Relationships between customers and insurers will be stronger as D2C models are adopted, and this will be beneficial to insurers. Direct interactions will allow insurance firms to better understand customer behaviour and risks. This could lead to customised products that more accurately assess levels of risk.

Listed below are the top underwriting and risk profiling trends impacting D2C in insurance, as identified by GlobalData.

Non-life insurers

The D2C model has become more widespread among non-life insurers. D2C models provide opportunities to underwrite policies online in order to streamline processes. As some personal lines become increasingly commoditised, online underwriting will become more and more common. In particular, online underwriting will be more prevalent for products with low risks. Some insurers use AI-driven chatbots to engage with customers by text, and this dynamic data can be used for automated underwriting.

As interactions with customers become more frequent and technology adoption increases, insurers will be able to use larger volumes of customer data and to do so more effectively.

Life insurers

The advisory channel is expected to dominate the distribution of life insurance policies for the foreseeable future. In this respect, it is unlikely that underwriting and risk profiling will change to a significant extent. Thus, the parameters taken into account by life insurers are unlikely to change. However, an increase in policies that can be coupled with technology such as wearables will allow for larger volumes of lifestyle data, and will help insurers refine their understanding of risk levels. This will lead to more accurate underwriting and risk profiling.

Some insurers increasingly focusing on D2C sales are moving towards more preventative approaches. Vitality’s rewards-based program incentivises customers to exercise regularly, while the insurer also offers policyholders discounts on the Good Health food range from supermarket chain Waitrose. Insurtech yulife, which offers policies underwritten by AIG Life, encourages customers to live a healthy lifestyle by rewarding them for completing physical and mental wellbeing activities.

Reinsurers

As the volume of customer data made available to insurance firms increases, reinsurers will be able to fine-tune the accuracy of their risk profiling. In addition, the number of collaborations between reinsurers and insurtechs is on the rise. A substantial proportion of insurtechs gather large volumes of dynamic customer data, which can lead to more accurate risk profiling.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

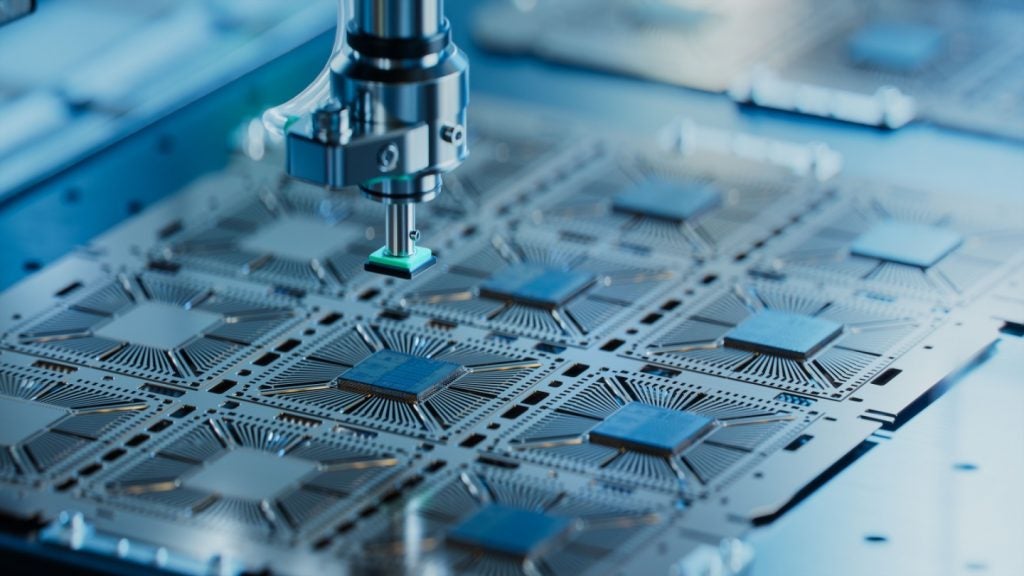

By GlobalDataSwiss Re is among has developed a D2C automated underwriting system, with its version known as Magnum. The system is incorporated into Swiss Re’s client platform and allows insurers to streamline their underwriting capabilities.

This is an edited extract from the Direct to Customer in Insurance – Thematic Research report produced by GlobalData Thematic Research.

Related Company Profiles

Swiss Re Ltd