SoftBank-backed proptech startup Katerra has gone belly up after burning through $2bn in investment, adding to the string of bad bets made by Masayoshi Son’s Vision Fund.

Menlo Park-based Katerra has told employees that it is closing shop, according to The Information. The startup was founded in 2015 to cut costs for real estate developers. It had grown to have over 8,000 staff members around the world in 2020.

However, the company struggled during the pandemic as the costs of labour and supplies jumped. In April 2020, then-CEO Michael Marks announced he would take out no salary as the company was forced to slash 7% of its staff, amounting to more than 400 employees.

In May 2020, SoftBank injected $200m into the floundering enterprise at roughly the same time as Marks was replaced by Paal Kibsgaard. The $128bn investor had previously backed Katerra’s $865m Series D raise in January 2018, according to GlobalData

However, it seems as if these efforts weren’t enough to save Katerra, and its collapse marks the end of yet another problematic SoftBank investment.

For instance, SoftBank is currently embroiled in the fallout from the collapse of the fintech startup Greensill, another receiver of Vision Fund dosh.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe Greensill supply-chain empire famously went into administration in March after knotty ties between the fintech, SoftBank, Credit Suisse and startups backed by the investor became known.

Credit Suisse set things towards the path of Greensill’s bankruptcy by stopping the $10.1bn line of supply chain funds it and the fintech had co-managed.

The scandal, which even further tarnished former UK prime minister David Cameron’s reputation, has also marred the relationship between Credit Suisse and SoftBank, with the former cutting ties with the latter last week.

SoftBank was also one of the leading investors behind WeWork. Having previously championed the workspace unicorn’s potential, the relationship turned sour when WeWork tried to go public the first time, its IPO filings revealing just how damaging the chaotic leadership of co-founder Adam Neumann had been.

WeWork pulled the plug on the initial public offering, ousted Neumann – who most recently could be seen laughing all the way to the bank after picking up his $450m severance check – and made an effort to turn its financials around. This involved sacking over 2,400 employees worldwide.

Despite many WeWork offices being left to sit idle by the pandemic, the company is reportedly on the way to make another attempt to go public, this time via a special purpose acquisition company, or SPAC.

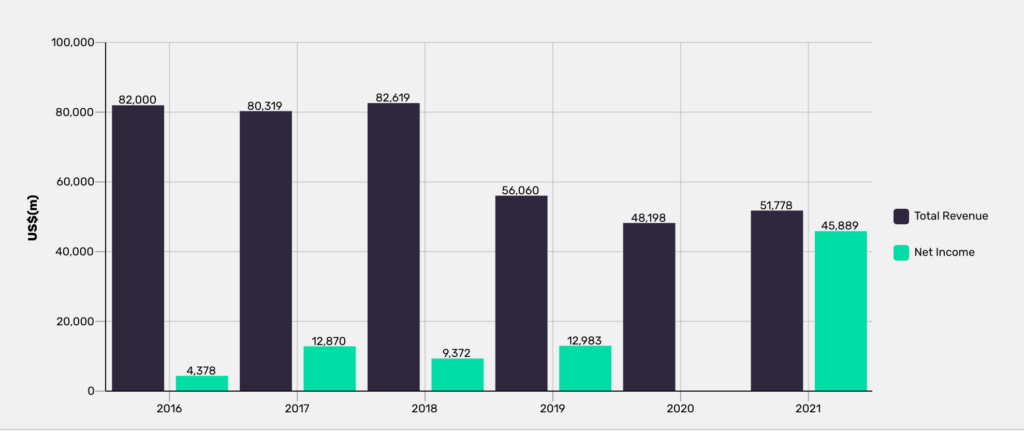

Despite these setbacks, SoftBank has managed to not only get back in the black after a tumultuous 2019, but also rake in a record-breaking net income of $45.88bn in 2020, representing profits of $36.99bn, according to GlobalData’s Technology Intelligence Centre and as shown in below chart.