Online shoppers are predicted to have spent over $12bn over this Black Friday and Cyber Monday holiday season, according to data from Adobe Digital Insights.

If these estimates are correct, shoppers will have spent 9.7% more than last year’s Black Friday and Cyber Monday.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

This increased spending has taken place alongside a recent downturn in M&A activity within the e-commerce sector.

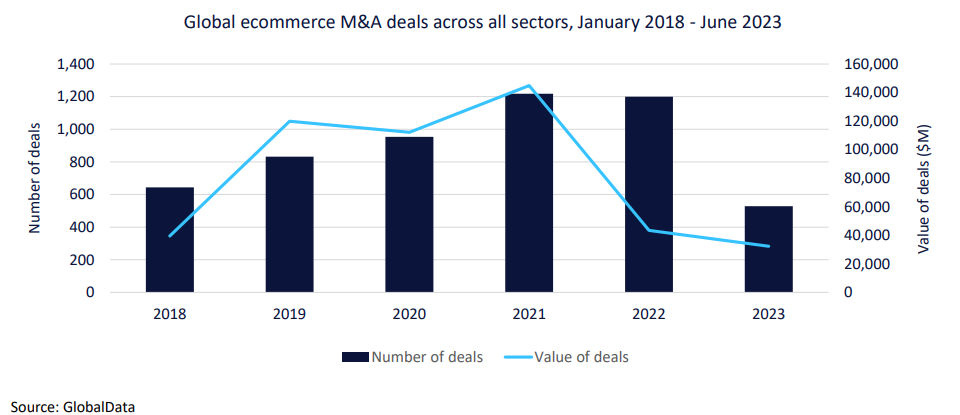

M&A activity in e-commerce grew rapidly between 2018 and 2021, but 2022 saw a slight fall in the number of deals made. The value of these deals declined rapidly at 71% between 2021 and 2022.

Research analyst company GlobalData attributed this bubble to the COVID-19 pandemic lockdowns changing consumer behaviour. Customers who may have never shopped frequently online now had little choice in where they could shop.

Pandemic lockdowns were a crucial factor behind the 15% compound annual growth rate that e-commerce achieved between 2016 and 2022 according to GlobalData, reaching a total market value of $5.9trn by 2022.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataBy 2027, GlobalData expects the e-commerce market to be worth over $9.3trn.

The global ecommerce industry is dominated by China and the US, with market shares in 2022 of 34% and 30%, respectively.

In addition, low interest rates before 2022 helped bolster M&A activity. However, increasing regulations around anticompetitive behaviour may have contributed to declining M&A activity.

In spite of 2022’s dwindling of activity, GlobalData’s research suggests that the number of deals is set to be approximately the same as 2022. The value of these deals, however, is expected to be substantially higher.

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets – patents, jobs, deals, company filings, social media mentions and news – to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.