According to the “Thematic Intelligence: Cryptocurrencies (2023)” report, the revenue generated by centralised cryptocurrency companies will accelerate as regulatory and security concerns are addressed.

The metaverse – which encompasses a multitude of virtual worlds where cryptocurrencies are used for shopping and trading – will become a $627bn market, GlobalData analysts predict.

This comes despite a series of bankruptcies that have negatively impacted the crypto market over the last year and culminated with the collapse of FTX, a centralised exchange, in November 2022.

In May 2023, Bittrex, another centralised exchange, filed for bankruptcy in the US, with its American affiliate now in a legal battle with the US Securities and Exchange Commission.

“The crypto market’s volatility means the growth trajectory is unlikely to be linear,” the report states. “Additionally, most cryptocurrency companies are not public, and businesses in the industry have historically offered little transparency. While the level of financial disclosure is improving, it lags behind most other industries”, it continues.

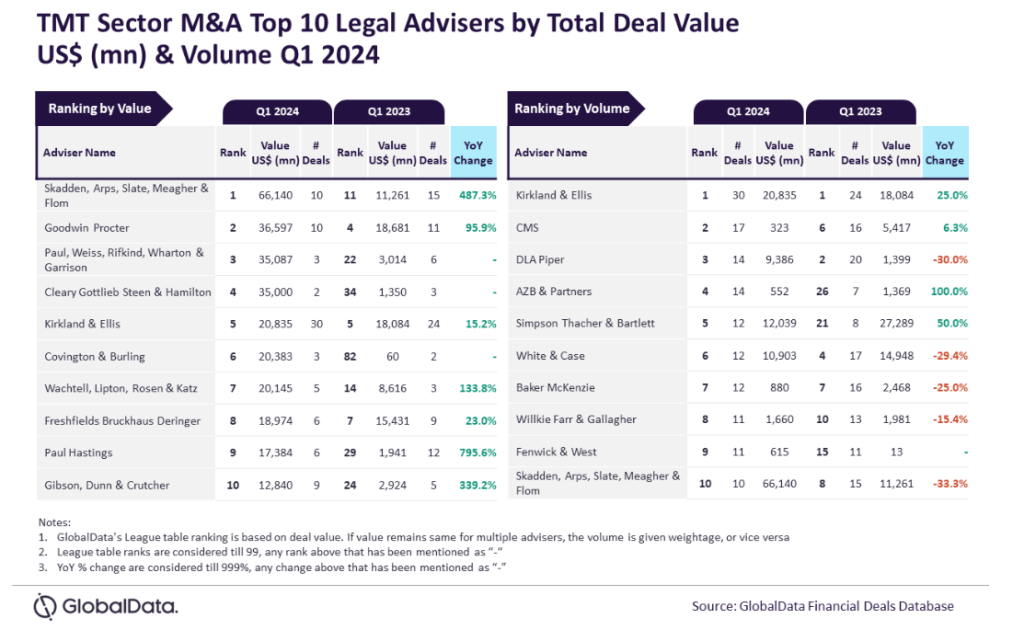

Mergers and acquisitions activity

As of 22 May, there have been 60 M&A deals in the crypto industry in 2023 – a decline of 17% compared to the same period in 2022.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAs the market cools off after peaking, corrections have offered attractive opportunities for acquirers. The deal volume increase in 2022 and a strong start in 2023 suggest that interest in the crypto industry remains strong.

“A drop in crypto prices, lower valuations, and liquidity challenges in the industry will lead to a rise in M&A activity”, the report says. GlobalData analysts further identify three companies that lead the way with the most M&A deals – Coinbase, Binance and Kraken.

“The transformative possibilities of cryptocurrencies come with a host of challenges that must be addressed”, the report notes. “High volatility, security concerns, and regulatory uncertainty, especially in the US with the enforcement actions taken by the Securities and Exchange Commission (SEC), are just some of the hurdles that cryptocurrencies face in their journey toward mainstream acceptance. Additionally, issues like the environmental impact of mining and the technology’s association with illicit activities pose significant barriers.”