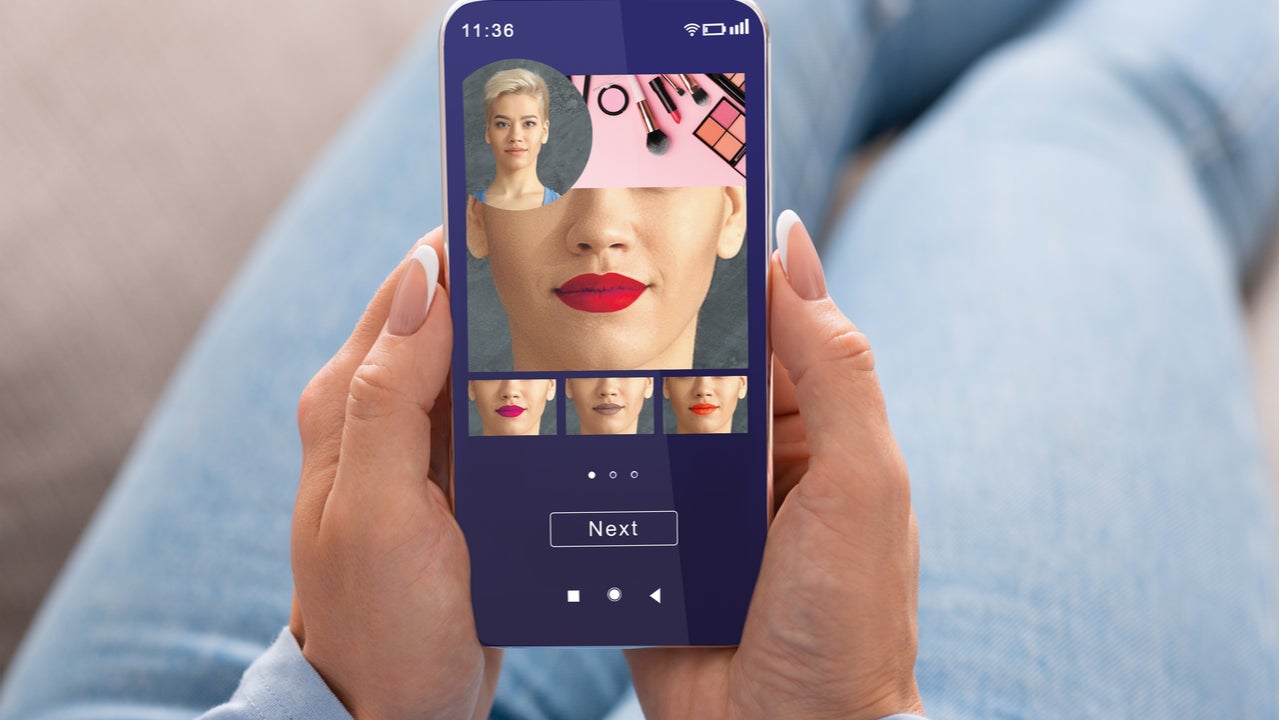

Beauty company No7 has partnered with Perfect to launch an AI-powered virtual try-on tool. Several major beauty companies have introduced similar products in the last two years, and consumers will soon expect all companies to offer technologically sophisticated products. Beauty companies without AI capabilities should seek partners soon.

L’Oréal acquired AI and augmented reality start-up Modiface in 2018. Modiface’s technology lets consumers ‘try on’ makeup products from their devices by superimposing the selected makeup onto an image taken from the device’s camera. The acquisition proved extremely fortuitous in 2020 when consumers were under lockdown; L’Oréal was one of only a small number of companies whose products could still be ‘sampled’ from home. Other companies, including P&G (Olay) and Johnson & Johnson (Neutrogena), soon made similar beauty tech investments of their own, and No7 is the latest to do so. It seems only a matter of time until these offerings are expected by consumers.

It is a similar story with fashion brands. PRADA and Farfetch products can now be tried on via Snapchat following a partnership between the luxury brands and the app. This follows Dior, which saw a six-fold return on its advertising spend after implementing try-on tech in its Snapchat promotions.

Virtual try-on shows how important AI is becoming

Virtual try-on is a salient example, but AI is becoming indispensable at every level of business. According to GlobalData’s ‘AI in Consumer Goods’ report, there were 25 AI-related M&As in 2020. Beauty tech deals included the US skincare and cosmetic company Shiseido, which acquired data and AI platform company Giaran in 2017, and Il Makiage, which acquired NeoWize, an AI start-up providing personalization algorithms for ecommerce sites, in 2019. According to GlobalData’s Hiring Trends Data, there were 3,670 AI-related job vacancies in the apparel sector as of Q3 2019, which rose to 12,041 as of Q3 2021.

AI can help companies to grow in several ways. For example, in the consumer goods industry—a saturated market—companies must target the right consumers and growth opportunities to be successful, and AI can be instrumental in targeting these. As well as this, investigating huge customer data stores using AI-driven data science provides consumer insights, trend predictions, and forecasting. Machine learning models are also instrumental in targeting growth, enabling targeted and personalized marketing and product recommendations.

Significant investment by consumer goods companies

AI is a very popular area for consumer goods companies and is receiving significant investment. Recently, PepsiCo used AI and their customer data stores when the company launched Quaker Overnight Oats. They identified 24 million households that they felt were the ideal target audience, then identified the shopping channels and venues that these households visited. Promotions were then made in line with these findings. PepsiCo claims that this method could drive 80% of product sales growth.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAll companies must have comprehensive AI strategies. Those that do not are likely already falling behind or losing ground to competitors.

Related Company Profiles

PRADA SpA

PepsiCo Inc