Brexit has had a “fundamental depressing effect” on financial jobs in London according to a report by Morgan McKinley.

The financial service’s latest London Employment Monitor, which highlights trends in the job market, demonstrates how job opportunities are shrinking in the capital as a result of Britian’s decision to leave the EU.

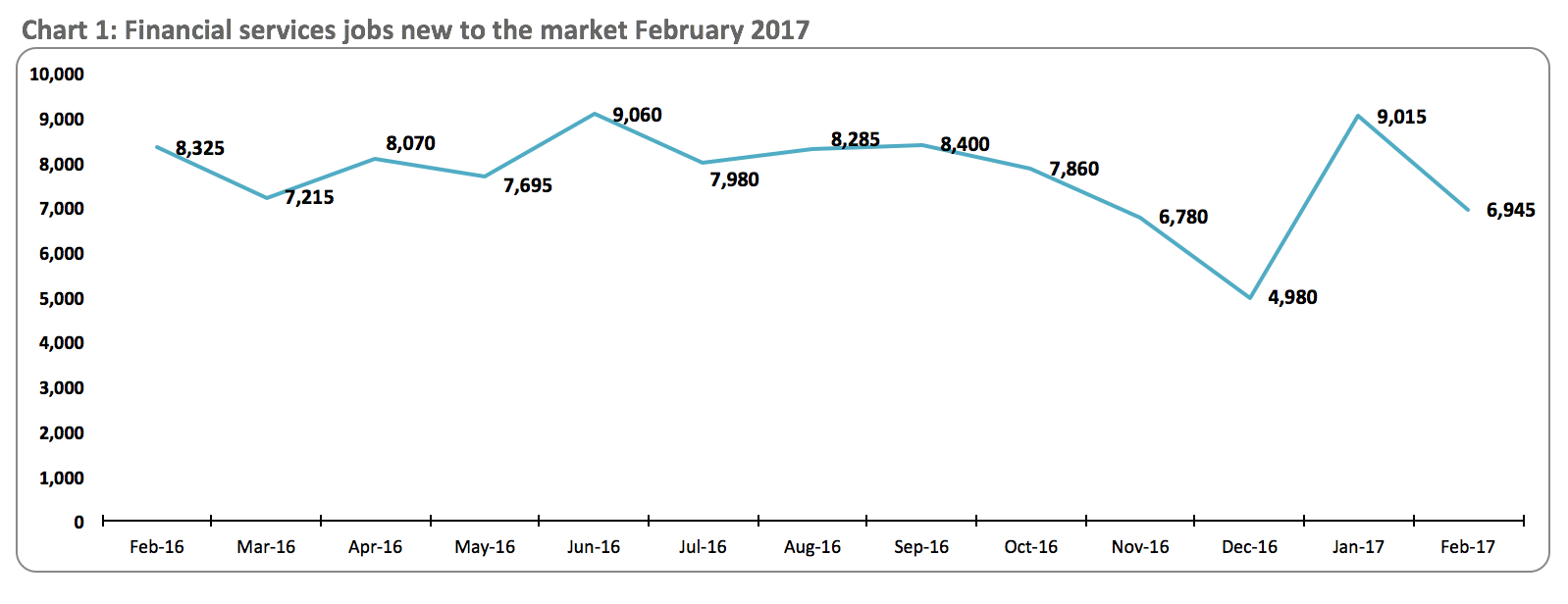

There was a 23 percent decrease in available financial jobs in London in Febuary, compared to earlier this year. The year-on-year drop was more moderate, with around 17 percent less job opportunities in 2017 when compared to February 2016.

However, what this does demonstrate is that the financial industry is under stress and Brexit is to blame.

Click to enlarge

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataHakan Enver, operations direction at Morgan McKinley, said:

Brexit has pushed institutions into two camps. On one side we’ve got the ‘business as usual’ team, and on the other we have the institutions that are tired of the government’s hemming and hawing and have already begun to move jobs to other EU countries. It’s the latter group that’s contributed to the quarter drop in jobs available.”

Larger companies, in particular are exercising ‘hiring caution’ at the moment due to the UK government’s mixed messages about Article 50 and the deal it will seek for Britain.

It is though Article 50 will be triggered at the end of March after the Brexit bill was officially passed by the UK parliament this week and it is affecting the way are corporations making decisions.

“Large institutions are currently using up incredible institutional resources to project years out and plan for a future that changes from one day to the next. For many, it’s simply proving easier to get ahead of the worst case scenario and get out of London now,” said Enver.

As well as companies choosing to hire less, there are fewer professionals seeking financial roles. There was a 38 decrease in professionals looking for new jobs in February 2017, compared with the same time last year.

At the core of the issue is the projected fear that financial services will leave London as a result of Brexit, affecting the country’s financial infrastructure as well as costing jobs. According to 2015 CityUK data, the relocation of financial services from the UK could cost the economy around £176bn a year and a total of 2m jobs.

Paris has been proposed as the city which will benefit from London’s loss, as it was announced in February that around 10,000 jobs could move over to France. It’s likely that US institutions could be the first to officially leave the UK.

“American banks are in the UK for the broader EU market. If Brexit cuts them off from it, they will have no incentive to stay, and will be forced to relocate. For smaller European banks, access to the British market will likely be enough to retain some operations in London and other British financial services hubs such as Manchester,” said Enver.

Overall, the situation could only get worse once Article 50 is triggered and Britain begins the formal process of leaving the EU. At this stage, though, it is still only a guessing game.

“There’s a chance we’ll see a post Article 50 uptick in April, just as we did post-Brexit,” said Enver. “But the data suggests that Brexit has had a fundamental depressing effect on City jobs. We’ve already witnessed, what was a handful of jobs leaving, become hundreds. How long before we’re looking at losing thousands, even millions?”

Over in the UK’s fintech scene, uncertainty surrounding Brexit caused investment to fall in 2016. Investments in startups declined by 34 percent, to just under the $1bn mark, last year.

However, in last week’s budget, chancellor Philip Hammond announced a new £270m fund for technologically advancements that could help boost fintech as the fastest growing sub-sector in the industry.

“The security risks are increasing, but employers no longer need to be convinced about the importance of investing in expertise, so we expect hiring in fintech to keep booming,” said Enver.