Earlier this week, Klarna rolled out its new Shopping app in the UK providing users with access to buy-now-pay-later (BNPL) services wherever they shop online. However, the founder of rival Zilch has suggested the Swedish fintech giant might have taken the idea from him. Klarna denies this is the case.

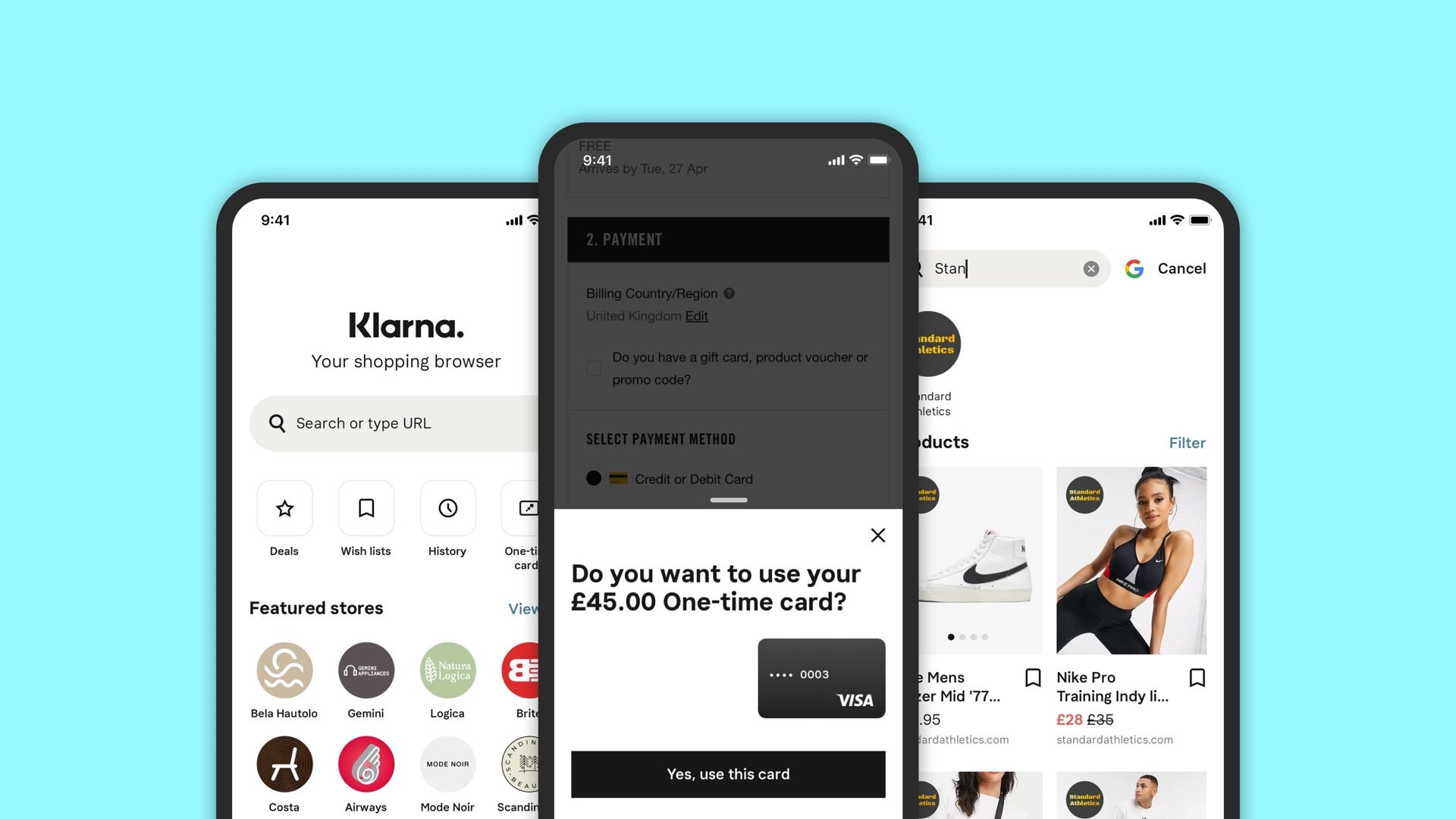

Klarna’s new Shopping app enables British consumers to use the BNPL company’s Pay in 3 solution at all online retailers, meaning they can split the payment into three instalments. Notably, the merchants do not have to be partnered with Klarna for the service to work.

“Shoppers now can interact with their favourite retailers without having to leave the Klarna app to create a smooth, safe and frictionless shopping experience,” said Sebastian Siemiatkowski, founder and CEO of Klarna. “Our one-stop-shop app is the future of shopping, it creates a truly personalised and bespoke service for every user and liberates consumers from ever paying more than the price of the product.”

However, the CEO and founder of UK competitor Zilch, Philip Belamant, told Verdict he believes Klarna may have been inspired by his own startup, which offers a similar solution where people can shop at any vendor even if the merchant is not signed up with Zilch.

“We look at businesses like Klarna and, where we can, draw inspiration from what they do or don’t do,” said Belamant. “In light of the new launch – it seems they draw inspiration from us too.”

He also took the opportunity to criticise aspects of Klarna’s Shopping app.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“Klarna’s ‘buy anywhere’ is a necessary add-on service to their core proposition but its implementation is inconvenient and fundamentally different from what we offer at Zilch,” he says. “Amongst other things, it currently debits you before you submit the details on the merchant page which flies in the face of its very proposition.”

When reached for comment, Klarna denies that the Swedish $31bn business lifted the idea from Zilch, pointing towards the fact that it has been around for years in the US, Australia and Sweden.

“This service has been live across key markets, including the United States, for over two and a half years,” a Klarna spokesperson told Verdict. “There are more than 18 million users in the US alone and the app was one of the 10 most downloaded shopping apps in 2020. Launching the game-changing new shopping feature in the UK, making interest-free shopping possible with all online retailers, is the latest way in which our 14 million customers here are benefiting from Klarna’s mission to provide a better, fairer way to shop, bank and pay.”

The spokesperson added that “Klarna’s default rate in the UK is well below 1% which is much better than credit cards and demonstrates that people use our products sustainably.”

Klarna achieved its $31bn valuation, technically making it a tridecacorn, in March on the back of a $1bn funding round. Klarna is rumoured to be on the cusp of becoming a quadradecacorn. Sources close to the matter recently told Business Insider that the fintech is close to raising more money in a deal that would give it a valuation north of $40bn.

In April, Zilch closed a $80m Series B funding round that saw the company’s valuation rise to over $500m.

The worldwide BNPL sector is expected to be worth $166bn by 2023, according to GlobalData Thematic Research.

As the sector grows, market stakeholders have voiced concerns that the proliferation of BNPL services could put more people’s financial well-being at risk.

Justin Basini, CEO and co-founder of credit score startup ClearScore, has warned that the “interest-free instalments and no hidden fees of buy-now-pay-later payments mean that shoppers have a lower perceived risk of debt, which can lead to overspending and ensuing problems.”

In the US, 40% of customers who’ve used BNPL services have missed a repayment, prompting expectations that the Biden administration will tighten the rules around the sector. Lawmakers have already launched similar initiatives around the world.

In the UK, the Financial Conduct Authority (FCA) published a review on the BNPL sector in February, pledging it would introduce stricter rules to reel in the industry. Both Klarna and Zilch have welcomed the move by the FCA.