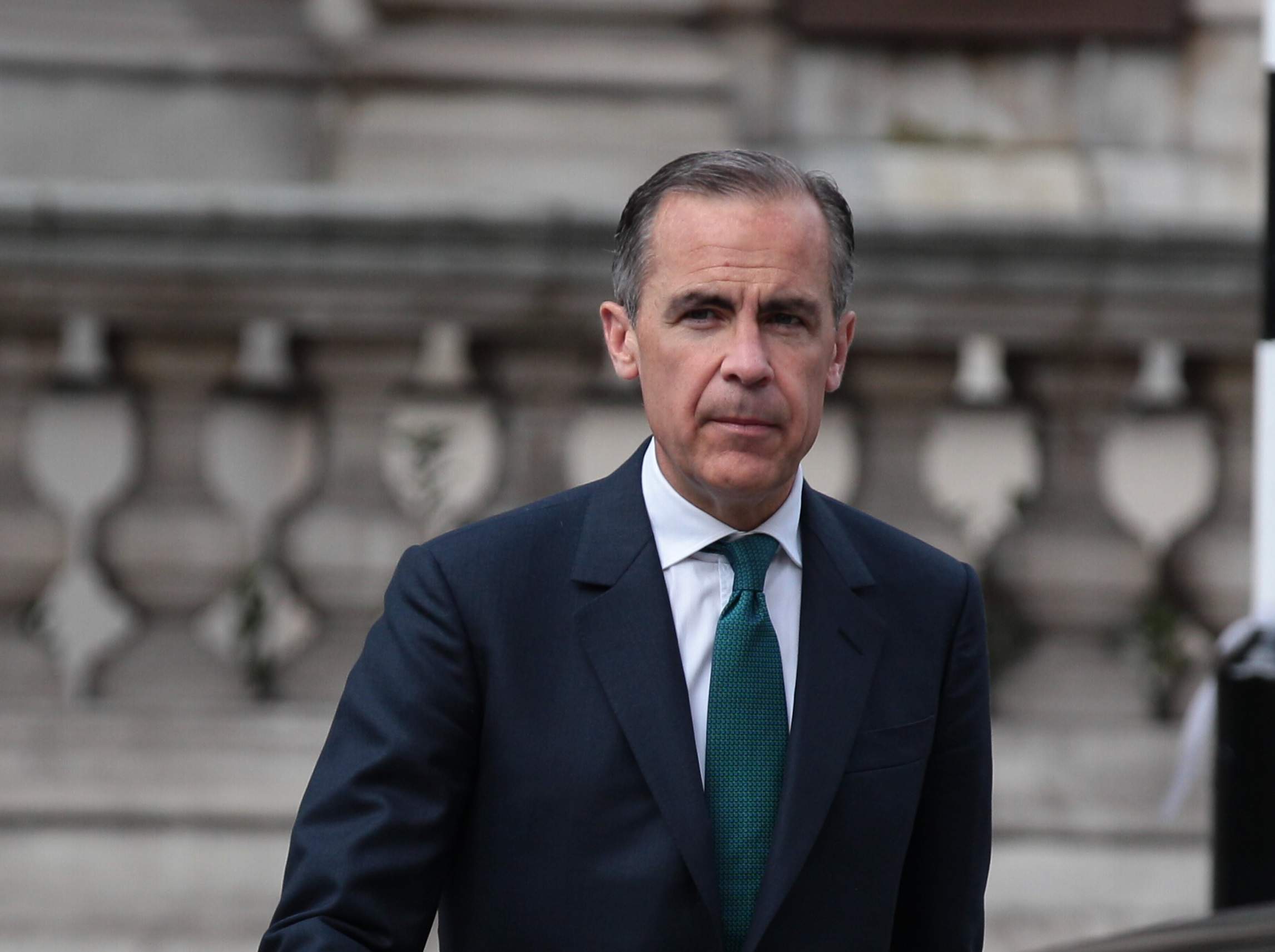

The Bank of England (BoE) governor Mark Carney has called for tighter regulation of cryptocurrencies like bitcoin.

Carney’s comments come as countries around the world are trying to get a better handle on the risk that cryptocurrencies pose to financial stability.

Speaking at the Scottish Economic Conference this morning, Carney said:

Crypto-assets raise a host of issues around consumer and investor protection, market integrity, money laundering, terrorism financing, tax evasion, and the circumvention of capital controls and international sanctions.

He said the time has come to bring digital currencies under the “regulatory tent’ so that crypto-assets can be held to the same standards as the rest of the financial system.

The BoE is currently investigating the effects of cryptocurrencies on UK financial stability.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataCarney said the wild swings in digital currency valuations over the past three months “exhibit the classic hallmarks of bubbles” which could destabilise financial markets.

He added that he thinks cryptocurrencies are unlikely to ever become a common means of exchange.

However, Carney warned authorities against stifling innovation in the cryptocurrency market.

Crypto-assets raise the obvious question about whether their infrastructure could be combined with the trust inherent in existing fiat currencies to create a central bank digital currency (CBDC).

Carney’s comments came days after a US crackdown on the cryptocurrency market, triggered by regulators at the US Securities Exchange Commission (SEC).

Authorities issued dozens of subpoenas and requests for information on sales and pre-sales of the initial coin offerings (ICOs), according to a report in the Wall Street Journal, citing anonymous sources.

The move follows a series of warnings by the SEC that many token sales and ICOs may be violating securities laws, as the coins aren’t yet governed by the same rules that govern public offerings.

Over the last year valuations for bitcoin and other digital currencies have swung wildly due to rising demand and fears of increased regulation.

In December bitcoin hit a record high of almost $20,000, before crashing below $6,000 in January. It’s since recovered somewhat and is currently trading around $10,000.