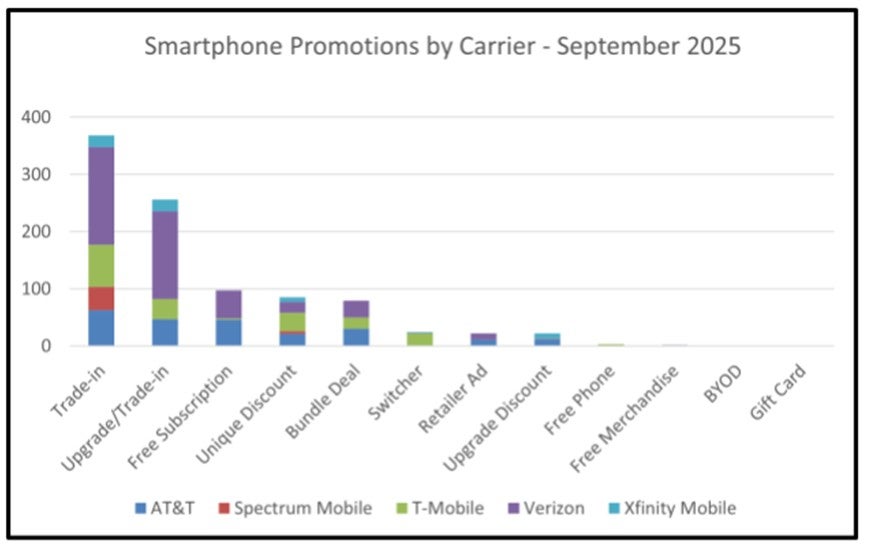

In September 2025, the US smartphone promotions landscape was competitive, with carriers rolling out 960 deals across 12 promotion categories.

Trade-in rebates and upgrade-with-trade offers were the most common tactics, lowering device costs when customers commit to long-term plans. Verizon led with 438 offers—nearly double AT&T’s 232 and well ahead of T-Mobile’s 188. Apple iPhone and Samsung Galaxy models dominated the spotlight, appearing in most of these offers.

Aggressive deals from carriers

Carriers like Verizon and T-Mobile used promotions heavily to upsell customers to premium unlimited plans. Verizon offered especially aggressive deals, focusing on large trade-in credits (often up to $1,100 off flagship phones like the new Apple iPhone 17) and bundling perks such as free streaming subscriptions or gadgets for customers on premium plans.

T-Mobile similarly tied its biggest discounts (like up to $1,100 off an Apple iPhone 17 Pro) to its top plan tiers, effectively locking customers in for two years. Both carriers’ strategies aim to boost customer lifetime value by driving plan upgrades, multiple device lines, and long-term loyalty through these incentives.

AT&T’s approach was more balanced. It also leaned on trade-in credits with up to $1,000 off new Apple iPhones (with an eligible trade-in), but made a point to extend such deals equally to new and existing customers. AT&T even relaunched up to $800 in credits to cover a switcher’s remaining device payments—removing a key barrier to switching.

By keeping promotion terms straightforward and consistent—such as a flat low monthly price for a new Samsung Galaxy S25 FE with no trade-in requirement—AT&T focused on building goodwill and long-term loyalty rather than flashy one-time gimmicks.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

Outlook

US carriers are doubling down on aggressive device deals to drive subscriber growth and higher average revenue for “free” phone offers—albeit only for customers willing to stick with a premium plan for the long haul.

The result is a market full of enticing deals for consumers ready to upgrade, though one that favours those on pricier plans. With Apple and Samsung capturing the lion’s share of deals, other phone makers may need to forge stronger carrier partnerships or special deals to gain more exposure.

While flagship phones historically drew the most attention, carriers are strategically increasing promotions on mid-tier and budget devices to capture value-seeking consumers. Not every customer will opt for a top-end $1,000+ handset, so deals like Verizon’s $200 gift card for mid-range upgrades or T-Mobile’s $5.99/month financing on the Samsung Galaxy S25 FE (with no trade-in) cater to more price-sensitive segments.

Cable companies are likely to follow the lead of their telco rivals and offer bundle devices and service for added value and retention. Going forward, all carriers must balance their zeal for new customer acquisition with rewarding loyalty to ensure long-time subscribers feel valued. Such balance will be key to reducing churn and maximising returns from these costly promotional campaigns.