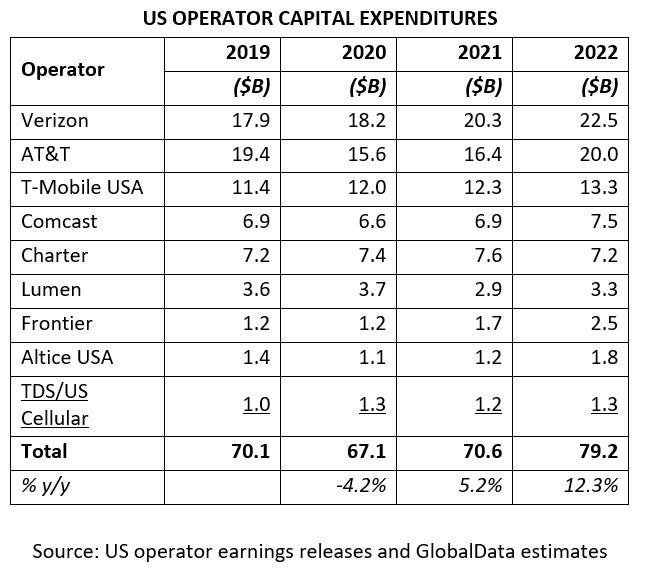

An analysis of US operator financial results based on Q4 2021 earnings releases shows that CapEx in 2021 came in nearly identically to 2019 levels after a Covid-driven dip in 2020. The nine network operators shown below – all of which spent more than $1 billion in CapEx – spent $70.6 billion in 2021 CapEx, up 5.2% from 2020 and nearly flat from 2019. GlobalData estimates that the big three that account for nearly 70% of total CapEx – AT&T, Verizon, and T-Mobile USA – spent roughly $49 billion, up 7% from 2020.

That spending is poised to jump in 2022, based on guidance provided alongside year-end 2021 results. GlobalData estimates that next year’s spend among these US operators will be up by $8.6 billion, a double-digit percentage increase, to $79.2 billion.

There are two primary factors accounting for the increased spending planned in 2022. For Verizon and AT&T, aggressive plans to deploy 5G in midband spectrum are fuelling significant deployment activity. In addition, a host of operators – including AT&T, Altice USA, and Frontier – are planning to deploy fiber more extensively across their networks.

A scan of international operator results shows a similar trend of post-pandemic CapEx increases in 2021; however, major multinational operators in Europe have taken more of a ‘steady as she goes’ approach to 2022 guidance. For example:

- Telefónica significantly increased its CapEx from €5.9 billion to €7.3 billion in 2021, and it appears poised to maintain 2021 spending levels in 2022.

- Orange’s CapEx increased from 2020 to 2021, from €7.1 billion to €7.7 billion. However, Orange expects CapEx to decline slightly, to less than €7.4 billion in 2022.

- Deutsche Telekom CapEx spending was flat in 2020 and 2021 at €7.7 billion (excluding investments toward T-Mobile USA). DT expects a slight increase in 2022 driven mainly by spending in its domestic German market.

One more positive note from year-end results: few operators have expressed specific concerns over supply chain constraints that could potentially slow their deployment activity. As a result, 2022 is shaping up to be a very busy year for network infrastructure vendors.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Related Company Profiles

Deutsche Telekom AG

Altice USA Inc