early in 5G’s hype cycle, can ill afford a prolonged spectrum drought.

Furthermore, the uncertainty surrounding the future of the FCC’s spectrum authority significantly undercuts recent overtures from the Biden administration and the National Telecommunications and Information Administration (NTIA) regarding plans for a ‘national spectrum strategy.’

While the government is way overdue in recognizing the need for more concerted coordination and collaboration in developing and auctioning spectrum assets, launching a national strategy at a time when no agency has established, long-term auction authority feels like the wrong order of operations. A cogent national approach is fundamentally necessary, of course, but so too is an engine to drive it.