President Joe Biden has proposed an agreement that would see Big Tech companies pay more tax, both in the USA and in other nations where they make their money.

Large multinationals inside and outside the tech sector often cut their tax bills using a variety of international techniques. One of these is “profit shifting”, in which profits are declared not in the nations where they are made but in tax havens. This practice is especially popular among tech giants such as Google and Facebook, which are both well known for making use of low corporate tax rates in the Republic of Ireland. Other major tax havens, according to the US Treasury, are Bermuda, the Caymans, Luxembourg, the Netherlands, Singapore and Switzerland.

According to US Treasury documents published this week, “more US profits are housed in tiny tax havens than in the major economies of China, India, Japan, France, Canada, and Germany combined”.

Efforts in recent years to create a more unified global corporate tax system have failed to gain traction. This has led some nations, including the UK, to implement special taxes on digital services.

The Biden Administration this week announced three proposals to increase corporate tax revenues, saying that the measures were necessary in order to pay for the new President’s planned, enormous economic stimulus package.

The President wants to increase the US federal corporate tax rate from 21% to 28%. He has also proposed a global corporate tax baseline of 21%, which his administration says will prevent a so-called “race to the bottom” between countries lowering rates to attract multinationals to their shores.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAccording to calculations by the Tax Justice Network, a global minimum corporation tax of 21% would raise an additional $300bn to $400bn in extra revenue for governments annually.

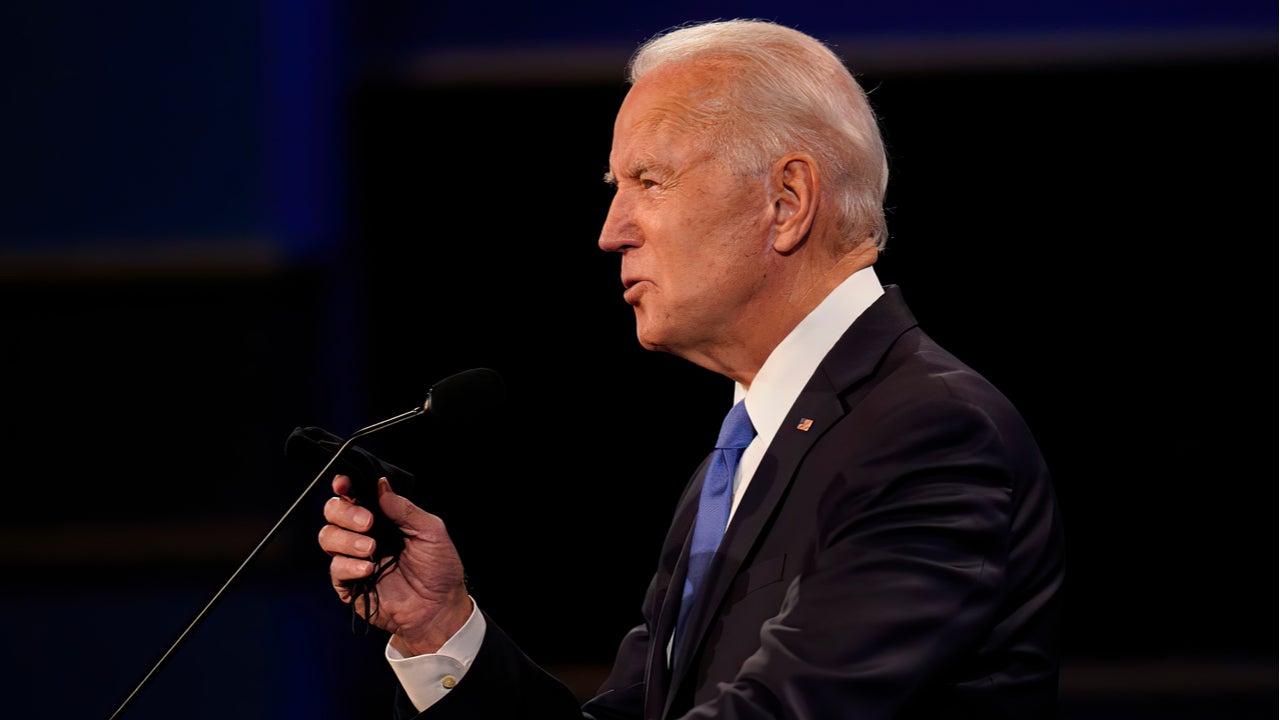

“It’s not a plan that tinkers around the edges. It’s a once-in-a-generation investment in America, unlike anything we’ve done since we built the interstate highway system and won the space race decades ago,” Biden said on Wednesday at the Eisenhower Executive Office Building in Washington, speaking of the economic stimulus spending which the tax hikes would pay for.

The third proposed tax measure is a minimum tax based on financial profits that companies report to their shareholders, as opposed to those they report to the government.

The Biden administration sent a document outlining plans to 135 countries on Wednesday.

The move marks a reversal of the corporate tax cuts rolled out under former president Donald Trump. Biden will face a tough challenge in getting countries on board with the proposed worldwide corporate tax floor, as well as receiving support from Republicans.

Some countries have unilaterally created their own taxes specifically for digital services after a previous failure to reach a global consensus. In April 2020 the UK launched its Digital Services Tax, which subjects search engines, social media platforms and online marketplaces that make revenue from users in the UK to a 2% tax on those revenues.

The UK government says it “strongly supports G7, G20 and OECD discussions on long-term reform” and is “committed to dis-applying the Digital Services Tax once an appropriate international solution is in place”.

Singapore, Bermuda and the Caymans are not members of the G7, G20 or OECD. Other major corporate tax havens such as Ireland, Luxembourg and the Netherlands do belong to one or more of these international organisations. Luxembourg raises almost 6% of its GDP in corporate taxes, the Netherlands almost 4% and Ireland just over 3%, according to OECD figures. The UK collects just over 2%, and the USA less than 1%.

Earlier this week Amazon CEO Jeff Bezos publicly supported an increase in corporate tax rates, which raised eyebrows given Amazon’s track record for paying corporate tax. In 2019 the e-commerce giant paid £293m in tax on UK sales of $17.5bn.

Updated to Add: Our suggestion that Biden might be successful in getting his deal turned out to be correct, as G20 ministers met in Washington to sign off on a global corporation tax floor of 15% in October 2021.