The long foretold AI winter may not be here yet, but autumn may be upon the sector as data trends are starting to show that the number of funding deals is falling. However, AI startup H2O.ai has just shown that investment in AI is still happening with a $100m funding round at a $1.7bn valuation: and overall, money flowing into AI is still up.

Any suggestion that AI investment in fintech could have dropped may come as a surprise to some. AI is everywhere in financial services these days. Banks use it to gain insights, cut costs, develop new features, fight financial fraud and to boost customer experiences with smooth onboarding and chatbots.

Startups are leveraging it to compete with incumbent players. It’s hardly a secret that neobanks like UK tridecacorn Revolut are heavily reliant on AI. In short, companies have every reason to invest in the technology if they want to remain competitive.

“There has never been a more important time for banks to invest in AI,” researchers said in a recent GlobalData thematic research report on AI in banking. “With threats to the industry coming from both disruptive fintechs and the Covid-19 pandemic, which uprooted traditional branch-based banking, banks must be proactive in adapting their strategies and processes to remain competitive and desirable to consumers.”

However, banks and financial firms have been slowing down their investment in the sector lately. GlobalData’s Intelligence Centre tracks deals, including venture financing, acquisitions, equity offering, private equity, debt offering, partnerships, asset transactions and mergers.

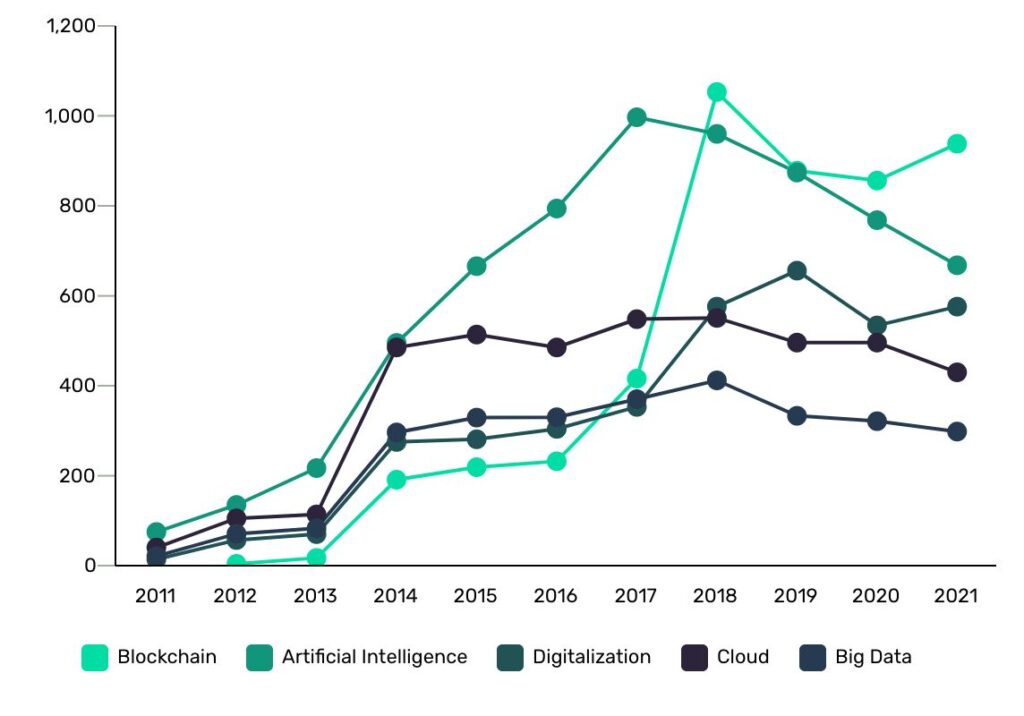

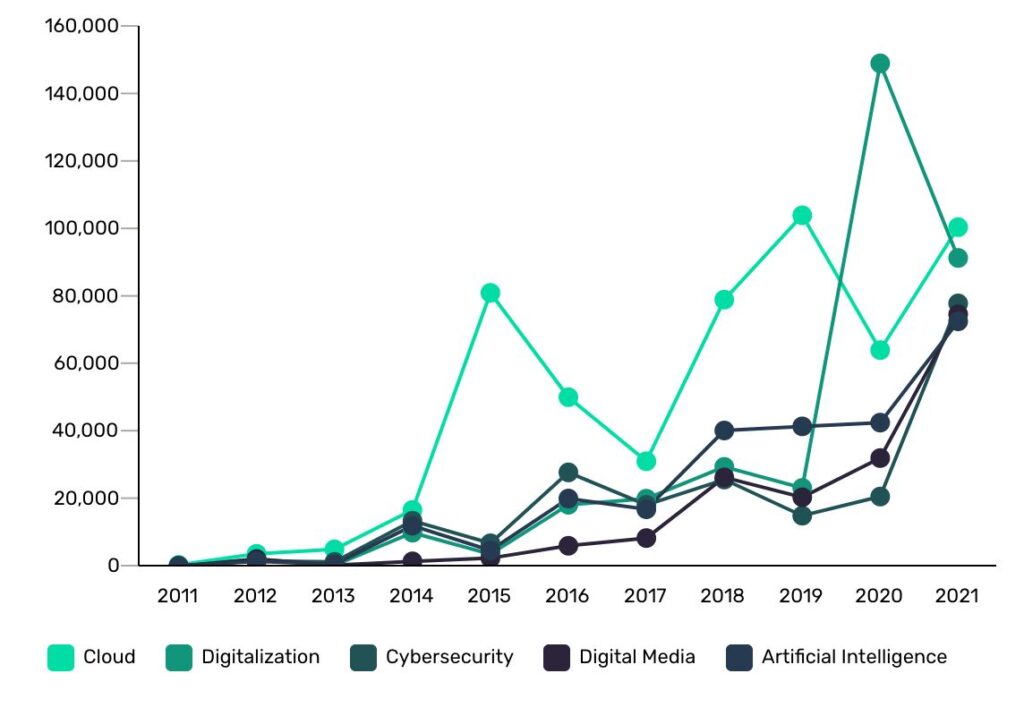

The latest data suggests that the number of deals has plunged from the peak in 2017 when 999 AI deals were recorded in the financial services industry. In 2020, only 770 deals were recorded. So far in 2021, there have been 670 deals recorded.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe dataset also suggests, however, that the total value of the deals which are done has continued to climb. Back in 2014, GlobalData recorded financial services AI deals worth $12.12bn in total. In the record year 2020, that figure had jumped to $42.69bn. That record has already been thoroughly smashed this year with the value of financial services AI deals in 2021 so far being worth $72.72bn, according to GlobalData’s data.

