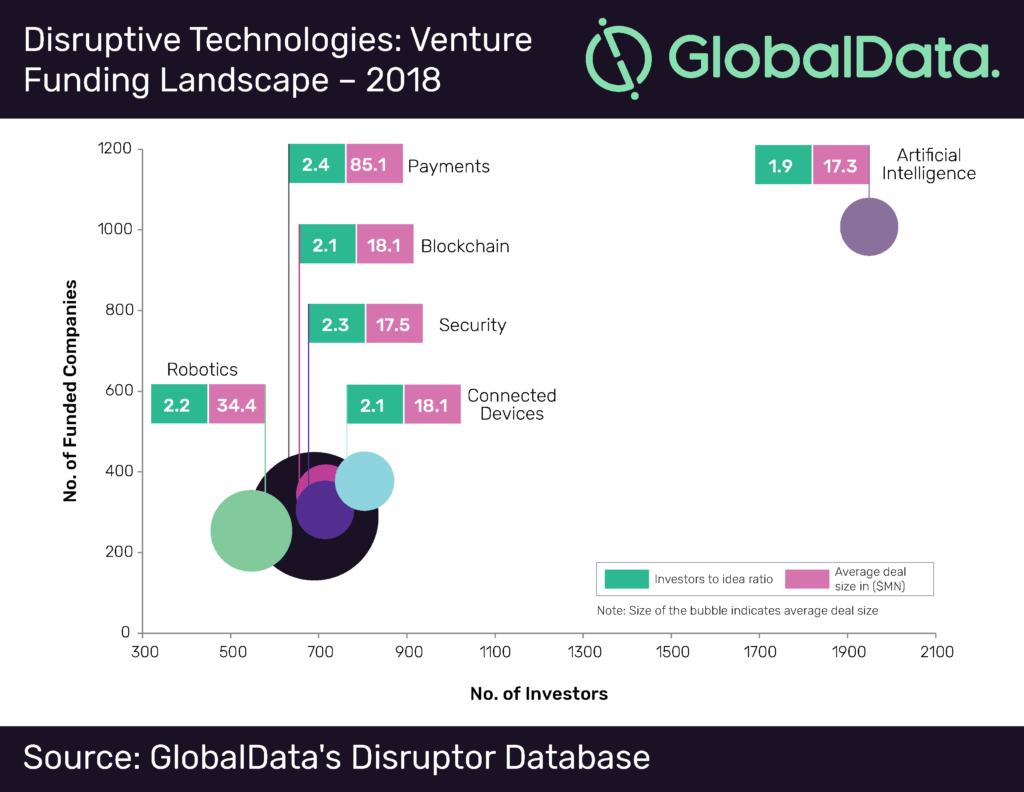

Despite attracting more investment in 2018 than any other emerging technology, artificial intelligence (AI) startups are seeing fewer AI investors each than any other segment.

This is according to research by GlobalData, which found that more than 1,900 investors funded AI companies in 2018, over 1,000 more than any other technology.

However, the average number of investors per company was just 1.9, compared to 2.1 for connected devices and blockchain, 2.2 for robotics, 2.3 for security and 2.4 for payments.

This meant that in 2018 AI had the lowest investors-to-idea ratio, which is the number of venture capital investors divided by the number of funded companies.

AI investors rule in number, but not in spend

The number of AI investors dramatically outstripped other emerging technologies – being roughly equivalent to security, blockchain and robotics combined.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataHowever, the amount spent per investment was lower than any of the other emerging technology fields, at $17.3m.

This is compared to security (£17.5m), connected devices ($18.1m), blockchain ($18.1m) and robotics ($34.4m). By far the highest for average deal size was payments, at $85.1m.

This indicates that while AI investors spent one of the highest totals in emerging technologies, the market is characterised by large numbers of investments in smaller, earlier stage companies compared to fields such as payments.

This in part reflects both the level of maturity of the AI field, but also the level of hype surrounding the technology in 2018.

However, GlobalData anticipates that investment will continue to grow in the coming years, suggesting that the AI hype is far from over.

“With expanding technology-driven disruption across industries, we expect further growth in disruptive tech companies’ funding in coming years,” said Aurojyoti Bose, financial deals analyst at GlobalData.

“These technologies will play a central role in the companies’ future strategies, with early adopters likely to emerge as winners.”