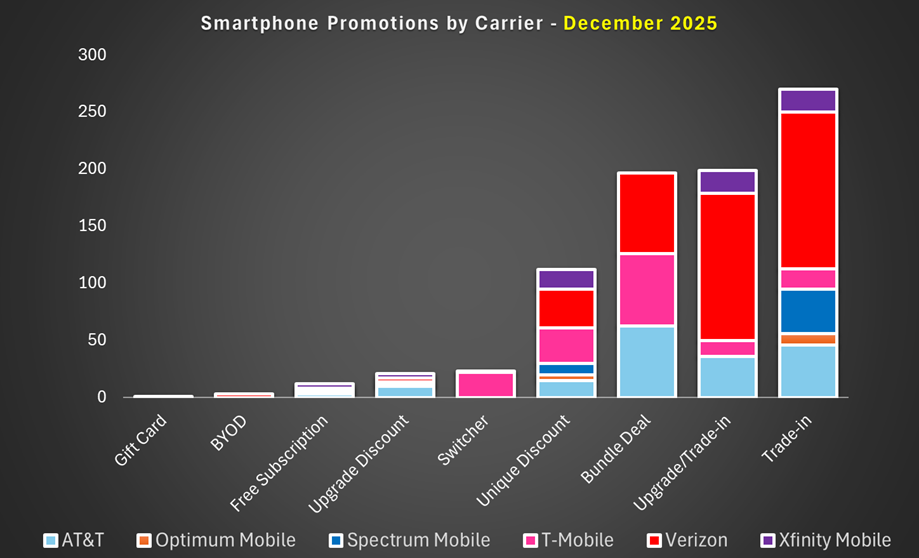

December 2025 closed with a highly competitive US promotional environment, with 838 new smartphone deals tracked across AT&T, T‑Mobile, Verizon, Spectrum Mobile, and Xfinity Mobile. The market was defined by breadth (nine promotion types) but concentrated leadership: Verizon (380 deals) dominated activity, followed by AT&T (173) and T‑Mobile (154).

From a device perspective, carrier support remained overwhelmingly concentrated around the top two OEM ecosystems. Samsung led with 502 promotional offers, and Apple followed with 231, reinforcing that premium flagship cycles and high-velocity iPhone/Samsung demand continue to anchor carrier acquisition strategies. This imbalance also signals an increasingly difficult environment for smaller OEMs to gain visibility without differentiated bundles or guaranteed trade-in value plays.

Verizon delivered the most aggressive posture, using promotions as a conversion engine for both new adds and upgrades. The carrier leaned heavily on trade-in (137) and upgrade/trade-in (129) constructs and reinforced them with “extras” (streaming bundles and companion devices). The reintroduction of discounted pricing on Welcome Unlimited, Unlimited Plus, and Unlimited Ultimate—paired with multi-line credits over 36 months—shows Verizon prioritising long-duration revenue protection and account stickiness.

AT&T presented the most “mature” promotional architecture. With 63 bundle deals, 46 trade-in offers, and 36 upgrade-with-trade-in incentives, AT&T focused on consistency and accessibility. T‑Mobile executed a dual-track approach: aggressive device incentives, but with clear premium-plan gating via Experience tiers (Experience Beyond/More). High-value iPhone offers (up to $1,000 off) and multi-line port-in constructs signal continued emphasis on switchers.

Among cable MVNOs, promotions were narrower but strategically focused. Spectrum Mobile ran 49 deals with roughly 80% requiring trade-in, using trade-in as the primary lever to reduce upfront device cost and drive activations. Xfinity Mobile ran 66 offers, also heavily trade-in dependent, and pushed customers toward Premium Unlimited to unlock the strongest incentives. The extended “free year of mobile” credit and the Elite Upgrade program (with eligibility controls) indicate a deliberate balance between retention perks and subsidy risk management.

Final verdict

December 2025’s smartphone promotion landscape affirms that the US wireless market has evolved beyond headline price slashing—today’s winners deploy multi-dimensional incentives, with an emphasis on trade-ins, bundled value, and plan-tier gating to drive both acquisition and long-term loyalty.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataUltimately, carriers are betting on ARPU lift over upfront volume. Promotions are no longer just about bringing new lines—they’re about fostering sticky customers: those tied in through multi-line commitments, tier upgrades, trade-ins, and ongoing benefits. As the promotional arms race continues, success will favour those who manage promotional intensity with discipline, offer clarity over complexity, and deliver value that resonates beyond the sticker price.

The market’s competitive fervour in December underscores that the smartest investments are not in the deepest discounts—but in crafting the most compelling ‘why stay?’ proposition.