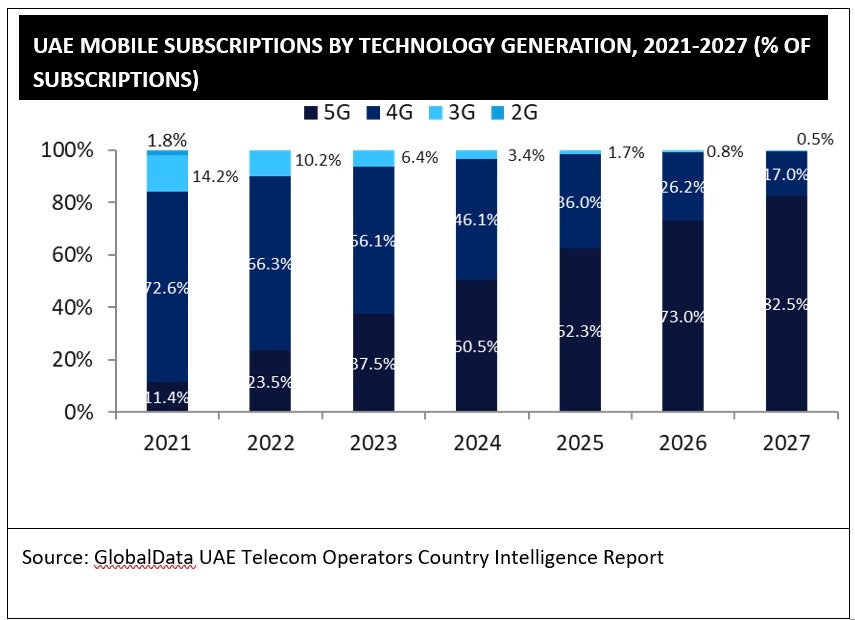

In the UAE, 5G share of total mobile subscriptions rose from 11.4% in 2021 to 23.5% in 2022 alone and will further grow to reach 82.5% by 2027.

While Etisalat by e& and du actively promote segmented plans to drive uptake and ARPU uplift, they are also well placed to derive additional value from their 5G networks.

In line with their connectivity business, the telcos are working to upsell, cross-sell and attract new customers with services like private 5G, 5G Standalone, 5G fixed wireless and 5G satellite service to both consumer and enterprise customers. In addition, the two MNOs are expanding their portfolio of B2B and B2C digital solutions to help unlock additional 5G revenue opportunities.

Examples of these include e& expanding its line of healthcare services and du’s showcasing drone services over 5G. Furthermore, an October 2022 acquisition of Smartworld, an IoT and AI solutions company, by e& and a February 2023 partnership announcement between du and Huawei to develop 5G advanced technology (5.5G), is indicative of the telcos expanding their capabilities and resources required to create more value and expand their addressable markets.

The UAE government’s push for digital transformation at a national level should also serve as a catalyst for the telcos’ 5G plans.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData