The technology industry continues to be a hotbed of innovation, with activity driven by increasing demand for Internet of Things (IoT) devices, flexible and scalable network solutions, rise in cloud-based applications, and the need for enhanced network performance and security, and growing importance of technologies such as virtualization, network function virtualization (NFV), and cloud-based management platforms. These technologies work together to provide centralized control, dynamic traffic management, real-time analytics, and improved network agility, ultimately optimizing connectivity and enhancing the overall performance of distributed networks. In the last three years alone, there have been over 3.6 million patents filed and granted in the technology industry, according to GlobalData’s report on Innovation in Internet of Things: Software-defined WAN. Buy the report here.

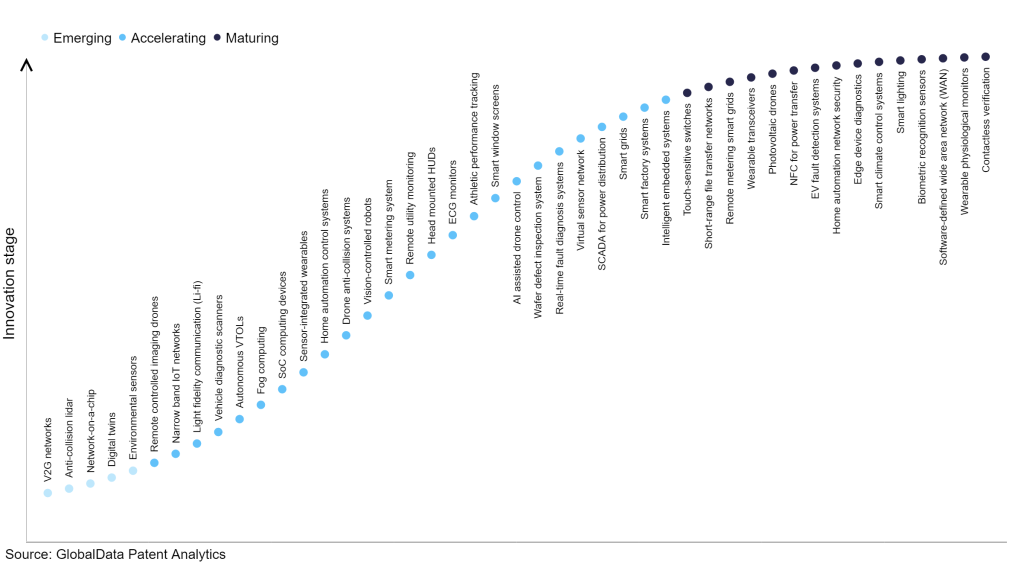

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilising and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

300+ innovations will shape the technology industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the technology industry using innovation intensity models built on over 2.5 million patents, there are 300+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, environmental sensors, digital twins, and network-on-a-chip are disruptive technologies that are in the early stages of application and should be tracked closely. Intelligent embedded systems, smart factory systems, and smart grids are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are contactless verification, wearable physiological monitors, and software defined wide area network, which are now well established in the industry.

Innovation S-curve for IoT in the technology industry

Software defined WAN is a key innovation area in IoT

Software Defined Wide Area Network (SD-WAN), a network architecture utilizing SDN, dynamically routes traffic across WANs, offering increased agility, flexibility, and simplified management. This technology provides businesses with a cost-effective solution for connecting branch offices, remote sites, and cloud applications, making WANs more efficient and adaptable.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 190+ companies, spanning technology vendors, established technology companies, and up-and-coming start-ups engaged in the development and application of software defined WAN.

Key players in software defined WAN – a disruptive innovation in the technology industry

‘Application diversity’ measures the number of different applications identified for each relevant patent and broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of different countries each relevant patent is registered in and reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to software defined WAN

| Company | Total patents (2010 - 2022) | Premium intelligence on the world's largest companies |

| Huawei Investment & Holding | 4455 | Unlock Company Profile |

| Qualcomm | 3873 | Unlock Company Profile |

| LG | 2641 | Unlock Company Profile |

| ZTE | 1552 | Unlock Company Profile |

| Samsung Group | 1415 | Unlock Company Profile |

| Intel | 1362 | Unlock Company Profile |

| Telefonaktiebolaget LM Ericsson | 1177 | Unlock Company Profile |

| Nokia | 1094 | Unlock Company Profile |

| Nippon Telegraph and Telephone | 1071 | Unlock Company Profile |

| GuangDong OPPO Mobile Telecommunications | 879 | Unlock Company Profile |

| Sharp | 825 | Unlock Company Profile |

| InterDigital | 810 | Unlock Company Profile |

| Apple | 647 | Unlock Company Profile |

| Sony Group | 530 | Unlock Company Profile |

| Ntt Docomo | 449 | Unlock Company Profile |

| Panasonic | 433 | Unlock Company Profile |

| Furukawa | 418 | Unlock Company Profile |

| NEC | 397 | Unlock Company Profile |

| BlackBerry | 365 | Unlock Company Profile |

| Datang Telecom Technology | 361 | Unlock Company Profile |

| Vivo Communication Technology | 292 | Unlock Company Profile |

| Mitsubishi Electric | 213 | Unlock Company Profile |

| Kyocera | 169 | Unlock Company Profile |

| China Tower | 147 | Unlock Company Profile |

| China Mobile Communication | 133 | Unlock Company Profile |

| Legend | 132 | Unlock Company Profile |

| Telefon AB Lm Ericsson | 127 | Unlock Company Profile |

| Hon Hai Precision Industry | 126 | Unlock Company Profile |

| ELG Electronic Kft | 124 | Unlock Company Profile |

| Broadcom | 121 | Unlock Company Profile |

| Toshiba | 111 | Unlock Company Profile |

| KT | 99 | Unlock Company Profile |

| China Pacific Insurance | 99 | Unlock Company Profile |

| Koninklijke Philips | 98 | Unlock Company Profile |

| Xiaomi | 96 | Unlock Company Profile |

| ASUSTeK Computer | 95 | Unlock Company Profile |

| SK Telecom | 93 | Unlock Company Profile |

| Sun Patent Trust | 93 | Unlock Company Profile |

| Datang Telecom Group | 89 | Unlock Company Profile |

| Motorola Solutions | 84 | Unlock Company Profile |

| Microsoft | 83 | Unlock Company Profile |

| CSR | 74 | Unlock Company Profile |

| Shanghai Langbo Communication Technology | 70 | Unlock Company Profile |

| Td Tech Communication Technologies | 70 | Unlock Company Profile |

| Coolpad Group | 68 | Unlock Company Profile |

| PANTECH | 59 | Unlock Company Profile |

| Canon | 58 | Unlock Company Profile |

| Microchip Technology | 58 | Unlock Company Profile |

| Neul | 58 | Unlock Company Profile |

| Deutsche Telekom | 56 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Huawei Investment & Holding is a leading patent filer in software defined WAN. One of the company’s patents focuses on a method for reporting channel state information, involving receiving a sounding signal set from the base station and determining a reference signal resource configuration index based on the received set. The method further includes receiving a corresponding reference signal set and determining channel state information accordingly. Finally, the method involves transmitting the reference signal resource configuration index and the channel state information back to the base station.

Other prominent patent filers in the space include Qualcomm and LG.

By geographic reach, CSR leads the pack, followed by Neul and Wireless Future Technologies. In terms of application diversity, Infineon Technologies holds the top position, followed by Dolby Laboratories and PHC Holdings.

IoT innovation has significantly impacted the realm of Software Defined Wide Area Network (SD-WAN), driving remarkable market growth. SD-WAN leverages IoT technology to enable efficient and secure network connectivity and management across distributed locations.

To further understand how IoT is disrupting the technology industry, access GlobalData’s latest thematic research report on Internet of Things – Thematic Research.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.