Only a handful of technology companies have entered the lexicon in the way that Zoom has. The Covid-19 pandemic, in 2020, brought the company global recognition, with rapid adoption that surpassed 300 million daily Zoom meeting participants at its peak. And ‘zooming’ became an adjective.

While the company has since seen a contraction in users, a number of factors including a broader product offering and a shift in corporate strategy has placed Zoom in a good position to redress its post pandemic slump.

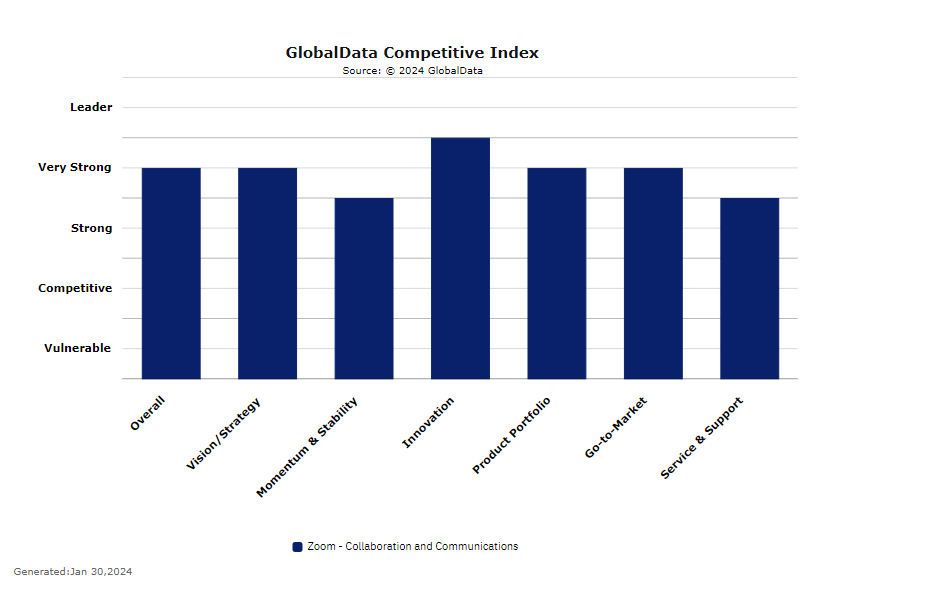

According to research and analysis company GlobalData, Zoom has succeeded in expanding its business to become a strong and holistic cloud-based collaboration platform player and continues to make good progress. GlobalData’s Competitive Index which tracks a company’s overall threat to its competitors, rates Zoom amongst collaborative communication market leaders Microsoft, Cisco and Google.

Following the Zoom boom of 2020, consumer and enterprise customers have retreated to leading competitor Microsoft Windows which remains the dominant force in the unified communication and collaboration platform market. The US software giant’s strength lies in its successful track record of integrating Teams, Microsoft 365 and Dynamics 365. But as the hybrid working model becomes ever more widespread, the market is ready for a challenger.

Enter Zoom. The company scored particularly highly on innovation in GlobalData’s Competitors Index. Indeed, Zoom has been focused on a wholesale transformation from video call platform to full workplace collaboration platform with a focus on the enterprise market.

The company’s third quarter 2024 fiscal year total revenue was up 3.2% year-over-year to $1,136.7m. Zoom’s consumer business comprises around 45% of revenues. CFO Kelly Steckelberg told CNBC that, in 2024, the company will focus on stabilising its consumer business through better product offerings and a rise in subscription prices.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataBut it is Zoom’s growing enterprise business that represents the company’s growth engine for the coming year. Indeed, Zoom’s enterprise business grew 24% year-over-year for the 2023 financial year, an increase that is sure to pique the interest of senior level executives at Microsoft. And that growth continues. Third quarter 2024 fiscal year results for enterprise revenue reached $660.6m, up 7.5% year-over-year.

The company’s rapid adoption and integration of generative AI (GenAI) has placed Zoom on an equal footing with archrivals such as Microsoft and presents the opportunity for the company to regain its market footing – only this time as a hybrid working platform.

Zoom AI Companion goes head-to-head with Microsoft’s Copilot

The surge in global awareness of the Zoom brand during the pandemic remains a blessing and a curse. Once universally recognised as a platform for video calls, the challenge will be for Zoom to achieve the same global recognition as a hybrid working platform.

