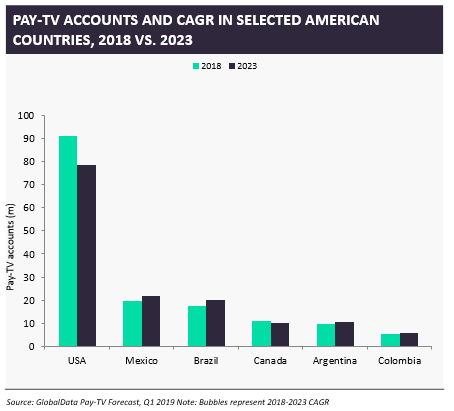

Pay-TV household penetration in the Americas reached 53.2% at the end of 2018, behind Central & Eastern Europe (71.2%), Asia-Pacific (67.4%), and Western Europe (62.5%), but above the global average, which stood at 55.3% for the same period.

We expect household penetration will continue to increase in all regions but the Asia-Pacific and the Americas, where it will decline to 67% and 48.8% in 2023, respectively as a result of ongoing cord-cutting trends.

Markets in these regions, such as the US and Canada, have been experiencing declines in the last few years as an increasing number of customers ditch their traditional pay-TV subscriptions in favour of over-the-top (OTT) alternative video platforms such as Netflix, Amazon Video and Hulu.

CAGR = compound annual growth rate

Although cord-cutting is not affecting Latin America as a region yet, we expect subscriber growth will decelerate in the coming years as customers’ appetite for on-demand content increases and new commercial platforms in the subscription video on demand (SVoD) market emerge. To slow the decline, traditional pay-TV operators are enhancing their video service proposition with OTT features and relevant content offers.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe increasing demand for high definition and 4K content, OTT video and interactive pay-TV platforms, pay-TV service provides have been allocating significant investments to upgrade and expand their network infrastructure with fibre-to-the-home (FTTH/B), rollouts and cable upgrades. The commercialisation of 5G services with increased transmission speeds will bring new growth opportunities in the OTT video segment as well as increase competition levels in the fixed broadband and media/pay-TV segments. This will accelerate cord-cutting trends, particularly in the most mature markets.