The world’s insurers have had to pay out a record amount due to last year’s natural disasters, according to research from the world’s biggest reinsurance company, Munich Re.

The insurance bill for 2017’s natural catastrophes, including the hurricane trio of Harvey, Irma, and Maria and a severe earthquake in Mexico, is expected to come to $135bn – higher than ever before.

And overall losses – which includes uninsured losses – amounted to $330bn from 710 natural catastrophes, the second-highest figure ever recorded, the German insurer found in its annual review of natural disasters.

The yearly average for global natural disasters is 605. Around 10,000 people lost their lives in natural disasters in 2017, slightly higher than in 2016 but much lower than the ten-year average of 60,000.

The only costlier year so far was 2011, when the Tohoku earthquake in Japan contributed to overall losses of $354bn in today’s dollars.

The costs are almost three times above the ten-year average of $49bn and eight percent higher than the previous records seen in 2005 and 2011.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataTorsten Jeworrek, Munich Re Board member responsible for the firms reinsurance business, said:

This year’s extreme natural catastrophes show how important insurance is in absorbing financial losses in the wake of such disasters.

For me, a key point is that some of the catastrophic events, such as the series of three extremely damaging hurricanes, or the very severe flooding in South Asia after extraordinarily heavy monsoon rains, are giving us a foretaste of what is to come.

Because even though individual events cannot be directly traced to climate change, our experts expect such extreme weather to occur more often in future.

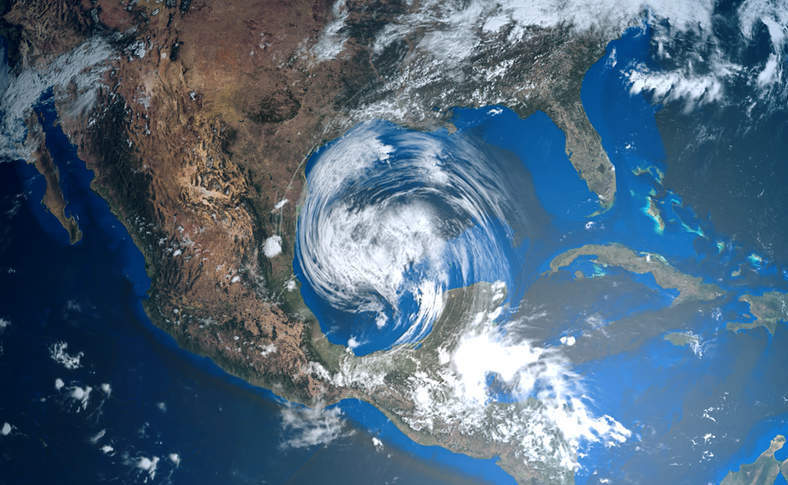

In the US — 2017 hurricanes

The US took the lions share of losses, at 50 percent, much higher than the long-term average of 32 percent of losses, driven by hurricanes Harvey, Irma and Maria.

Hurricane Harvey is estimated to be the largest economic loss of the year, at $85bn. Hurricane Irma though was the biggest driver of insured losses, at $32bn.

The California wildfires though are only estimated as an $8bn insurance and reinsurance industry loss which is lower than many in the industry had been anticipating.

However it is a largely insured loss, with the economic figure only slightly higher at $10.5bn.

In late August, Hurricane Harvey made landfall in Texas as a Category 4 storm. After landfall, the storm stalled over the state for several days and was able to continue to tap moisture from the very warm Gulf of Mexico.

This resulted in torrential rainfall of such magnitude over the city of Houston that, based on long-term statistics, should occur less than once in a thousand years.

A short time later, Hurricane Irma, a Category 5 storm (the highest category, featuring winds over 300km/h), blew a swath of destruction through the Caribbean before crossing the Florida Keys on 10 September and making landfall on the southwest coast of Florida.

Considering the wind speeds, losses in Florida remained comparatively moderate. But, given her larger share of insured storm damage, Hurricane Irma nevertheless ended up being the costliest natural disaster for insurers in 2017, with insured losses of around $32bn.

Hurricane Maria caused extreme damage to the islands of the Caribbean.

For example, on Puerto Rico, many production facilities, including those used to manufacture pharmaceuticals, were affected.

Infrastructure on the island, a territory of the US, was almost totally crippled; six weeks after the storm, three-quarters of households were still without power.

A series of severe thunderstorms in the spring, with accompanying tornadoes and hail, also contributed to the heavy US losses. No less than five tornado-hail outbreaks caused insured losses in excess of $1bn each.

Paradoxically, last winter’s heavy snow and rainfall in California actually fuelled this year’s devastating brushfire season. This is because, after a long drought, the precipitation had caused many plants to sprout and grow again.

The summer heat turned this increased vegetation into a veritable matchbox, leading to severe brush fires that lasted well into December.

Due to the high insurance density in some impacted suburbs, overall losses for the October fires alone were $10.5bn, and insured losses are expected to be around $8bn.

In Europe — late frost and long summers

Unusually low temperatures in April caused billions in damage to European farmers since their crops had already grown robustly in an otherwise warm spring.

Depending on the region and particular fruit, harvests were up to 50 percent smaller than usual.

Another apparent paradox is that such events may start to occur more frequently in the future as a result of climate change: plants in certain regions are beginning to sprout earlier in spring, while the threat of frost often does not diminish to the same extent, so that the risk actually increases.

Losses caused by the late frost amounted to US$ 3.6bn (€3.3bn), of which only $650m was insured, given the low insurance penetration in the agricultural sector.

In Asia — monsoon rains cost lives

Some 2,700 people lost their lives following an extremely severe monsoon in South Asia.

The annual monsoon season, which brings the otherwise desperately needed rain, lasted about four weeks longer than normal in 2017.

The regions most severely affected this time were the Terai lowlands in Nepal, where almost half of the Nepalese live, as well as certain Indian provinces along the Himalayas. In some districts, three-quarters of the territory was under water.

The fact that only a small fraction of the US$ 3.5bn in total losses was insured contributed to the humanitarian catastrophe.

Is climate change to blame for the record insurance losses?

Governments around the world are working to tackle climate change, with the US withdrawal from the Paris climate accords spurring others on to do more to try to limit emissions.

US president Donald Trump has sought to undermine the importance of climate change, which is thought to appeal to his conservative base in the US.

Despite this the Trump administration released a report in November last year that warned “extreme climate events” like heavy rainfall, heatwaves, wildfires, and rising sea-levels get more severe and potentially result in abrupt, irreversible climate changes.

However, assessing whether climate change is directly responsible for individual events is difficult.

The Bulletin of the American Meteorological Society has begun issuing a special report each year assessing the impact of climate change on the previous year’s extreme events, according to a recent report in Scientific American.

Meanwhile, the intensity, frequency and duration of North Atlantic hurricanes have increased since the early 1980s, according to the most recent National Climate Assessment.