Financial services companies now put the acquisition of intellectual property and new technologies as the most important objective in mergers and acquisitions activity, above the growth of market share or extending into new product lines.

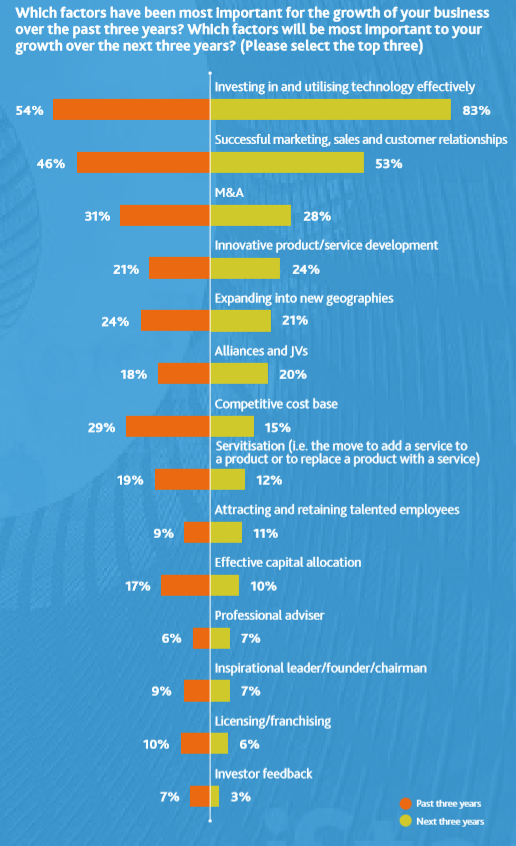

Also according to international law firm Pinsent Masons, only 3% of FS companies believe investor feedback is important to growth over the next three years, half the number from the previous three years.

New technologies an increasingly popular method for growth

Head of Financial Services and Partner at Pinsent Masons, Alexis Roberts, said: “Although M&A remains a popular method for growth, we are increasingly seeing financial services companies enter into alliances and joint ventures which give them exposure to new technologies without the same commitment as M&A.

“Technology continues to render more traditional M&A objectives, such as increasing market share or expanding into new geographies, as much less important. In crowded markets, financial services companies that fall behind in developing and using technology will find it difficult to keep up.

“Effectively harnessing the power of technology is key for M&A activity and organic growth amongst financial services companies. This is true across the entire financial services sector – not just fintech and insurtech.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

IT failures increasing because of the prioritisation of the customer experience

Financial services companies are prioritising customer experience interfaces over the crucial back-office IT systems, says Pinsent Masons.

77% of FS companies have put customer experience at the top of the list while only 2% are putting investment in back office technology to the top.

At the same time, there has been a big jump in the number of IT failures at FS firms in the last year.

Roberts said: “The race to capture market share through customer-friendly technology is, understandably, very important but that shouldn’t be at the expense of essential architecture.

“Financial services companies can be seriously undermined by underinvestment in the back office.”

A “litany of failures of banking IT systems”

Last year, TSB suffered a major IT failure that caused 1.9 million people to lose access to online banking services and in October the Financial Conduct Authority fined Tesco Bank £16.4m for failures in a 2016 cyberattack.

Service failures at Natwest and Barclays in September 2018 meant that customers could not access their online banking services.

Nicky Morgan MP, chair of the Treasury select committee said: “This is yet another addition to the litany of failures of banking IT systems. Potentially millions of customers could be affected by uncertainty and disruption.

“It simply isn’t good enough to expose customers to IT failures, including delays in paying bills and an inability to access their own money.”