The US House of Representatives passed a landmark bill on Wednesday (22 May) to regulate cryptocurrency in the country, as centralised crypto topped blockchain M&A activity in 2023.

The Financial Innovation and Technology for the 21st Century Act (FIT21) was passed by a 279-136 vote and will now be passed to the US Senate to enact.

The bill is intended to support the US crypto industry by providing legal clarity and protection for cryptocurrency users.

According to Republican Rep. Patrick McHenry, the bill will end the “food fight for control” of crypto between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission.

SEC Chair Gary Gensler has criticised the bill for creating regulatory gaps.

“[FIT21] would create new regulatory gaps and undermine decades of precedent regarding the oversight of investment contracts, putting investors and capital markets at immeasurable risk,” stated Gensler.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataIn its 2024 thematic intelligence report into blockchain technology, research and analysis company GlobalData recorded that blockchain was seeing an increase in the number of tech M&A deals related to the technology.

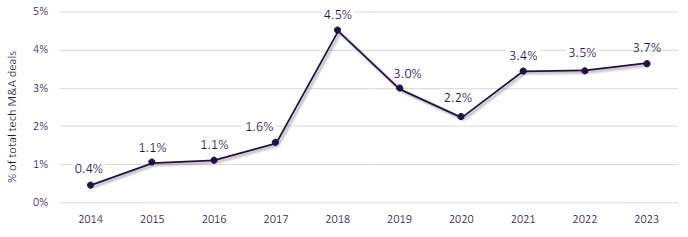

By 2023, around 3.7% of all technology M&A deals were related to blockchain technology, up from just 2.2% in 2020.

GlobalData reported that the primary targets of these deals were blockchain development platforms, mining and node infrastructure players, and crypto exchanges and trading platforms.

Large, centralised cryptocurrency exchange platforms such as Coinbase and Kraken led this M&A activity.

Between 2014 and 2023, the majority of these deals were based in the US. Around 35% of all blockchain M&A deals were conducted by US companies.