In pursuit of this mission, the company has launched a suite of AI enabled tools from Zoom Docs, Zoom Phone – which can move a voice call into a video conference call without interruption – and Zoom Mail and Calendar which allows users to connect their email and calendar services directly into the Zoom client which will help reduce the ‘toggle tax’ of switching applications, save time and simplify the work experience.

The company has also rolled out a helpdesk feature called Zoom Contact Center that can help businesses to deliver personalised responses to customers over channels including voice, chat, SMS, and video.

Zoom Huddles is another video-enabled feature which serves as a virtual co-working space which replicates the ‘working alongside’ aspect of an open office and allows users to get quick answers to questions, brainstorm with a colleague, or even just feel closer to coworkers.

But the real battleground has emerged with the widespread adoption of GenAI. Zoom’s GenAI tool was launched in August 2023 and by October, had registered more than 125,000 accounts using AI Companion, generating more than one million meeting summaries. Zoom AI Companion, has seen the company go head-to-head with Microsoft Windows’ AI Copilot. And it will not stop there. Zoom’s 2023 Q4 financial report outlines how the company plans to “layer more AI technologies into our products to help our customers maximise their ROI on our platform.”

Is Europe Zoom’s big market opportunity?

In a blog on 31 August 2023, Microsoft confirmed that it had bowed to pressure from European regulators by confirming that it would unbundle Teams from its Microsoft 365 and Office 365 suites in Europe. From 1 October, 2023, the company started selling the products without Teams, for two euros less a month per seat. What that means in practice for smaller market players remains to be seen but, at the very least, it signals that Microsoft’s historic monopoly may not be as assured as once thought.

Regardless of Microsoft Team’s unbundling, Zoom’s head of EMEA Frederik Maris says the continent’s market opportunity is not to be underestimated. Maris joined Zoom in March 2023 and is the perfect hire for a company on the brink of a European expansion. As former vice president for EMEA at US security platform, Splunk, from 2016-2021, Maris has a track record of expanding a US business across disparate markets.

Maris describes his former role at Splunk, as taking “a lot of silos, reporting into the US” and “really building a team” with a new media plan across Europe. This, says Maris, requires a different approach to a US business plan, one that accounts for different cultures, languages and levels of market maturity. An overarching framework adapted to a local situation is how he describes it in simple terms but this, he admits, is no easy feat. The company’s two largest European offices in the Netherlands and the UK each have around 200 employees. But a global growth plan will see this number continue to rise.

Hybrid working is here to stay

Joining Zoom at a time when the company can no longer rely on the inbound business growth model, Maris says the company’s strategy is now wholly proactive. “This is why I joined,” he adds. “You could argue why not earlier,” says Maris. But Zoom’s timing is all about its improved offerings. The company has undergone massive transformation. “A couple of years ago, we only did meetings,” Maris explains. “During the pandemic, we had no outbound motion. We didn’t need to.”

