The long-awaited and much-heralded IPO of semiconductor company and chip designer Arm is unfolding with suitable hype, driven largely by the clamour surrounding artificial intelligence (AI).

Much has been made of the claim that orders are more than 10 times oversubscribed, and it was confirmed yesterday (13 September) that shares have been priced at $51 each – the top end of the $47-to-$51 guidance range.

The projected valuation of $54.5bn (although lower than the $64bn valuation at which SoftBank bought the 25% of Arm it didn’t already own in August) will knock into a cocked hat the $40bn offered for the British company by NVIDIA in 2020.

And key clients of Arm – including Nvidia, as well as Apple, Alphabet, Advanced Micro Devices, Intel and Samsung Electronics – are investing to the tune of $735m, it has said, while global chipmaking leader TSMC announced on Tuesday (12 September) that it will stump up $100m.

The Nasdaq listing, confirmed in August, has been credited among some as giving a shot in the arm to a flagging tech IPOs market.

Growth of Arm

On the face of it, all this seems understandable.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

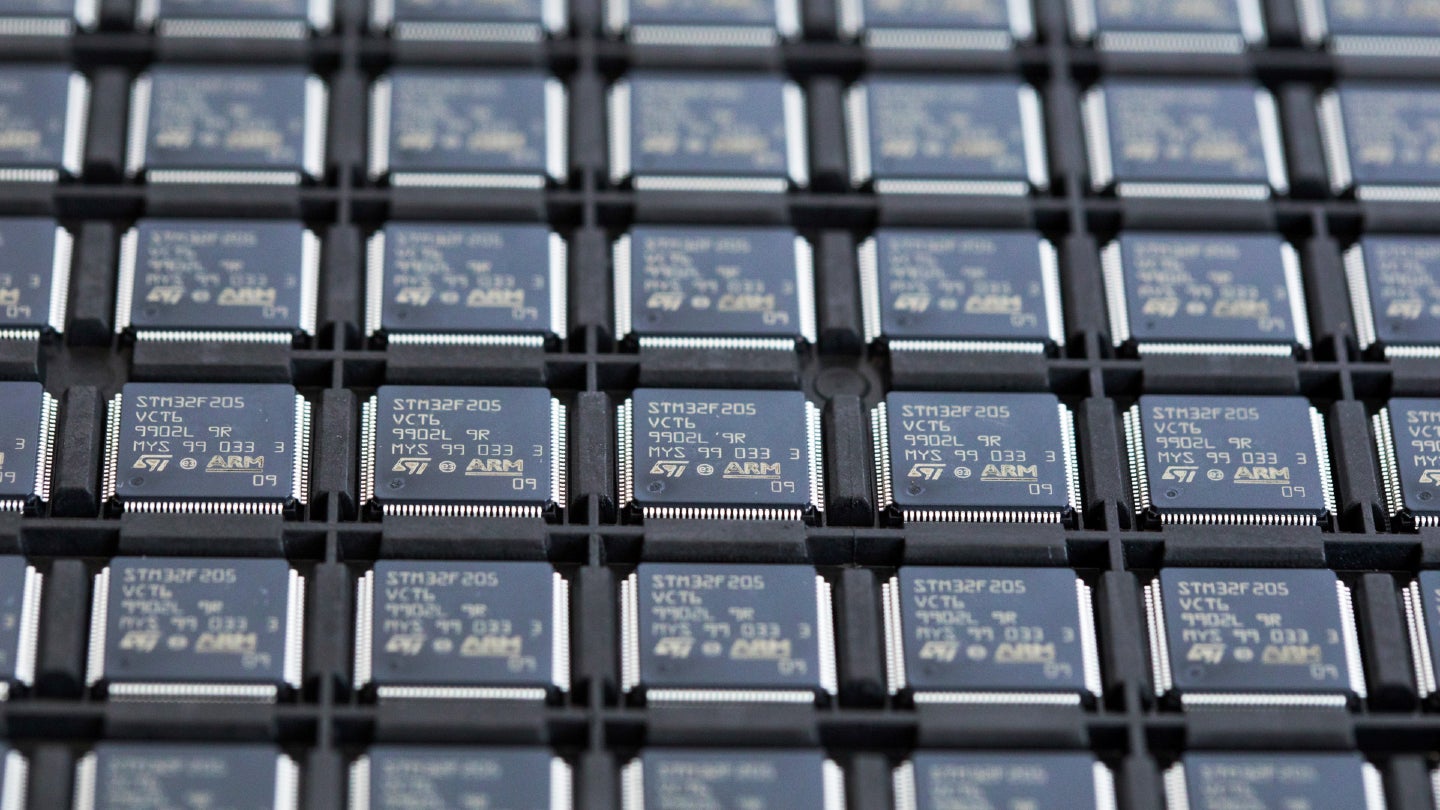

By GlobalDataSince Softbank bought it in 2016, Arm has continued to cement itself as a central part of the tech ecosystem and indispensable for chipmakers (as assessed in GlobalData’s Semiconductors Sector Scorecard Q2 2023). Processors designed with the intellectual property it sells are found in 99% of smartphones, as well as a host of other devices.

The company’s 30-year growth journey has been one of increasing pervasiveness, with market share increasing even during the shocks of the global semiconductor shortage and the Covid-19 pandemic, the impact of which on the industry was outlined in GlobalData’s Thematic Research: Covid-19 Impact on Semiconductors report.

Nvidia’s shock bid for the company three years ago showed how highly valued the company’s capabilities are – as perhaps did the deal’s collapse due to insurmountable “regulatory challenges”.

In announcing its intended acquisition, Nvidia gave notice of its intention to create the “world’s premier computing company for the age of artificial intelligence (AI)”.

At the time, Arm CEO Simon Segars said: “Arm and Nividia share a vision and passion that ubiquitous, energy-efficient computing will help address the world’s most pressing issues from climate change to healthcare, from agriculture to education. Delivering on this vision requires new approaches to hardware and software and a long-term commitment to research and development. By bringing together the technical strengths of our two companies we can accelerate our progress and create new solutions that will enable a global ecosystem of innovators.”

Artificially intelligent?

