The US Federal Trade Commission (FTC) has refiled its antitrust case against Facebook, alleging that it “unlawfully” acquired competitors to “maintain its dominance” during the transition to mobile-based web browsing.

The complaint, filed on Thursday in the US District Court for the District of Columbia, accuses Facebook of resorting to an “illegal buy-or-bury scheme” in which it acquired competitors developing mobile social media features to prevent them from becoming rivals.

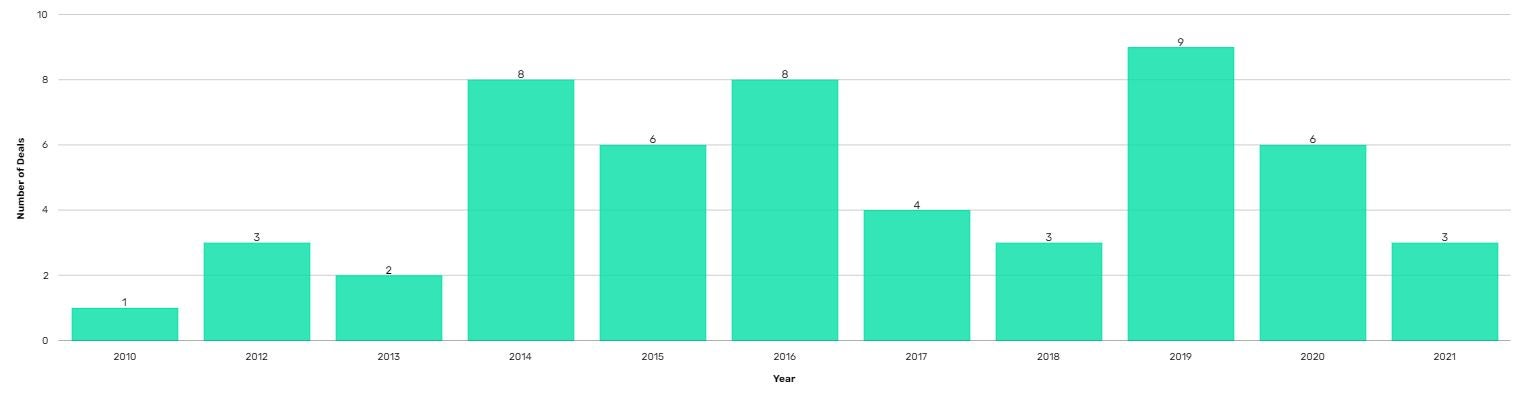

According to GlobalData’s deals database, Facebook has acquired more than 50 companies since it snapped up Instagram for $1bn in 2012.

“This conduct is no less anti-competitive than if Facebook had bribed emerging app competitors not to compete,” said Holly Vedova, FTC Bureau of Competition acting director.

She added that Facebook “lacked the business acumen and technical talent to survive the transition to mobile”.

It is the FTC’s second attempt to pursue Facebook on antitrust grounds. In June, the District Court for the District of Columbia found the FTC’s argument to be “legally insufficient” and dismissed the suit.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataIn its dismissal, the court said the FTC’s case was too broad and relied too heavily on it agreeing to “the conventional wisdom that Facebook is a monopolist” rather than laying out specific arguments.

The amended complaint instead uses statistics to support its claim that Facebook had a dominant market share in the US social media market.

The FTC also claims to have “direct evidence” that Facebook can use this market power to “control prices or exclude competition” and “significantly reduce the quality” of its services without suffering a significant drop in users.

For an antitrust case to be successful under US law it must demonstrate that consumers are being harmed, such as a monopoly leading to higher prices for a product or service.

However, many digital companies – including Facebook – are free to use for consumers, making it more difficult to prove direct harm.

“For the FTC case to be successful it needs to demonstrate that by crushing competition Facebook has significantly reduced the quality of its platform, without impacting usage, which is not easy to demonstrate,” said Laura Petrone, senior thematic analyst at GlobalData. “Quality is a difficult criterion to measure, but the FTC has a good chance to win that argument.”

The FTC alleges that Facebook forced third party developers to agree to conditions that “prevented successful apps from emerging as competitive threats to Facebook”.

The complaint cites Facebook’s acquisitions of Instagram, WhatsApp, Path and Foursquare as evidence that it used its dominance to buy out rivals.

The alleged lack of competition reduced the quality of Facebook’s services, the FTC said.

“Facebook’s flaws on data privacy will be a key argument in this case to demonstrate its decreased product quality,” said Petrone.

“Lacking serious competition, Facebook has been able to hone a surveillance-based advertising model and impose ever-increasing burdens on its users,” the FTC said in a statement.

A Facebook spokesperson said: “There was no valid claim that Facebook was a monopolist – and that has not changed. We will continue vigorously defending our company.”

Facebook also lost its petition to have new FTC chair Lina Khan recused from the case because of criticisms she made about the tech giant prior to taking the role in June.

Khan rose to prominence in antitrust circles for her academic work on antitrust and competition policy and has levelled criticism at several tech giants. The Facebook case is the first to be launched since she was appointed.

Last month Amazon filed a request with the FTC to recuse Khan from taking part in any future investigations into the ecommerce behemoth, describing her as its “adversary-in-chief”.

Should Facebook lose the antitrust case, it is expected to have ramifications for the wider industry.

According to Petrone, social media companies will have a “strong incentive to diversify away from their ad-funded business model”.

She added: “Social media companies are already moving into other sectors, mainly entertainment and ecommerce, but even so they will continue to be under regulators’ scrutiny, both for antitrust and data privacy-related issues, as they are viewed as digital monopolies in whichever sector they move into.”

It is the second time the FTC and Facebook have clashed in as many weeks, with the regulator accusing the tech giant of using “misleading claims” to justify its ban of Ad Observatory researcher accounts used to investigate targeted political ads on the social media platform.

It comes amid a wider antirust crackdown on Big Tech that has seen the UK’s Competition and Markets Authority open a probe into Facebook’s 2020 acquisition of GIF library Giphy.

In April, a Republican senator introduced a bill designed to prevent companies with a market cap exceeding $100bn from ever buying another company.