Private equity is on a roll. Fund raising records are repeatedly being broken and the latest is the record for a European private equity fundraising round.

CVC Capital Partners has raised €16bn ($17.98bn) for its latest flagship fund for private equity investments in Europe and North America, on demand of between €25bn and €30bn from investors.

The seventh fundraising by CVC is the largest by a European private equity firm, surpassing the €11.2bn raised by Apax Partners in 2007 and the €10.5bn CVC raised for its sixth fund in 2013.

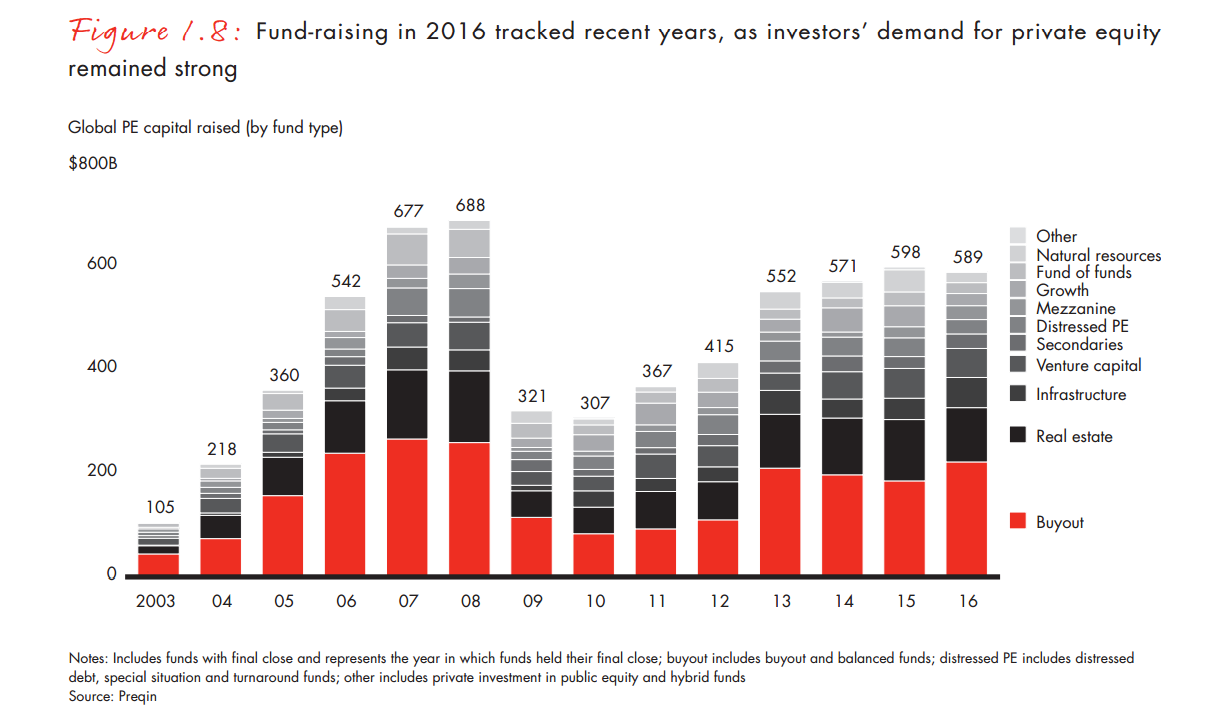

According to industry data provider Preqin, globally funds raised $589bn in 2016, in line with 2013-15 levels. The number of firms raising more than $5bn has surged to a post financial crisis high last year.

Pension funds and other institutional investors are pouring vast sums of money into the best-performing private equity funds. However CVC did not disclose which organisations invested in Fund VII, but almost half of investors in Fund VI were public pension funds.

CVC is based in Luxembourg but has offices around Europe and has raised a total of $107bn since it was founded in 1981. It has invested in companies from Swiss luxury watchmaker Breitling to Formula One motor racing and currently has $65bn of assets under management.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataHere’s how the latest record raising stacks up against other recent rounds

Earlier this month Chequers Capital, the French mid-market buyout group, raised more than €1bn in less than three months.

At the end of 2016 Apax, the European private equity group, completed its largest fundraising since the financial crisis raising $9bn in less than a year from investors, with plans to invest a third of its capital in businesses that can benefit from or oversee digital disruption in their sectors.

In March last year private-equity firm Advent International has raised $13bn for its latest fund, exceeding a $12bn fundraising target in spite of escalating market turmoil.

One of the world’s larger buyout firms, Advent took just six months to secure the money for its eighth fund. In 2012, it raised $10.8bn for its last global investment vehicle.

BC Partners is currently fundraising for its 10th fund, seeking €7bn, and currently has more than €12bn of assets under management.

European private equity firm Cinven raised $7.9b underscoring robust fundraising across the buyout sector.

In New York, Apollo is set to raise $20bn from investors this year.

Mega funds are increasingly dominant

Bain & Company’s newly released Global Private Equity Report 2017 underscores in rising megabuyout fund trend. There are now 11 mega funds — defined as raising more than $5bn — close to raising $90bn.

Click to enlarge

Click to enlarge