It is this view of Arm as a major player in the rocketing AI industry that is driving much of the excitement around its IPO. Indeed, it is a view that Arm has fostered and one that Softbank has been hoping will help to raise in the region of $5bn through the 9.4% stake listing.

GlobalData thematic research shows that mentions of AI in the company’s filings grew from triple figures in 2016 to over 18,600 last year, and AI was mentioned 44 times in Arm’s filing to list alone.

However, GlobalData consultant Michael Orme suggests that this focus is being overplayed.

“Despite its attempt to position itself as an AI company, due primarily to the fact that Nvidia AI chips are based on the Arm blueprint, Arm is not an AI company,” he says. “But, as and when more and more AI work is done in edge devices, such as smartphones rather than in the cloud, then such a positioning would be more credible. After all, it’s why Nvidia wanted to buy Arm in the first place.’’

That timeline is complicated by other issues, though.

RISC-V and China

There is an increasing threat from RISC-V, an emerging open-source instruction set architecture that is not only free but that a growing number of chip designers believe is better than what Arm can offer.

Famed processor engineer Jim Keller has predicted that RISC-V will dominate the datacentre within a decade, Google announced early this year that Android will support RISC-V and Intel is building a RISC development platform.

Perhaps most pertinently, China, which is desperate to escape any dependence on foreign chips or intellectual property, is investing heavily in RISC-V through the likes of Alibaba, Tencent, Huawei and ByteDance. The proportion of Arm’s current revenues from China stands at upwards of 24%.

“China is intent, long-term, on taking back its smartphone market with an overall endgame of basing itself on blueprints from RISC-V rather than from Arm,” says Orme. “Unlike Arm’s, they don’t carry threats of US sanctions.

“On top of that, Arm is obviously vulnerable to any further heating up of the chip war between the US and China.”

Chancing an Arm

All this is not to say that Arm represents a bad investment or that it won’t continue to perform robustly. However, the smartphone market remains flat, and Arm will soon be facing threats the likes of which it has not had to deal with before.

“The anchor investors are not taking up nearly 20% of this very small float because they think Arm is an outstanding stock market investment but to protect their interests,” says Orme.

“As Arm licensees, they are aiming to leverage suitably advanced Arm technology as AI is increasingly done in end-user devices interconnected to the cloud, but, for now, Arm is not the explosive AI play as which it has been positioned.”

GlobalData resources

- Semiconductors Sector Scorecard – Thematic Intelligence

- Thematic Research: Covid-19 Impact on Semiconductors