The Netherlands-based semiconductor gear manufacturing startup Nearfield Instruments is considering an initial public offering (IPO) by 2028 amid a growing market for its chip measurement tools, reported Reuters citing the company CEO Hamed Sadeghian.

Sadeghian was cited by the news agency as saying: “We are planning for IPO in 2027, 2028 at the latest. It depends on the market situation.”

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

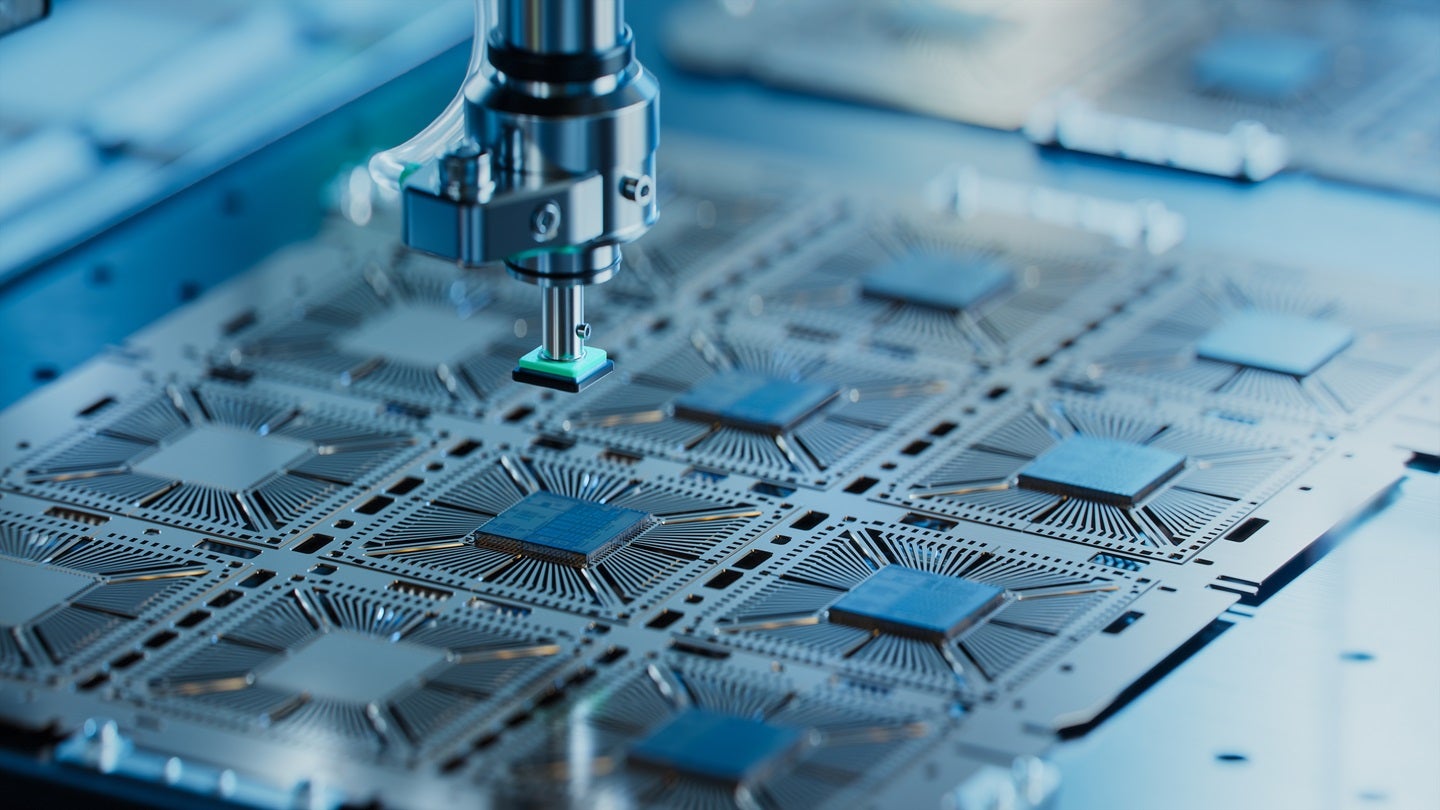

Nearfield Instruments’ technology, which utilises atomic force microscopy, is said to allow for precise measurements of silicon wafers at dimensions smaller than most light wavelengths.

Sadeghian said that while Nearfield Instruments’ tools are primarily used for advanced logic chips, there is growing interest from memory chip manufacturers and producers of older-generation chips.

These chips are used in various applications, including automobiles and power grids, where innovation is ongoing.

Established in 2016 as a spin-off from the Netherlands research institute TNO, the company recently secured “multiple orders” from a US customer and is planning to expand its presence in the country.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn July 2024, Nearfield Instruments raised €135m ($147m) in Series-C funding round. This investment, which saw contributions from major players like Walden Catalyst and Temasek.

At that time, the company said that the proceeds were intended for enhancing its product range and increasing its production capabilities.

The funding round, which was oversubscribed, also included M&G Investments as a co-investor through its Catalyst strategy.

Other participants were existing investors such as Invest-NL, Innovation Industries, and ING.