The US recorded the highest number of outbound and inbound mergers and acquisitions (M&A) deal volume in the technology sector in 2018, finds GlobalData, a leading data and analytics company.

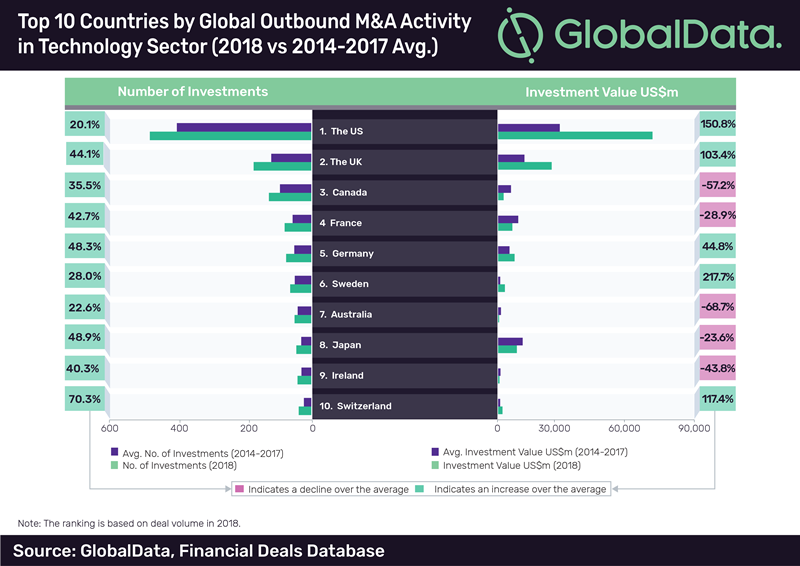

Out of the top ten positions with regard to the number of outbound M&A deals, all were occupied by developed nations. The US-led this chart in terms of both deal volume and value in 2018.

In the top ten list, the US stood way ahead of other countries, recording 552 outbound M&A deals and $85.2bn in disclosed investment value.

The top ten countries experienced an increase in outbound M&A deals volume in 2018. However, five countries witnessed a fall in investment value when compared with the 2014-2017 average.

The highest growth in deal volume in 2018 was recorded by Switzerland as compared with the 2014-2017 average, while Sweden took the top spot with regard to growth in investment value.

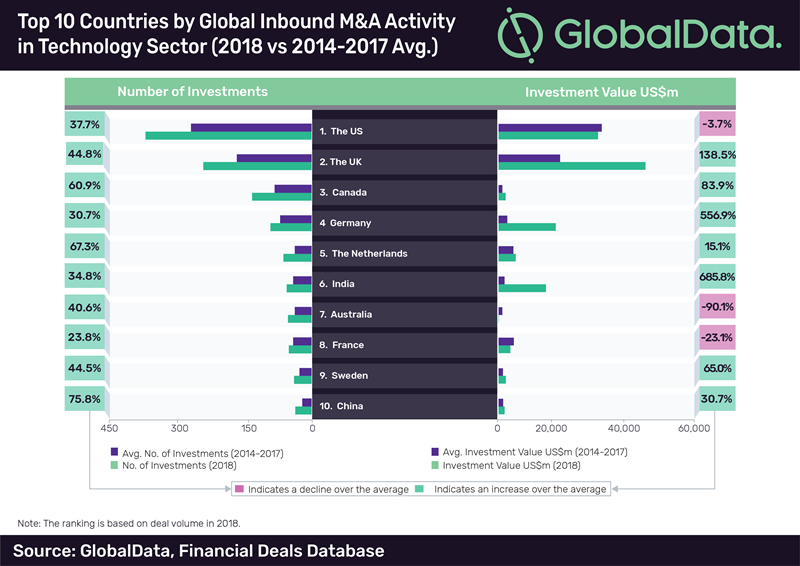

All of the top ten countries experienced an increase in the number of inbound M&A deals in 2018 compared to the 2014-2017 average. However, three of them experienced a fall in the disclosed investment value in 2018.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe US took the top position in 2018, recording 408 inbound M&A investments. Although the UK was behind the US with 266 investments, these had a disclosed investment value of $56.7bn. This placed the UK at the top in terms of value, outpacing the US by a huge margin.

The US also fell behind other countries in terms of value growth. This put it among three nations that witnessed a decline in the disclosed investment value in 2018.

Aurojyoti Bose, lead analyst at GlobalData, said: “M&A in the technology space is expanding outside Silicon Valley. Now, emerging countries such as China and India are creating attractive acquisition targets.”

In terms of volume growth, China occupied the top position. However, India recorded the highest growth in the disclosed investment value last year.

Bose added: “Cross-border M&A strategy has moved beyond geographic expansion, and technology access remains the key driver of M&A.”

The acquiring entities are targeting technologies such as e-commerce, FinTech, artificial intelligence (AI), cloud computing and cybersecurity.

Some notable cross-border M&A deals in these sectors last year included SAP’s acquisition of cloud computing company Qualtrics for $8bn. Also, Walmart’s 77% stake in online retailer Flipkart for $16bn; PayPal’s acquisition of mobile payments company iZettle for $2.2bn; and BlackBerry’s acquisition of AI and cybersecurity company Cylance for $1.4bn

Bose concluded: “Companies are now looking outside their borders to acquire technologies. This means that cross-border deal-making across the sector is likely to remain buoyant. Nevertheless, trade disputes and increased scrutiny of deals still remain areas of concern.”