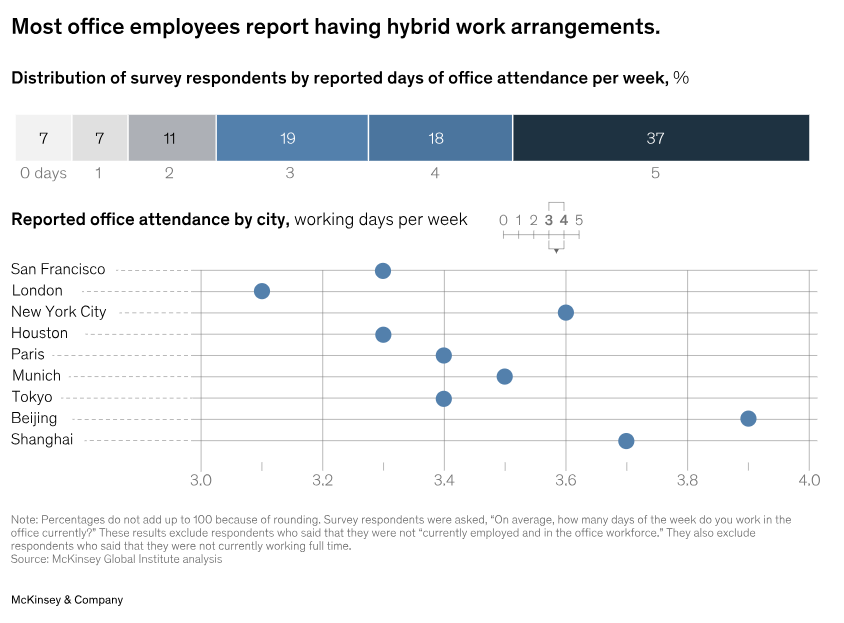

Now that Zoom’s transition from video meetings into a full workspace platform is complete, the company is facing an opportunity milestone. “The world is becoming hybrid, and this can be a real growth accelerator for Zoom,” says Maris. Indeed, a July 2023 by McKinsey demonstrated that employees in large metropolitan areas are mostly following the hybrid working model.

Zoom’s proposition is all about crossing the hybrid working divide. “Nobody’s going back to the office all the time,” says Maris. And this means that a workforce platform has to service a disparate workforce while still creating and maintaining a sense of belonging to the organisation, facilitating employee engagement and helping employees to establish their work identity.

Maris and his AsiaPacific counterpart are on a mission to make sure the company’s US operations include an awareness of the needs of their overseas colleagues including anything from GDPR and security, to data localisation and language support. On this point, Maris is confident. During his 30-year career he has never experienced another company that, “develops and innovates as quickly as we do.”

Zoom’s product development is second to none, he notes.

In addition, there has been a concerted market strategy focus in the last six to nine months since Maris was hired on overseas expansion and equipping Zoom’s executive hires in this mission. “The biggest opportunity we have is that we’ve got so many zoom users,” says Maris. A big marketing and branding push to get the message out there about the excellent product is part of the challenge. “And it’s easier to start with somebody that’s already using it and knows the power of the product. It’s easy to use, it always works,” adds Maris.

The Zoom value proposition

According to a poll of Windows users in January 2024 by Windowsreport.com, when asked if users would still use Copilot if it included fees or subscriptions, 46% of respondents answered with a definitive ‘no’.

Graeme Geddes, Zoom’s chief growth and sales officer says that the company’s value proposition in Europe is already very strong regardless of Microsoft unbundling Teams. Microsoft AI Copilot costs an extra $30 per seat for enterprise users in addition to the standard Windows subscription. Google’s AI assistant Duet is also an additional $30 per user per month.

By contrast, Zoom’s AI companion is available to paid Zoom user accounts at no additional cost. This says Geddes, is groundbreaking, and aligns with the company’s approach to AI development and its broader proposition of democratising emerging technologies. “Everyone should have access to this amazing technology [AI],” he says.

Zoom’s meteoric rise was driven, in part, by the fact that the platform included 40 minutes of free video calls before having to access the paid product. It proved to be Zoom’s key to capturing the global market. “When you open up access to everyone, the use cases are limitless,” adds Geddes.

Zoom’s technology architecture is very cost efficient. “Video is very bandwidth intensive, CPU intensive, it’s very costly, the architecture of the Zoom platform allows for us to do it in a very, very cost-efficient manner. And that’s an architectural difference that allows us to have great margins,” says Geddes. And the company’s heavy investment in AI will create further efficiencies, he adds.

But it isn’t simply an issue of cost, according to Geddes who reiterates Zoom’s existential purpose: saving people time. The product creates greater efficiencies because “it works so well”, he adds. Zoom’s enterprise offering and Zoom AI assistant are easy to manage – something IT leaders should consider when evaluating when selecting an enterprise platform, notes Geddes.

Industry analysts believe that there is an appetite among enterprises for competition to Microsoft’s Teams. But Zoom has its work cut out as it is not an established heavyweight like Microsoft or Cisco. It will be tough challenge, but if Teams unbundling happens and Zooms builds out the right partner ecosystem for devices and for AI development, then it has a chance.

Indeed, the company is embracing new channel partners, says Geddes, with a level of interest from partners in product and services that leaves standing room only at partner events. And as for partners in the AI space, the company announced a strategic partnership and investment in AI company Anthropic in May 2023, to bolster Zoom’s federated approach to AI by integrating Anthropic’s AI assistant, Claude, into its platform.

In the rapidly evolving world of technology, there is no room for nostalgia. But if ever there was a public fondness for a technology brand within the recent past, Zoom has everything to build upon. And has everything to play for within the post pandemic landscape where technology has become integral not only to the work we do but, moreover, the way in which we do it.