Cryptocurrencies have no intrinsic value, yet the market has now hit a cap of more than $600bn and the value of the biggest cryptocurrencies is continuing to rise.

Daily trade volume exceeds that of major European stock exchanges, and hundreds of cryptocurrencies are available to purchase.

So what are the five biggest cryptocurrencies on the market today?

The expansion of cryptocurrencies

The rise in cryptocurrencies reflects a historical trend in the direction and evolution of money, solving many of the problems that arise from regular currency such as security, privacy, forgery, double-spending, centralised control, risks of inflation. Cryptocurrencies overcome these problems by providing a decentralised digital cash system whereby anonymity and supply can be preserved.

Bitcoin was the first cryptocurrency released in 2009, but since then many altcoins (alternative cryptocurrencies to Bitcoin) have been created. Now many of the biggest cryptocurrencies are serious business, and the future looks bright.

Biggest cryptocurrencies: the market landscape

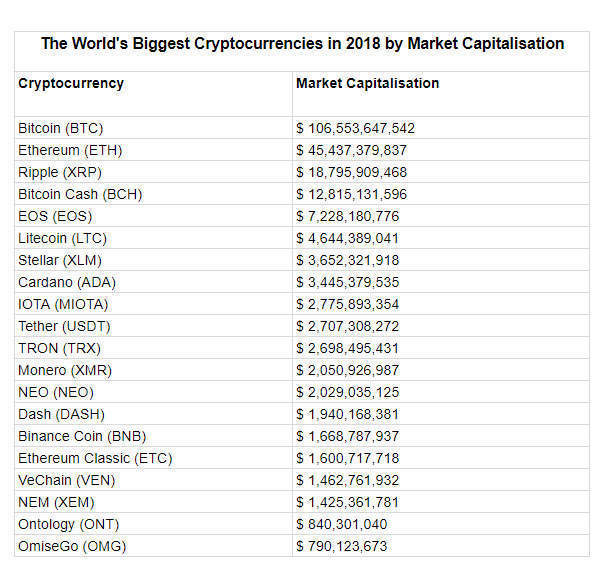

There are technically over 1,000 cryptocurrencies in existence, but only a few are relevant and even fewer command large market presence. Market capitalisation (also referred to as market cap) is a significant indicator of a cryptocurrency’s attractiveness and value. It is calculated by multiplying the total number of coins by the price, and provides the total value of a cryptocurrency.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe frontrunners of the market attract a significantly larger following and market cap than their competitors.

This can in part reflect the credibility and USP of specific cryptocurrencies, for example Monero’s focus on privacy and decentralisation, but also the value people place on a currency. After all, a cryptocurrency is only as valuable as people perceive it to be.

Its price is determined predominantly by demand, since supply is fixed. In this way, cryptocurrencies can be created as a joke, yet gain significant value. For example, Dogecoin, created from the popular Doge meme, gained a significant following that increased its value.

Despite this, no altcoin has rivalled Bitcoin, as it remains the top cryptocurrency on the market in terms of value, market cap, volume and acceptance.

Biggest cryptocurrencies: the top five

Bitcoin

Bitcoin is the original cryptocurrency, created in 2009 by the mysterious developer Satoshi Nakamoto. Bitcoin is the most well-known and used of the cryptocurrencies available, and boasts a considerable market cap at $106bn, dominating a third of the market, and claiming top spot.

Bitcoin uses SHA-256, a set of cryptographic hash functions designed by US National Security Agency, and is based on the proof-of-work system. This verifies that computers ‘mining’ the cryptocurrency have done the necessary work to produce each unit of it, and so prevents fraud.

It has nodes running all over the world and its flow in the market is dependent on miners who deploy hashing power to mine bitcoins and validate transactions. The supply of Bitcoins in existence is controlled, being limited to 21 million. From September 2017 to February 2018 the difficulty of mining Bitcoins has tripled as the number in circulation nears this limit. There are also now over 2,000 Bitcoin ATMs worldwide.

Bitcoin Cash was created as a fork of Bitcoin. It was intended to solve the lengthy transaction processing time associated with Bitcoin as a result of their small block size. It is priced below Bitcoin, but still above many other altcoins.

Ethereum

Ethereum lies second as Bitcoin’s closest rival. Created by Vitalik Buterin, it was launched in 2015 as a decentralised blockchain network. In addition, Ethereum has a decentralised platform that can execute peer-to-peer smart contacts and distributed applications. Peer-to-peer smart contracts enable people to code and enact contracts without third-parties, providing an alternative function to blockchain technology not offered by other cryptocurrencies. Ethereum holds a market cap of $45.8bn.

As of September 2016, and as result of a significant attack to a high-profile decentralised business built on the platform, Ethereum split into two, creating Ethereum (ETH) and Ethereum Classic (ETC).

EOS is a further Ethereum-based cryptocurrency that does not have its own blockchain network yet. However, it has quickly risen in less than a year to become one of the leading cryptocurrencies on the market, gaining a market cap of over $7bn. EOS sales are considered revenue for the parent company.

Ripple

Ripple holds third place with a market cap of $18.9bn. It was released in 2012 and serves as a payment system that supports any fiat currency, cryptocurrency or commodity. Its aim was to reduce the time required to complete bank transactions. To achieve this, the blockchain technology was adapted, resulting in Ripple often being considered not a cryptocurrency in the true sense.

Ripple is pre-mined and there is a monthly limit of one billion Ripples that is able to flow into the market every month. However, since mid-2016, 300 million on average have been sold each month. The value of Ripples is considerably smaller than the top cryptocurrencies at approximately $0.48 this month.

Litecoin

Litecoin was created October 2011 by Charles Lee and offered an early alternative to Bitcoin. Similarly to Bitcoin, it can be mined, used for currency and transacted for goods and services, but Litecoin uses the algorithm scrypt to verify the mining process, rather than Bitcoin’s SHA-256. This removed the need to purchase specific equipment for mining such as the ASIC machines used to mine Bitcoin, allowing more users to become cryptocurrency miners. Litecoin also provides faster transaction approval than Bitcoin.

Litecoin holds a market cap of $4.7bn and is actively developed and traded.

Stellar

Stellar is a blockchain-based ledger and database that facilitates cross-asset transfers of value, including payments. The cryptocurrency is officially called Lumens (XLM). Both the cryptocurrency and payment network is overseen by a non-profit, Stellar.org, whose platform is open-source and decentralised.

Like Ripple, Stellar can handle exchanges between fiat-based currencies and cryptocurrencies, and has fast transaction speeds of around two to five seconds with low fees.

It has a market cap of $3.7bn, but the price of Lumens is low at $0.20. However, this in part reflects the high supply in the market.