While 5G in the US and abroad is widely hyped as a massive change agent for mobile operators and the broader telecom ecosystem, it is also widely recognized that any substantial revenue realization due to 5G won’t happen for another several years. So where are we in 2021?

GlobalData’s latest US Forecast for mobile broadband (see https://technology.globaldata.com/Analysis/details/north-america-mobile-broadband-forecast-pack) includes some fascinating statistics about the penetration and growth of 5G in the US in 2021 as well as information leading to insights about IoT traction and business segment penetration for cellular connections.

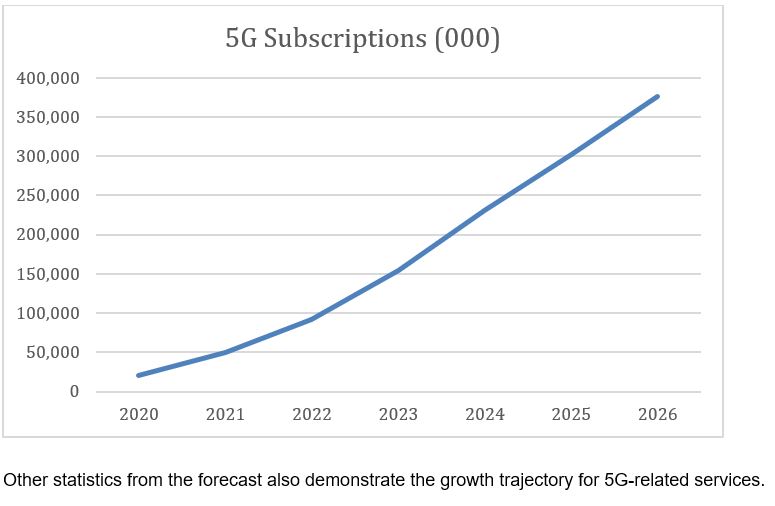

The chart below shows GlobalData’s forecast for 5G subscriptions from 2020 to 2026, in which subscriptions will rise from 6.5 million in 2020 to 376 million in 2026.

5G Statistics in the US

- GlobalData predicts there will be 50 million 5G subscriptions in the US in 2021, compared to 6.5 million in 2020. 2020 was the first year in which GlobalData counted any 5G subscriptions in its forecasts.

- 5G makes up 15% of all cellular subscriptions in 2021 – up from 6% in 2020

- 5G data traffic in 2021 will reach 8,743,803 Terabytes compared to 2,733,783 Terabytes in 2020

Business and IoT Statistics in the US

- IoT devices reached 43% of all mobile devices in 2021, up from 38% in 2020

- IoT cellular subscriptions will reach 144 million in 2021, compared to 125 million in 2020

- Business mobile subscriptions across all cellular generations in 2021 will reach 194 million (compared to 336 million for consumer subscriptions). In 2020 business mobile subscriptions were 175 million compared to consumer subscriptions of 333 million.

Clearly we are making progress in 2021 although we are just at the beginning of the 5G growth curve. Not only is 5G growing, but the percent of subscriptions among business users and the percent of subscriptions and devices for IoT use cases is also growing reasonably. This is especially important at a time when the pandemic was originally thought to be having a dampening effect on both business 4G/5G and IoT up-take.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAlso in 2021, US operators, while still focused on who has the biggest, fastest network with the most device options, are also announcing capabilities that prepare them for the next wave of beyond-connectivity services. In fact in Q1 2021 the 5G conversation has changed. For operators, 5G is no longer dominated by rollout strategies, device options and spectrum resources. They are increasingly focused instead on monetization. Many 5G trials have been noted by operators all over the world, but their long-term strategy includes finding a set of compelling use cases that will not only be commercially deployed after the trial phase, but which will turn into repeatable solutions that operators can count on for future earnings.

5G Announcements in 2021

In 2021, AT&T, Verizon and T-Mobile have all made announcements or disclosures about their 5G network or service rollouts.

AT&T

- AT&T and The Texas A&M University System’s RELLIS Campus open private 5G testbeds to public and private sector organizations to develop 5G powered applications. Autonomous vehicles and road-side safety, augmented and virtual reality, and robotics applications will be tested.

- AT&T andCradlepoint expnd joint offerings for 5G solutions in the US using AT&T 5G Wireless Broadband, which reaches over 230 million people in 14,000 cities and towns. The new solutions combine Cradlepoint 5G wideband adapters and routers with AT&T’s wireless broadband network, data plans, and device management. Cradlepoint provides a cloud-managed 5G modem that integrates with SD-WAN architectures.

- A private 5G network from AT&TBusiness is aimed at improving the way patients and researchers connect at the Lawrence J. Ellison Institute for Transformative Medicine of USC. The on-site 5G network is providing ultra-fast connectivity for patient-centered cancer research, treatment, and wellness education.

- AT&T announced plans to cover 200 million people with 5G over C-band spectrum by the end of 2023. In May it completed field test calls over C-band 5G spectrum using a mobile test platform in Plano, Texas and Detroit, Michigan. AT&T was the second largest bidderin the C-band auction in February, having committed to spend $27.4 billion.

Verizon

- Verizon Business announced On Site 5G, its commercially available, private 5G network solution in the US On Site 5G networks are custom-designed and managed by Verizon, allowing large enterprise and public sector customers to bring Verizon’s 5G Ultra Wideband capabilities to indoor or outdoor facilities where high-speed, high-capacity, low-latency connectivity is crucial, regardless of whether the premises is within a public 5G Ultra Wideband coverage area. Verizon’s can deliver a customized On Site 5G solution, to provide interconnection to the organization’s LAN, SD WAN and enterprise applications.

- Verizon announced deployment of 5G Ultra Wideband in 14 additional arenas as well as multi-year agreements as the exclusive 5G partner of the 15 NBA teams who play at these venues, bringing the total number of arenas and stadiums enabled with 5G to more than 60.

- Verizon announced Hyper Precise Location, a SaaS solution which can deliver GNSS correction data in real time at vast scale and low cost to developers and customers on 5G and 4G networks. When paired with 5G Edge, HPL can work with emerging autonomous technologies such as Cellular Vehicle-to-everything (C-V2X) communication. Verizon recently teamed with automakers to demonstrate HPL applications in vehicle-pedestrian safety scenarios.

T-Mobile

- T-Mobile added preemption to existing priority network access, so that First Responder agencies are assured network access for critical communications. Wireless Priority Service-enrolled first responder agencies with Connecting Heroes plans will get both priority access and preemption for voice.

- T-Mobile unveiled services for small businesses in the “post-pandemic, digital-first world”. They include new smartphone plans with unlimited 5G access; Small Business Internet without annual contracts; and Facebook Advertising on Us, a program designed to accelerate small businesses’ digital marketing capabilities, including consultations with digital marketing experts, $200 of digital advertising to be used on Facebook or Instagram, and resources to help small businesses reach more customers.

While some of these announcements are focused on network build-outs most are now about new business services that can take advantage of 5G. Segmentation of the wider business market is also apparent as small businesses and public sector organizations are included in the news. This shows a maturity in operators’ strategies with a realization that “beyond-connectivity” services will become the most important and most profitable elements in their monetization strategies over time.