While bitcoin remains the dominant global cryptocurrency, a swathe of alternatives (known as alt-coins) have appeared over time; LiteCoin, ByteCoin, Ripple and even the meme inspired DogeCoin.

However, it appears that Ethereum is the rising star on the cryptocurrency scene, having surpassed Ripple in May to become the second-most valuable and sizeable cryptocurrency in 2017.

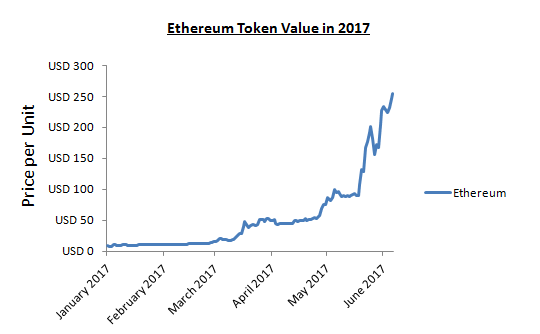

Ethereum’s value increase

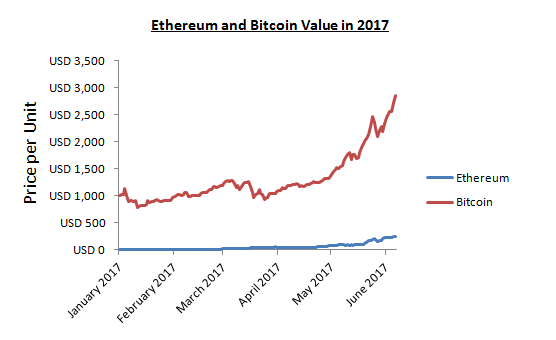

Ethereum’s value rose by 2,888.4 percent between 1 January 6 June, bringing the price per token to £254.61, while the famously volatile bitcoin equivalent rose by 186.9 percent over the same period, bringing the value per bitcoin to $2,862.31.

Whilst Bitcoin’s value remains extremely high, Ethereum’s value and market share are beginning to make headway and are positioned to challenge the leader in the medium to long term.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe value of Ethereum could surpass bitcoin by the end of 2018

According to research by Coinmarketcap, bitcoin accounted for 87.2 percent of the digital currency market at the start of 2017, while Ethereum accounted for just 4.06 percent.

By 5 June, this had radically altered, with bitcoin falling to 45.26 percent and Ethereum surpassing Ripple to account for 23.88 percent of the market.

This impressive leap in share has been driven by the market noting interest from the Bank of America, Santander and JPMorgan’s in Ethereum-based blockchain applications.

These applications feature smart contracts that enable automated, decentralised operations, which allow for secure contract negotiation and payment.

While the price per bitcoin is still around 10 times that per Ethereum token, its market share is decreasing.

Price predictions can be perilous

Cryptocurreny is notoriously hard to forecast, and its fortunes often coincide with economic and political uncertainty, but if the market remains on this trajectory, the value of Ethereum could well surpass that of bitcoin by the end of 2018.

However, this relies heavily on banks’ continued endorsement and support for the cryptocurrency.

Beyond the bubble, the extra value of Ethereum lies in its continued adoption into the payments infrastructure of the banks’ clients’ businesses.

Related Company Profiles

JPMorgan Chase & Co