H20.ai bucks the AI deals trend

H20.ai bucks the AI deals trend

It’s against this background of AI deals that H2O.ai’s latest cash injection should be seen. The cloud company markets itself as a venture enabling other businesses to develop their own AI solutions via its open-source framework and proprietary apps.

The Series E round was led by Australian lender the Commonwealth Bank of Australia. Other investors include Pivot Investment Partners, Goldman Sachs Asset Management and Crane Venture Partners.

That these heavyweights in the financial services industry are betting on H20.ai’s success is unsurprising given that about 40% of the startup’s revenue comes from the financial sector.

“Commonwealth Bank and H2O.ai are led by our core belief that we can make the world better by serving our communities and customers with AI,” said Sri Ambati, founder and CEO of H2O.ai. “This strategic partnership between the leading global AI Cloud movement and Australia’s largest bank will unleash the juggernaut of co-innovation and will further democratize AI with trust and freedom. This will be fun.”

H2O.ai will use the money to scale partnerships, sales, marketing, and customer success globally, betting on a trend that has seen businesses around the world accelerate their digital transformations, including introduction of AI.

H2O.ai has now raised over $250m and is valued at $1.7bn. It raised a $72.5m Series D round in August 2019.

Matt Comyn, Commonwealth Bank of Australia CEO, said: “Commonwealth Bank processes and makes decisions based on millions of data points collected every day. AI already has helped us to improve our customer experience, however, we know there is untapped potential to do more. The investment in and strategic partnership with H2O.ai extends our leadership in artificial intelligence and ultimately boosts the bank’s ability to offer leading digital propositions and reimagine products and services to customers.”

H20.ai bucks the AI deals trend

H20.ai bucks the AI deals trend