Apple has offered to allow its rivals access to its tap-and-go mobile payments system used in mobile wallets, in a move that could save the company from EU antitrust charges, Reuters reported, citing three people familiar with the matter.

The move comes after the EU watchdog, last year, accused Apple of purposefully blocking its rivals’ access to its tap-and-go technology.

The EU said the iPhone maker made it difficult for rivals to develop similar services on Apple devices, benefiting its proprietary Apple Pay feature on iPhones and iPads.

Apple Pay, the feature on iPhones and iPads that allow tap-and-go payments, is used by over 2,500 banks in Europe.

European Competition Commissioner, Margrethe Vestager, previously said there were “indications that Apple restricted third-party access to key technology necessary to develop rival mobile wallet solutions on Apple’s devices.”

The EU watchdog pointed to Apple’s power in the smartphone and mobile wallet markets.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

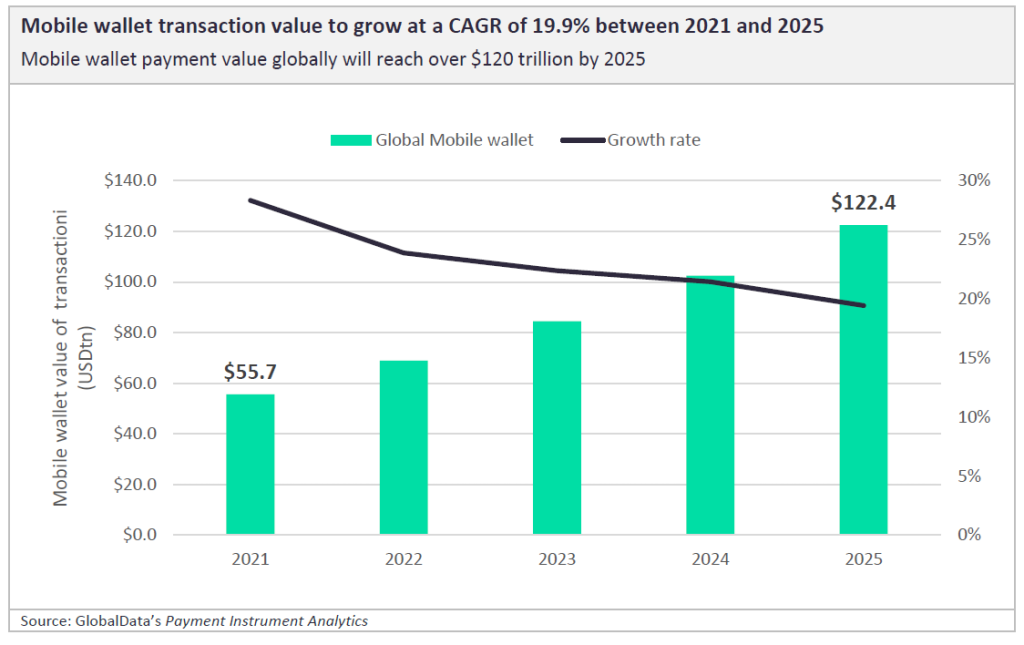

By GlobalDataAccording to GlobalData’s Payment Instrument Analytics, cited in its Thematic Research: Mobile Payments (2022) report, the global mobile payment sector was worth at least $55.7tn in 2021, with China representing about 90% of the value of transactions made during that period.

As the world economy is accelerating its transition to becoming cashless, transactions will gradually migrate from physical cash to the point of sale terminal, according to the report.

Across the world, the growth forecast ahead of mobile payment transaction value will be a compound annual growth rate of 21.8% between 2021 to 2025, reaching $122.5tn in 2025, GlobalData states.